Global Net Zero Policy Report

Taskforce on Net Zero Policy releases report on global net zero policy, aimed at summarizing the implementation of net zero policy in jurisdictions.

Taskforce on Net Zero Policy believes that jurisdictions have recognized the importance of net zero action, but existing net zero policies are still insufficient to achieve the global warming target. Jurisdictions need to strengthen net zero policy action and coordination.

Related Post: CFA Institute Releases Report on Net Zero Investment Solutions

Overview of Global Net Zero Policy

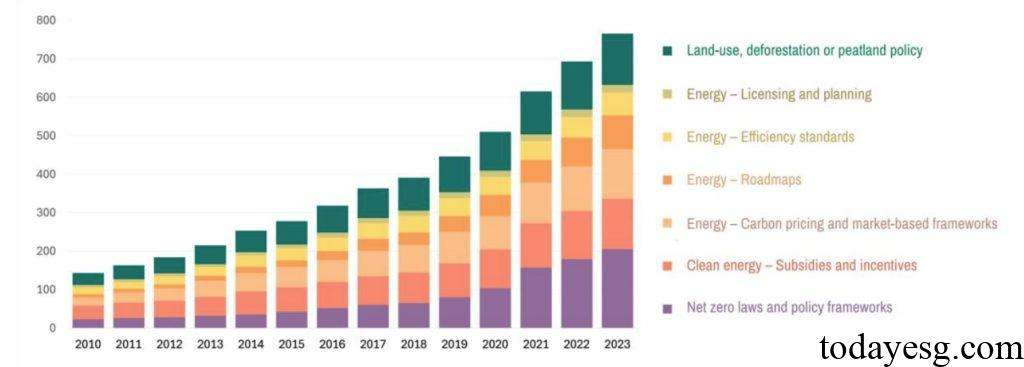

To evaluate the development of global net zero policy, Taskforce on Net Zero Policy analyzes 1000 net zero policies from G20 countries aimed at supporting enterprises and financial institutions to take action to achieve climate change mitigation and adaptation goals. All G20 countries, whether developed or emerging market economies, have issued net zero policies, and the number of policies has tripled since 2020. The global net zero policy mainly includes:

Enterprise and Financial Institution Policy

G20 countries have issued over 200 policies requiring enterprises and financial institutions to address climate change. Currently, International Sustainability Standards Board (ISSB) standards are adopted in three G20 countries, EU Corporate Sustainability Reporting Directive (CSRD) is adopted in three G20 countries. More than 20 jurisdictions are adopting the above standards.

Early policies of enterprises and financial institutions focused more on information disclosure, and these policies are gradually expanding into multiple directions such as taxonomies, financial product labeling, and engagement policies. These policies create a favorable environment for net zero transition creativity and are a fundamental condition for maintaining consistency between investment and net zero emissions. In the economic field, the net zero framework, clean energy, and carbon pricing have the widest application scope.

Climate-related Disclosure

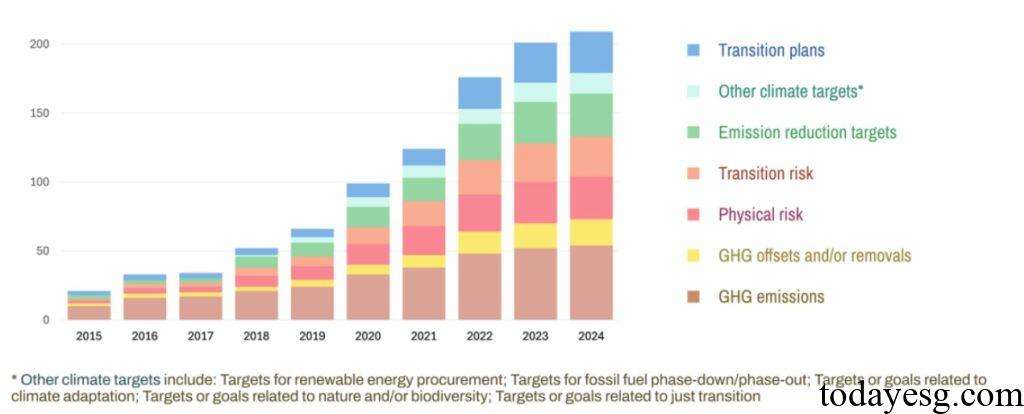

Climate-related disclosure is an important tool to support enterprises and financial institutions in addressing climate change, focusing on providing analysis of their strategies, operations, and performance in climate and sustainability issues. Since the release of IFRS S1 and IFRS S2, multiple jurisdictions have been establishing climate disclosure regulatory based on these standards.

Early climate-related disclosures were mainly based on greenhouse gas emissions, and 14 of G20 countries have established Scope 3 disclosure regulations, but most of them are voluntary disclosures. 13 of G20 countries require or suggest assurance of carbon emissions, and 11 of G20 countries require reference to the international greenhouse gas accounting system. With the development of information disclosure policies, greenhouse gas offsetting, physical risks, transition risks, carbon reduction targets, transition plans, etc. also become important topics for disclosure.

Transition Plan

The net zero transition plan is an important tool for achieving net zero for enterprises and investment portfolios, but it is still in the early stages of development. Among the G20 countries, only the European Union (France, Germany, and Italy) mandatory requires companies to adopt, implement, and disclose transition plans, while five other countries have incorporated transition plans into their policy frameworks and made voluntary requirements.

In addition to adopting and disclosing transition plans, some jurisdictions have introduced specific information about transition plans, such as climate goals, financial planning, and governance structures, but have not required the development of complete transition plans. Some climate and energy policies are also driving net zero transition, or requiring to reduce carbon emissions. Some Nationally Determined Contributions (NDCs) also involve national transition strategies.

Sustainable Taxonomy

The sustainable taxonomy classifies economic activities based on sustainable standards, which helps to achieve sustainable goals. The sustainable taxonomy can provide a list of activities that meet specific environmental and social goals, as well as technical standards to confirm whether these activities comply with sustainable goals. Among G20 countries, the European Union and China have mandated the use of taxonomies, 4 countries have developed voluntary taxonomies, and 6 countries are currently developing taxonomies.

Taxonomies can help enterprises and financial institutions attract investments consistent with net zero targets, reflecting the economic situation of each country. In terms of interoperability, the Common Ground Taxonomy launched by the International Platform on Sustainable Finance is an important measure to achieve taxonomy compatibility.

Reference: