2024 Progress Report

The Net-Zero Asset Owner Alliance releases its 2024 progress report, which aims to summarize the net zero development of asset owners over the past year and provide relevant recommendations.

The Net-Zero Asset Owner Alliance has 88 members with a cumulative AUM of $9.5 trillion. All members plan to achieve net zero emissions by 2050, making their investment portfolios align with the 1.5 ° C warming target.

Related Post: Net Zero Asset Owner Alliance Releases 2023 Progress Report

Development of Net-Zero Asset Owner Alliance

Since the establishment of the Net-Zero Asset Owner Alliance in 2019, the number of members has increased from 12 to 88, and the cumulative AUM has grown from $2.4 trillion to $9.9 trillion. At present, insurance companies (62%), pension funds (28%), and sovereign wealth funds (5%) account for a relatively high proportion. These members all plan to decarbonize their investment portfolios by 2050, with 81 members already adopting the net zero target setting method provided by the Net-Zero Asset Owner Alliance.

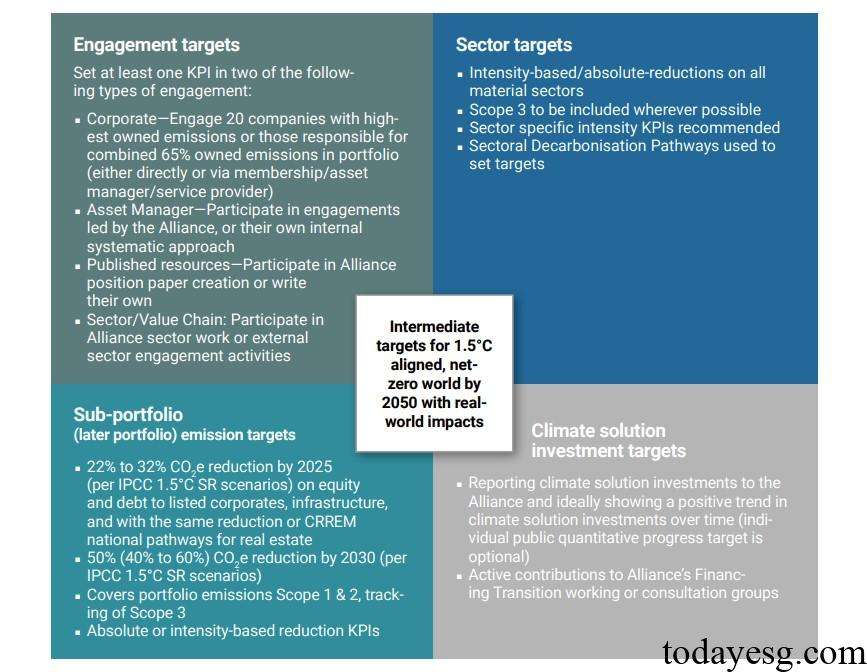

The Target Setting Protocol provided by the Net-Zero Asset Owner Alliance is based on a 1.5 degree Celsius warming target and is divided into engagement targets, sector targets, sub portfolio emission targets, and climate solution investment targets. Alliance members must set engagement targets and can choose at least two of the other three targets. The contents of these targets are as follows:

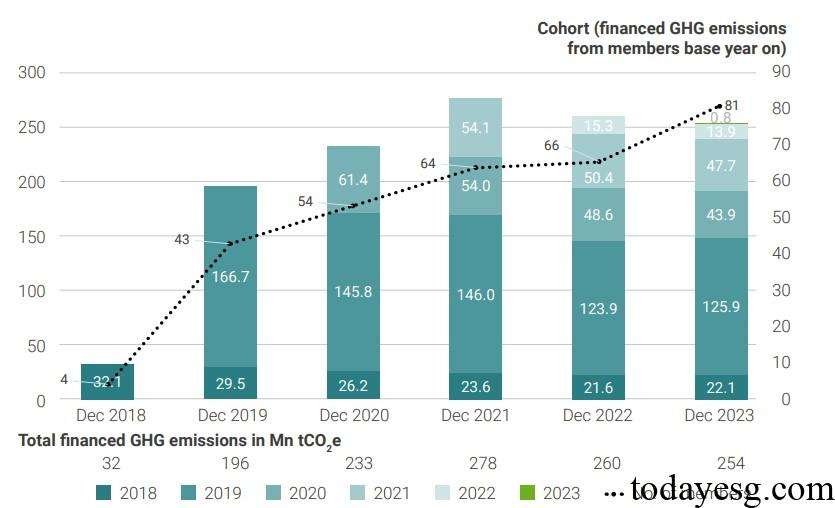

The Net-Zero Asset Owner Alliance requires its members to publicly disclose their absolute financed greenhouse gas emissions. With the increase in the number of alliance members, this indicator reached a stage high of 278 million tons in 2021. Although the number of alliance members continues to grow in 2022 and 2023, the carbon emission indicator has decreased from 260 million tons to 254 million tons, reflecting the progress in net zero. This phenomenon mainly comes from the redistribution of investment portfolios, where members transfer funds to more sustainable investments.

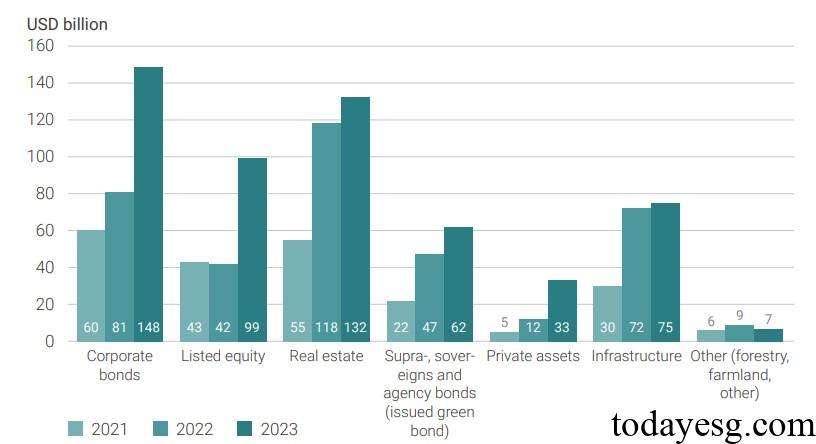

The Net-Zero Asset Owner Alliance requires members to report investments in climate investment solutions, and out of 81 members who have set mid-term goals, 80 have set climate investment targets. The cumulative climate solution investment target for alliance members in 2023 reaches $555 billion, an increase of $175 billion compared to 2022. These investments are mainly concentrated in bonds ($148 billion) and real estate ($132 billion), followed by equities ($99 billion) and infrastructure ($75 billion).

Net Zero Progress in Investment Portfolio and Industry

Among the 81 members who have set mid-term goals, 79 have set investment portfolio goals. The investment portfolio objective is a key indicator for measuring carbon reduction, and the carbon reduction targets of different assets vary to some extent, with the lowest reduction target being 12%. The maximum emission reduction target is 45%, and the average emission reduction target is 28%. Less than 20% of the members have set absolute emission reduction targets, while the remaining members have set emission reduction targets based on carbon intensity.

In terms of industry goals, the Net-Zero Asset Owner Alliance recommends that members set physical strength targets to reflect real carbon emission reductions. In various industries, the minimum emission reduction target is 6% and the maximum emission reduction target is 49%. The current obstacle to carbon reduction is that many members rely on external asset management companies, which have not yet provided products that reflect the decarbonization path of the industry. Therefore, asset management companies need to provide new products to meet the allocation needs of asset owners.

Suggestions From Net-Zero Asset Owner Alliance

The Net-Zero Asset Owner Alliance believes that regulators need to take the following measures to help asset owners achieve net zero transition:

- Take systematic measures to increase the supply of low emission and zero emission energy.

- Design and implement a fair carbon pricing mechanism, consistent with the Paris Agreement.

- Develop a detailed and credible transition plan to reduce barriers to net zero investment.

- Reduce non compliant electricity production based on a 1.5 degree Celsius path.

- Expand blended financing and support the net zero transition of developing economies.

Reference:

Demonstrating 1.5°C-Aligned Decarbonisation: NZAOA’s Fourth Progress Report

Contact:todayesg@gmail.com