2024 Swiss Impact Investment Market Report

The Swiss Sustainable Finance releases 2024 Swiss Impact Investment Market Report, aimed at analyzing the development of the Swiss impact investment market.

According to the Sustainable Investment Market Report released by Swiss Sustainable Finance, the size of the Swiss impact investment market is 180 billion CHF, accounting for 11% of the total size of the sustainable investment market.

Related Post: Switzerland Plans to Revise Corporate Climate Disclosure Regulation

Overview of Swiss Impact Investment Market

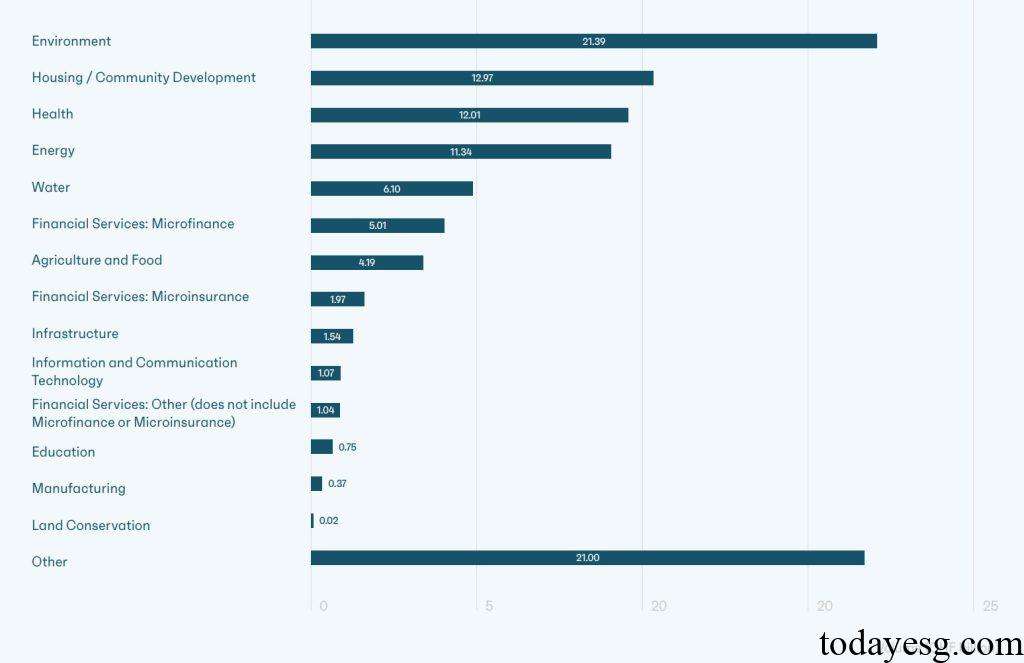

The investors in the impact investment market include institutional investors and private investors, with institutional investors investing 130 billion CHF and private investors investing 50 billion CHF. In terms of investment themes, environment (21.4 billion CHF), housing construction (13 billion CHF), health (12 billion CHF), and energy (11.3 billion CHF) are the main directions. Some investments such as new material technology, sustainable transportation, and waste management have been classified into Other category, with a total investment scale of 21 billion CHF.

In terms of asset classes, listed stocks (31%), real estate (25%), corporate bonds (15%), and sovereign bonds (13%) account for a relatively high proportion. 90% of asset managers and 83% of asset owners use publicly available guidelines, principles, and frameworks for impact investing. The impact investment approach is typically used in conjunction with other sustainable investment methods, with over 98% of impact investments being used in conjunction with at least three sustainable investment methods, the most common of which are exclusion and ESG integration.

Overview of Swiss Impact Investment Funds

Switzerland is a globally renowned center for managing impact investment funds. Currently, there are 18 impact asset management companies, managing a total of 83 private asset impact funds with a total management scale of $11.2 billion. The scale of Swiss private equity impact investment accounts for 12% of the global total, and the main sources of funding for private equity impact funds are private institutional investors (67%), individual investors (15%), and public investors (14%).

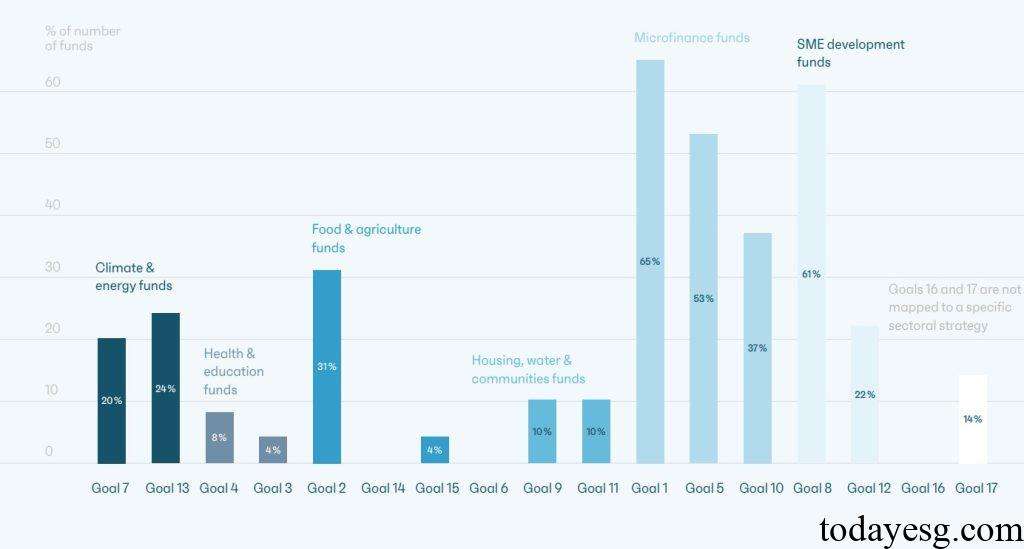

Among the 83 private equity impact funds, microfinance(30), multi-sector (22), and food and agriculture (15) sectors account for a relatively high proportion, with microfinance assets accounting for 65% of the total. In terms of asset strategy, private debt (55) and private equity (20) account for a relatively high proportion, with the asset size of private debt accounting for 81%. In terms of investment asset categories, senior debt (81%), subordinated debt (10%), and common stock (5%) account for a relatively high proportion.

In terms of impact management and measurement frameworks, internal frameworks (93%), United Nations Sustainable Development Goals (74%), and impact management projects (50%) are commonly used. In terms of the United Nations Sustainable Development Goals, the market is more focused on Goal 1 (65%), Goal 8 (61%), and Goal 5 (53%), all of which are related to microfinance and small and medium-sized enterprise development.

The EU Sustainable Finance Disclosure Regulation (SFDR) requires funds to disclose sustainable information, and Switzerland has a total of 43 impact investment funds that comply with SFDR, of which 91% belong to Article 9 funds and 9% belong to Article 8 funds. Swiss asset management companies believe that the disclosure of information, data availability, and interpretation of regulatory policies are the main challenges faced in implementing SFDR.

How to Expand Impact Investment Market

Swiss Sustainable Finance believes that expanding impact investment market can be achieved through the following aspects:

- Alignment with the needs of asset owners: The current impact investment market is unable to match the investment needs of large asset owners (such as pension funds), and the market can provide specific policy incentives such as tax exemptions.

- Education: Some participants lack experience in impact investing, and the market can provide more impact investment research, guidelines, and cases to enhance their understandings.

- Product supply and standardization: Asset managers can develop more impact investment products to meet investors’ allocation needs and provide clearer impact measurement reports.

- Collaboration: The public and private sectors should collaborate to implement impact investments, reduce investment risks, and achieve impact goals.

Reference:

A Stocktake of Swiss Impact Investing

ESG Advertisements Contact:todayesg@gmail.com