Nature Investor Toolkit

The Responsible Investment Association Australasia (RIAA) releases the Nature Investor Toolkit, aimed at helping investors understand nature-related risks and opportunities.

The Responsible Investment Association Australasia is the largest responsible investment organization in Australia and New Zealand, with its AUM exceeding $29 trillion. Addressing nature-related financial risks is an important goal of RIAA.

Related Post: Introduction to Natural Capital Valuation in China by Asian Development Bank

Assess Nature-related Risks of Investment Portfolios

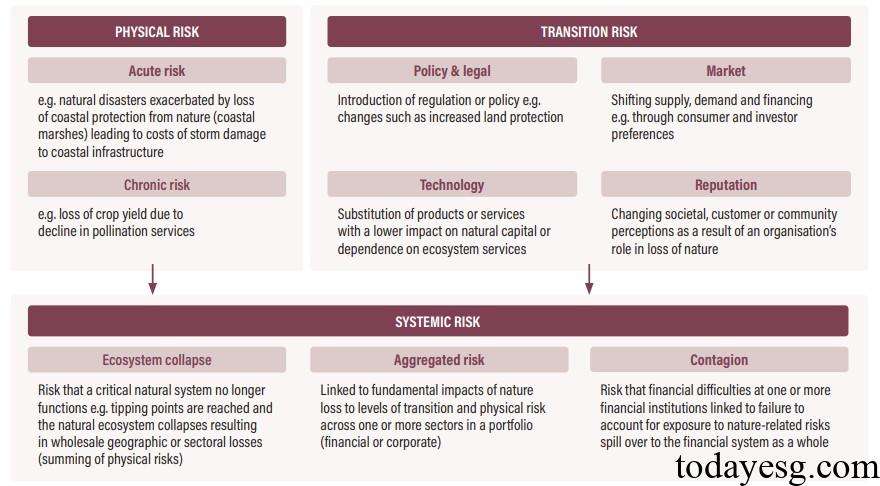

The Taskforce on Nature-related Financial Disclosures defines nature related risks as potential threats arising from the dependence and impact of organizations and society on nature, including:

- Physical risks, such as water scarcity.

- Transition risks, such as financial liabilities arising from pollution.

- Systemic risks, such as deforestation leading to regional changes in water and land resources.

Evaluating the nature-related risks of an investment portfolio can help investors understand how these risks affect financial performance, identify specific industries, regions, and assets that are most susceptible to impact, and take appropriate actions to mitigate or reduce these risks. Natural risk assessment can focus on determining the industry and location of the risk, or on some natural themes based on investors’ professional knowledge. The RIAA has listed some commonly used natural risk assessment tools:

1. Industry level risk assessment: Investors need to map the industry risk exposure of their investment portfolio to natural factors. Common industry level risk assessment tools include:

- The Nature Sector Materiality Tool, based on the Intergovernmental Science Policy Platform on Biodiversity and Ecosystem Services, evaluates the materiality of 12 pressure categories.

- ENCORE(Exploring Natural Capital Opportunities, Risks and Exposure), evaluates the impact and dependence of 271 sub industries in a range of natural fields.

- The TNFD Guidance on Engagement with IPLCs, offers guidance on collaborating with indigenous peoples and local communities to assess natural risks.

- Commodities focused tools, which can assess the natural impacts generated during the production, procurement, and processing of commodities.

2. Location based risk assessment: Investors need to focus on specific geographic locations, identify natural dependencies and impacts. For example, Activities in Biodiversity Sensitive Areas under the Sustainable Financial Disclosure Regulation. Common location-based risk assessment tools include:

- Integrated Biodiversity Assessment Tool, which can be used to map locations to geographic areas that are significant to biodiversity.

- The Water Risk Filter published by the World Wildlife Fund or Aqueduct published by the World Resource Institute can map water resource risks.

- The Global Forest Watch, released by the World Resource Institute, provides real-time data and tools for monitoring forest loss.

3. Company based risk assessment: Investors can examine each company in their investment portfolio to understand the natural risks associated with the company. Common company based risk assessment tools include:

- Reputation Risk Flags, which check whether a company has any controversial events, such as the RepRisk database.

- Governance Disclosure: Evaluate the disclosure of corporate governance, such as the Roundtable on Sustainable Palm Oil.

- Product: Check for natural related financial risks, such as CDP’s company dataset.

- Company performance: Some databases provide rankings and scorecards for companies in responding to natural related risks, such as Forest 500 or Forest IQ.

- Disputes in specific locations: Investors can combine dispute markers with location data to assess risks in specific locations, such as the Geospatial tool published by RepRisk.

The RIAA provides different evaluation methods for different asset classes:

- Publicly traded stocks and bonds: Listed companies typically disclose more natural data and may have better internal resources to implement natural strategies than non listed companies. Common natural tools can be used for this category.

- Private equity and debt: Private companies typically do not have an obligation to publicly disclose data, but investors may gain access to the company’s operational information through their ownership, and may also obtain more detailed data through the board of directors.

- Sovereign bonds: The World Wildlife Fund provides the Climate and Nature Sovereign Index to assess long-term risks of climate change and natural losses at the national level. Investors can also view the National Biodiversity Strategies and Action Plans to understand the natural goals and roadmap at the national level.

Assess Nature-related Opportunities of Investment Portfolios

In addition to assessing natural related risks in investment portfolios, investors also need to consider evaluating natural related opportunities. The TNFD defines nature related opportunities as activities that create positive outcomes for companies and nature by mitigating negative impacts or having a positive impact on nature. Evaluating opportunities related to nature can enhance the investment portfolio’s ability to withstand risks, obtain new financial return opportunities, and meet international standards. The RIAA provides three methods for evaluating opportunities related to nature:

Identify nature related opportunities through the nature risk assessment: Investors can adopt methods similar to assessing nature related risks to evaluate nature related opportunities.

Assess identified nature related opportunities for prioritization: Once investors have identified information related to nature related opportunities, they need to evaluate which opportunities are worth prioritizing.

Engage to realize nature related opportunities: Investors can take action, engage with companies, and convert nature related opportunities into financial performance.

Reference: