New Reporting Framework Released

The United Nations Principles of Responsible Investment (UNPRI) released the report framework of asset management companies and adjusted the 2021 version. UNPRI believes that this update focuses on improving the clarity, consistency, and practicality in order to reduce the reporting work of the signatories.

The new reporting framework will be officially put into use in May this year, which will provide new guidance for the development of responsible investment. UNPRI plans to hold a webinar in March this year to provide guidance for signatories.

From the simple assessment survey developed in 2006 (there were only about 100 signatories at that time) to the complete report and assessment framework launched in 2012, the framework used to describe these activities has also grown with the depth and breadth of ESG practice. At present, UNPRI is composed of more than 3000 signatories and manages more than 103 trillion dollars of assets. Therefore, it is necessary to continue to ensure the significance of the signatories of the PRI for the development of the industry. This is why UNPRI decided to review the reporting process and framework to ensure that it remains relevant in the market.

United Nations Principles of Responsible Investment

Updates to UNPRI Reporting Framework

UNPRI concludes that the reporting framework has been updated from four aspects, namely:

- Changes in reporting efficiency: The new framework provides a simpler indicator structure, allowing signatories to consolidate indicators and delete duplicates. At the same time, some areas within the framework have been restructured to form a more coordinated structure;

- Changes in report disclosure: signatories only need to provide information for different asset classes;

- Changes in report content: UNPRI revised all indicator terms and improved the applicability of indicators through previous reporting experience. If necessary, the signatory can add description content;

- Changes in report clarity: all definitions, indicators and methods have been revisited to improved clarity;

Brief Description of the New Reporting Framework

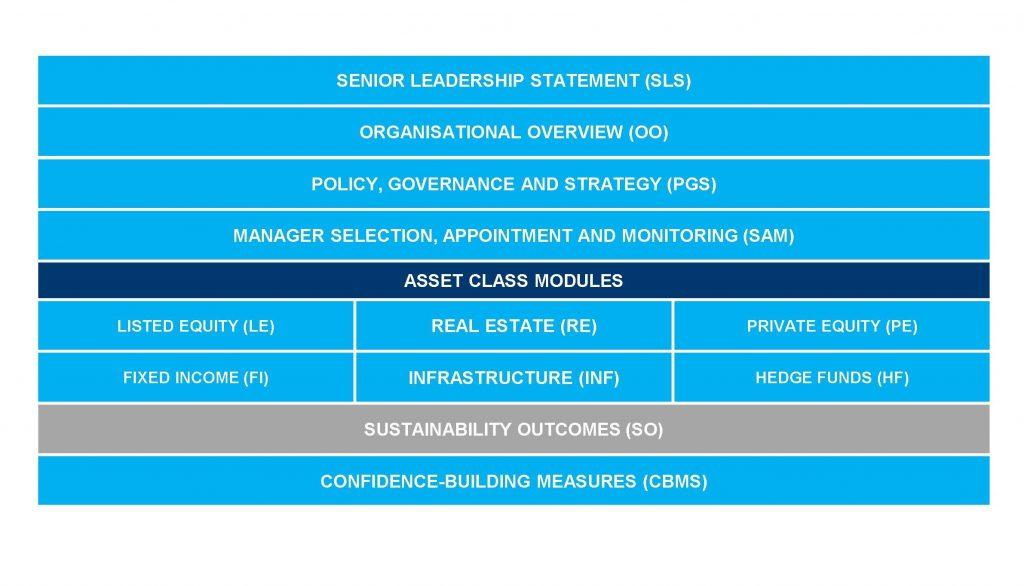

The new reporting framework can be divided into 12 parts, which can be divided into three stages:

The first stage, the report preparation:

- Senior leadership statement: explain why the company chooses responsible investment, the overall method of investment, the situation of responsible investment this year and the development plan for the next two years;

- Organizational overview: describe the company’s development, asset management, ESG strategy and ESG financial products;

- Policy, governance and strategy: describe the main concepts of corporate responsible investment, including asset allocation, climate change, sustainable results and other topics;

- Manager selection, appointment and monitoring: describe the responsible investment method of the company’s externally managed assets, which is applicable to the signatories of 10% AUM’s external custody or the custody scale reaching 10 billion US dollars;

The second stage, the main report procedure:

- Listed equity investment: describe the equity investment method, ESG strategy application, risk management and performance tracking;

- Fixed income investment: describe the method of bond investment, ESG strategy application, risk management and performance tracking;

- Real estate investment: describe the methods, asset selection, investment monitoring and post-investment management of real estate investment;

- Infrastructure investment: describe the methods, asset selection, investment monitoring and post-investment management of infrastructure investment;

- Private equity investment: describe the methods, asset selection, investment monitoring and post-investment management of private equity investment;

- Hedge fund investment: describe the ESG research, application and risk management of hedge fund investment;

The third stage, the report summary:

- Sustainability outcomes: describe the company’s sustainable results, net zero goals, and asset allocation, external trusteeship, and stakeholder analysis for this purpose;

- Confidence building measures: describe how the company can improve the credibility of the report, such as internal audit and third-party certification;

Reference: