Sustainable Investment Classification Method

This article introduces the sustainable investment classification method released by the European Sustainable Investment Forum (Eurosif), which is developed in collaboration with University of Hamburg, Sustainable Finance Research Group, and Advanced Impact Research.

The European Sustainable Investment Forum believes that in the past, sustainable investment research typically collected a range of different sustainable investment data and directly aggregated them into sustainable investments. However, these procedures do not make a clear distinction between sustainable investments based on their investment strategies and goals. The new sustainable investment classification method will address this issue and reflect the current development of sustainable investment in Europe, providing practical solutions for stakeholders.

Related Post: Eurosif Responses to European Sustainability Reporting Standards

Introduction to Sustainable Investment Classification Method

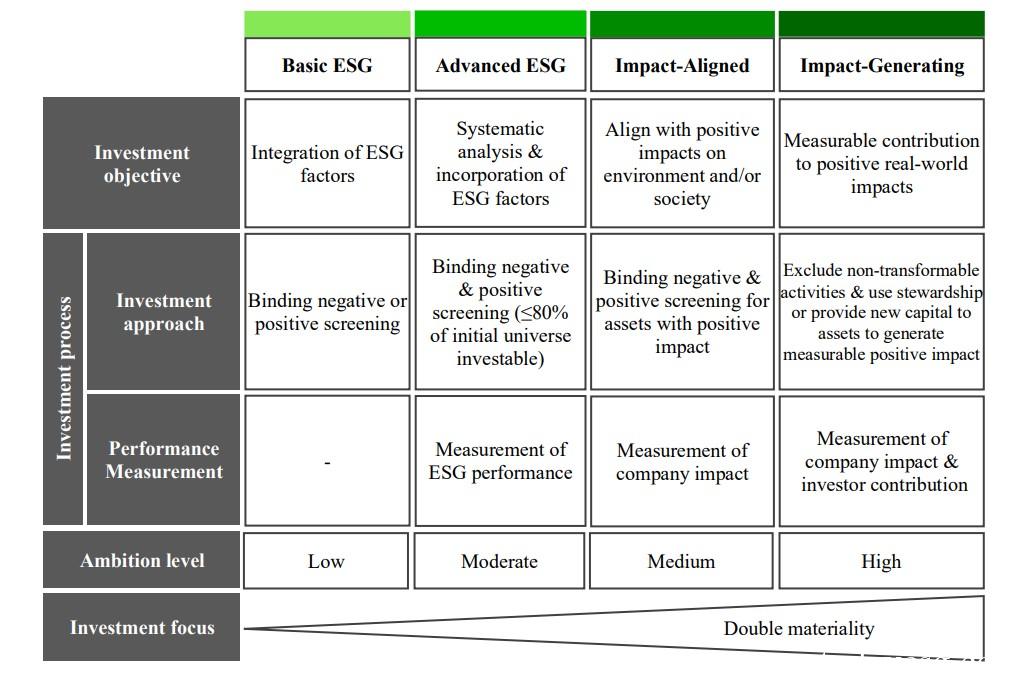

The sustainable investment classification method proposed by the European Sustainable Investment Forum is based on researches conducted by the Global Sustainable Investment Alliance, Principles for Responsible Investment, and CFA Institute. The new sustainable investment classification method divides sustainable investment into four categories, each involving different investment objectives, investment methods, and performance measurement indicators. These categories include:

- Basic ESG: The goal of Basic ESG investment is to integrate ESG factors, and investors use either positive or negative screening methods. This method can assess the risks and opportunities of sustainable investment, but does not involve explicit ESG performance measurement, nor does it include contributions to sustainable transition.

- Advanced ESG: The goal of Advanced ESG investment is to systematically analyze and integrate ESG factors, with a focus on the risks and opportunities of sustainable investment. It can indirectly promote sustainable transformation and adopt binding positive or negative screening methods. The biggest difference between this method and Basic ESG is that the screened sustainable assets will be less than 80% of the initial investable range, meaning that advanced ESG investments will use stricter screening criteria.

- Impact-Aligned: The goal of Impact-Aligned investment is to provide positive impacts on the environment and society, using sustainable taxonomy as a reference framework. The biggest difference between this method and Advanced ESG is that it can measure the impact generated by the company and aims to promote sustainable transition. However, the impact on consistent investment does not include the active influence of asset managers on the investees.

- Impact-Generating: The goal of Impact-Generating investment is similar to that of Impact-Aligned investment, but the biggest difference is that asset managers will adopt an active management approach to directly influence the investees. This method aims to create positive sustainable transition and provide evidence of positive impact.

The European Sustainable Investment Forum has designed a sustainable investment classification questionnaire, which includes investment objectives, investment methods, and impact performance measurement indicators related to the four sustainable investment categories mentioned above. By answering the questions in the questionnaire, investors’ sustainable investments will be automatically classified into one of the four categories.

Sustainable Investment Classification Methods and Regulations

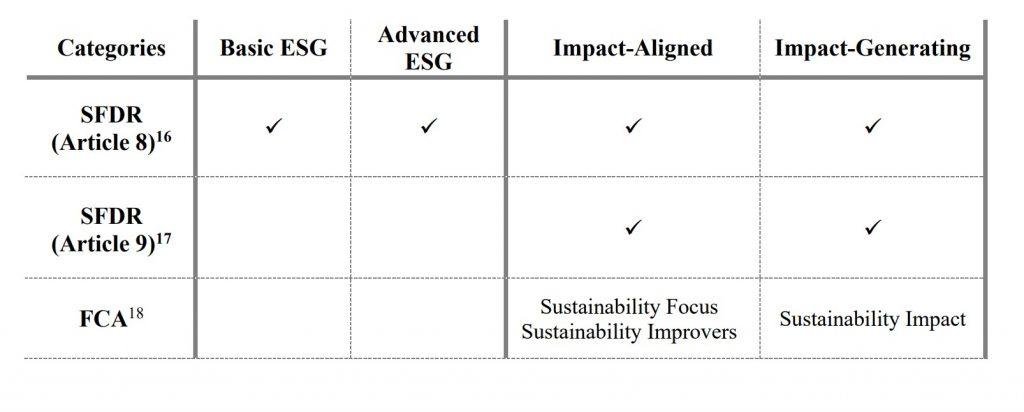

In order to improve the interoperability between sustainable investment classification methods and regulations, the European Sustainable Investment Forum compared the classification methods with the Sustainable Finance Disclosure Regulation (SFDR) and the UK’s Sustainability Disclosure Requirements (SDR).

For the Article 8 classification under European Sustainable Finance Disclosure Regulation, all four categories of sustainable investments mentioned above meet the criteria. For Article 9 classification, only two categories related to the impact are eligible. For the UK’s Sustainability Disclosure Requirements, the definitions of Sustainability Focus and Sustainability Improvements are consistent with Impact-Aligned investments, and Sustainability Impact is consistent with Impact-Generating investments. The European Sustainable Investment Forum plans to continue revising the sustainable investment classification method in the future.

Reference:

Methodology for Eurosif Market Studies on Sustainability-related Investments