Report on Climate Transition Bond Market

The Organization for Economic Co-operation and Development (OECD) releases a report on climate transition bond market, aimed at analyzing the role of the bond market in climate transition financing.

The OECD believes that current climate transition financing can only meet half of market demand and emerging markets and developing economies need to raise climate transition funds through the bond market to develop low-carbon economies.

Related Post: Asia Investor Group on Climate Change Releases 2025 Climate Transition Report

Current Status of Global Climate Transition Finance

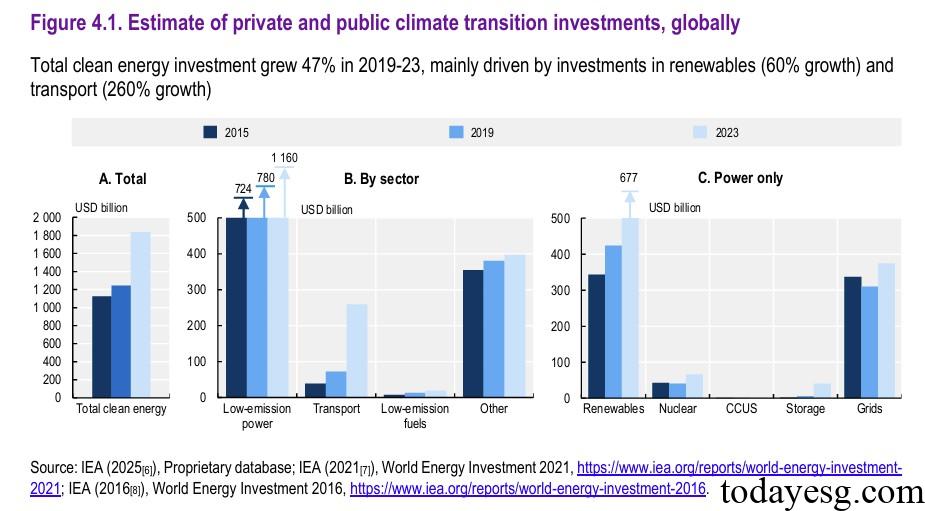

There are differences in estimates of the scale of global climate transition funds by different institutions. Bloomberg believes that the scale of global climate transition funds is $1.8 trillion, the Climate Policy Initiative believes that this figure is between $1.5 trillion and $1.6 trillion, and the International Energy Agency believes that this figure is $2 trillion. According to data from the International Energy Agency, investment in climate transition increased by 47% from 2019 to 2023, with the main contributions coming from the renewable energy and transportation sectors.

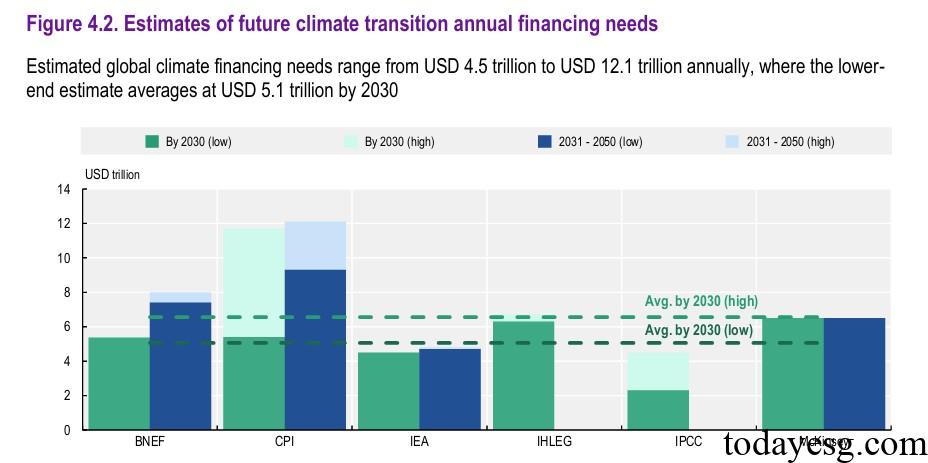

There are differences in the estimation of climate transition funding scale among various institutions, but all figures are lower than the global climate transition market demand. Bloomberg believes that the world needs to invest $5.4 trillion annually in climate transition by 2030, and $7.4 trillion to $8 trillion annually by 2050. The Climate Policy Initiative believes that climate transition requires $5.4 trillion to $11.7 trillion by 2030 and $9.3 trillion to $12.1 trillion by 2050. The International Energy Agency believes that the peak investment in 2030 will be $4.5 trillion, and an annual investment of $4.9 trillion is needed from 2031 to 2050.

The total global investment in climate transition (based on 2023) is $1.8 trillion, including $918 billion from developed economies, $606 billion from China, and $276 billion from emerging markets and developing economies outside of China. For other emerging markets and developing economies, climate transition investment needs to be tripled by 2030 and sevenfold by 2050 to meet market demand.

Role of Bond Market in Climate Transition

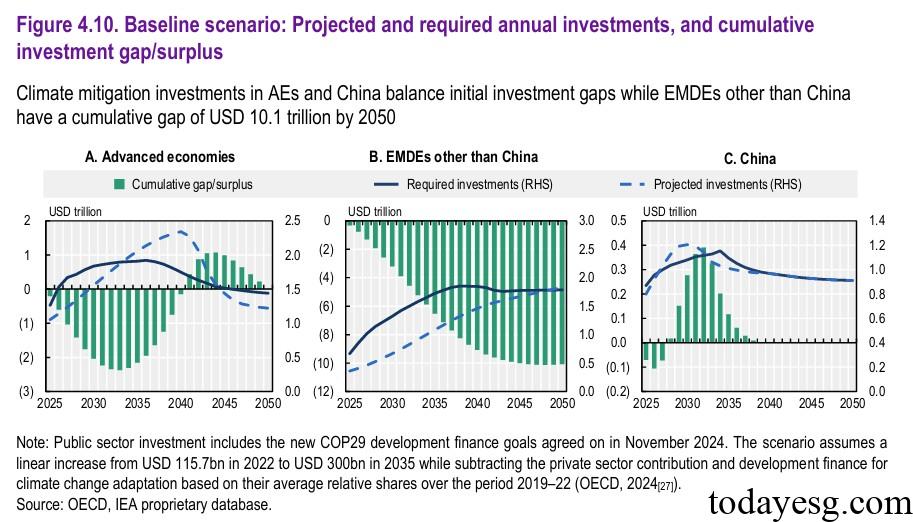

The OECD uses three scenarios to analyze the role of the climate transition bond market, namely baseline scenario, public sector scenario, and capital market scenario. In the baseline scenario, climate transition investments from both the public and private sectors remain at the current level, while climate investments from developed economies and China can narrow the investment gap, while emerging markets and developing economies will have a climate transition funding gap of $1.01 trillion by 2050.

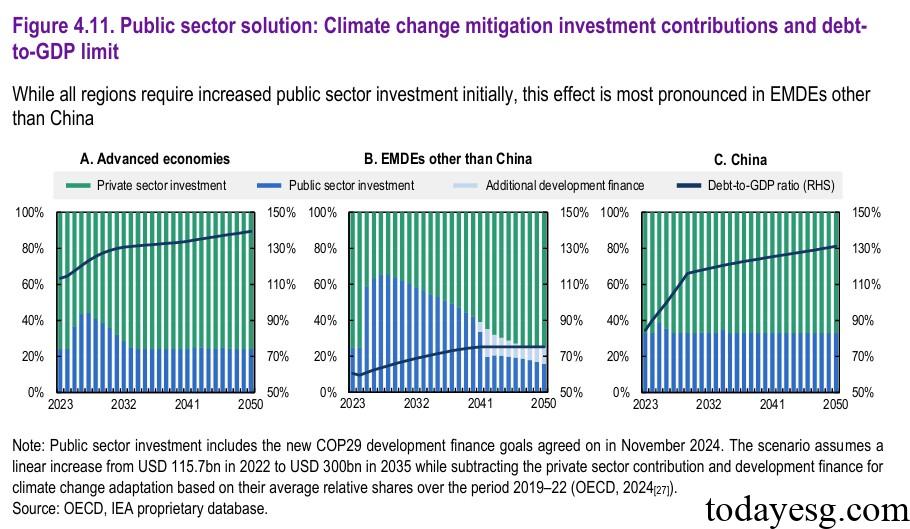

In the public sector scenario, all climate gaps are met by the public sector, and there is no funding gap. However, the proportion of public sector investment will increase to 59% by 2025 and reach a ceiling of 75% by 2050. Due to the debt ratio limitation, the public sector also needs to raise funds to meet other economic needs. It is difficult for the public sector’s climate transition funds to continue to increase according to the scenario assumptions.

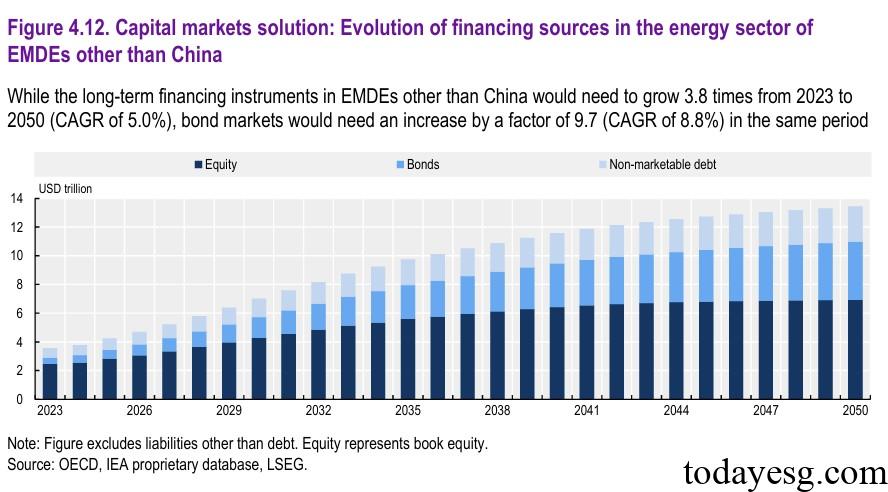

In the capital market scenario, when the public sector debt reaches its ceiling, the remaining investment gap is met by the private sector. In this case, the long-term financing instruments of emerging market economies need to increase by 3.8 times, and the bond market needs to increase by 9.7 times. Their bond financing ratio will approach that of developed economies. At present, the proportion of debt financing in developed economies is 48%, while the proportion of debt financing in emerging market economies is 30%, which means that the bond market will play a more important role in the climate transition.

Reference: