Central Bank Climate Action Report

The Network for Greening the Financial System (NGFS) releases a central bank climate action report, aimed at analyzing the climate actions of central banks in various jurisdictions, and helping central banks identify, assess, and manage the risks brought by climate change.

The NGFS believes that central banks climate actions aim to protect their balance sheets from the impact of climate risks and promote the transition to a low-carbon economy. Although the central bank often uses market neutrality as a guiding principle, it may deviate from this principle in practical activities due to climate factors and other reasons.

Related Post: NGFS Releases Second Edition of Guide on Climate-related Disclosure for Central Banks

Introduction to Central Bank Climate Action

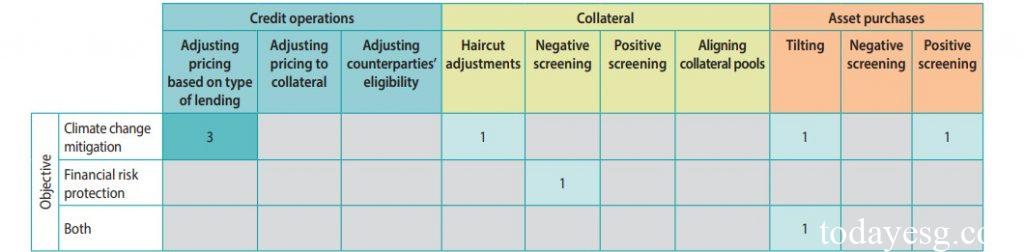

Central bank climate actions typically include three aspects, namely:

- Credit Operations: Central banks can choose to provide refinancing for low-carbon projects of financial institutions at more favorable interest rates in order to reduce costs for borrowers. When evaluating low-carbon projects, central banks usually use indicators such as energy performance or refer to green asset standards developed by financial institutions.

- Collateral Policies: Central banks can reduce the haircut on green bonds or loans, increase the liquidity available to financial institutions, and encourage them to provide services for green assets. The central bank can also provide relatively low discount rates for assets that provide climate related information disclosure but temporarily do not meet the green definition, thereby strengthening the development of climate disclosure.

- Asset Purchases: Central banks can purchase more bonds issued by low-carbon economy issuers, reduce the carbon emissions of investment portfolios, and encourage the market to establish preferences for green assets. Central banks typically adopt tilting measures, which involve reducing assets with negative climate characteristics and increasing assets with positive climate characteristics. Some central banks have also adopted negative screening methods to exclude issuers involved in certain high-energy consuming activities.

Challenges in Central Bank Climate Action

The NGFS believes that central bank climate actions typically face the following challenges:

- Strategic Focus: Central banks need to prioritize which climate change issues are strategic priorities in order to take more effective climate action from an economic or balance sheet perspective. They typically determine their strategic priorities based on the size of their climate risk exposure and need to consider the climate characteristics of their counterparties, such as commercial banks and enterprises. Due to the particularity of monetary policy, the actions of the central bank may have a significant impact on the financial market.

- Calibration: Central banks needs to balance the proportion of climate factors and other factors in monetary policy in order to balance climate risk and financial risk. For example, the central bank needs to consider the proportion of low-carbon assets in the asset purchase plan and the value of preferential interest rates in green loans. If a larger discount rate is applied to green assets, it may increase the liquidity of financial institutions and affect the effectiveness of monetary policy in a tight environment. When the central bank holds too many green assets, its industry concentration will also increase, which is not conducive to risk diversification.

- Data Limitations: Central banks need to address limitations on climate data, such as its accuracy and completeness. They can adopt top-down climate assessments to analyze the impact of climate change on businesses based on their balance sheets, or adopt bottom-up assessment methods to analyze the overall climate risks faced by assets starting from their climate characteristics. For the assessment of green assets, they can refer to some internationally recognized principles (such as the Green Bond Principles of the International Capital Market Association) to reduce the risk of greenwashing.

The NGFS believes that in addition to the aforementioned challenges, central banks also need to consider the accuracy of climate data in risk management models, the professional capabilities of external partners, and the central bank’s own climate talent reserves.

Reference:

NGFS Publishes Report on Adapting Central Bank Operations to a Hotter World

ESG Advertisements Contact:todayesg@gmail.com