SDG Indices Related to the UN SDGs

S&P Dow Jones Indices launched two SDG indices related to the United Nations Sustainable Development Goals (SDGs): S&P 500 SDG Index and S&P Global LargeMidCap SDG Index.

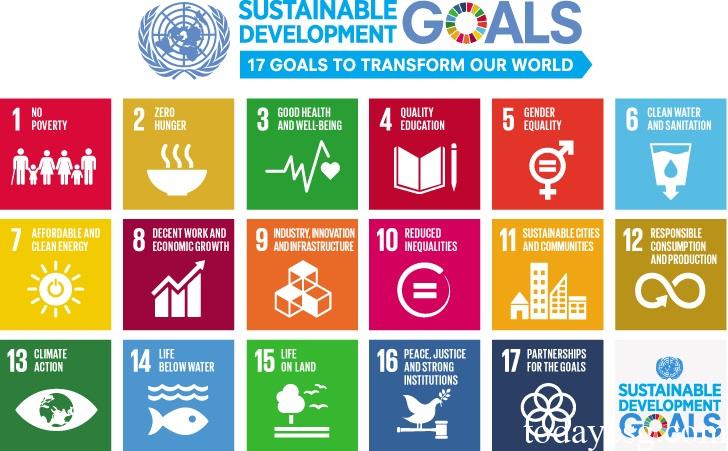

The new Sustainable Development Goals-related SDG Indices will provide market participants with the tools to track and measure corporate sustainability, especially performance related to the 17 United Nations Sustainable Development Goals.

Related Post: Morningstar Launches Sustainable Activities Involvement Indexes

Technical Solutions for Establishing SDG Indices

Since the United Nations launched the SDG goals in 2015, investors have focused on how to align investments with these sustainable development goals and assess the impact of investments on the environment, economy, and society. S&P Indexes believes that the focus of establishing the SDG index is to determine the impact of company activities on society and the environment, and each SDG goal provides a clear definition and classification, which can classify whether activities are aligned with SDGs.

Compared with other ESG index construction processes, SDG index process does not focus on analyzing the financial materiality of environmental, social, governance and other factors, but on measuring the impact of company business activities on SDG goals. This is in line with the principle of double materiality, measuring the company’s external impact on the environment and society.

S&P Indices uses the SDG framework provided by data provider Impact Cubed to assess the impact of company activities. On the one hand, the company will have an impact on the SDGs in the process of providing products and services. On the other hand, the company will also have an impact on the SDGs when interacting with other stakeholders. Impact Cubed provides company SDG data that is 3.5 times more detailed than other data providers, allowing for a more objective measurement of the impact of company activities.

In the process of constructing the index, S&P excludes companies that are not related to SDG factors and uses negative screening methods for specific industries. The SDG Indices will readjust the weight of constituent stocks every six months and conduct reviews every quarter to eliminate constituent stocks that do not meet the requirements in index construction.

Introduction to S&P 500 SDG Index

The S&P 500 SDG Index (Bloomberg code: SPXSDGUP) is designed to measure the performance of stocks in the S&P 500 Index that are aligned with the United Nations Sustainable Development Goals. The return of the S&P 500SDG Index in the past year was 26.40%, and the return of the S&P 500 Index was 20.42%. The index is denominated in two currencies: USD and EUR. It currently contains 330 constituents, of which the technology industry (35.6%), the healthcare industry (16.1%) and the financial industry (14%) account for a high proportion.

In terms of sustainable performance, the S&P 500 SDG Index does not include listed companies in the energy industry, and the carbon emissions of the constituent stocks from fossil fuels are zero. The ratio of index carbon emissions to income (carbon dioxide emissions per $1 million of income) is 54.45, and the carbon intensity is 73.95.

Introduction to S&P Global LargeMidCap SDG Index

The S&P Global LargeMidCap SDG Index (Bloomberg code: SPGXSDUP) is designed to measure the performance of stocks in the S&P Global LargeMidCap Index that are aligned with the United Nations Sustainable Development Goals. The S&P Global LargeMidCap SDG Index Index’s return in the past year was 19.45%, and the S&P Global LargeMidCap Index ‘s return in the past year was 15.04%. The index is denominated in two currencies: USD and EUR. It currently contains 1,247 constituents, of which technology industry (27.8%), financial industry (20.8%) and healthcare industry (15%) account for a high proportion. The constituents mainly come from the United States (313), Japan (174), China (92).

In terms of sustainable performance, the energy industry accounts for less than 0.05% of the S&P Global LargeMidCap SDG Index. The ratio of carbon emissions to income (carbon dioxide emissions per 1 million US dollars of income) is 88.11, and the carbon emission intensity is 85.91.

Reference: