2024 European Sustainable Fund Report

MSCI releases 2024 European Sustainable Fund Report, aimed at analyzing the performance of European sustainable funds and the impact of European ESG regulations.

MSCI believes that the EU Taxonomy, Corporate Sustainability Reporting Directive, and European ESG fund naming rules have already had an impact on the sustainable financial market, and sustainable funds need to make adjustments to meet the requirements of stakeholders.

Related Post: European Securities and Markets Authority Releases Sustainable Finance Report

Current Status of European Sustainable Fund Market

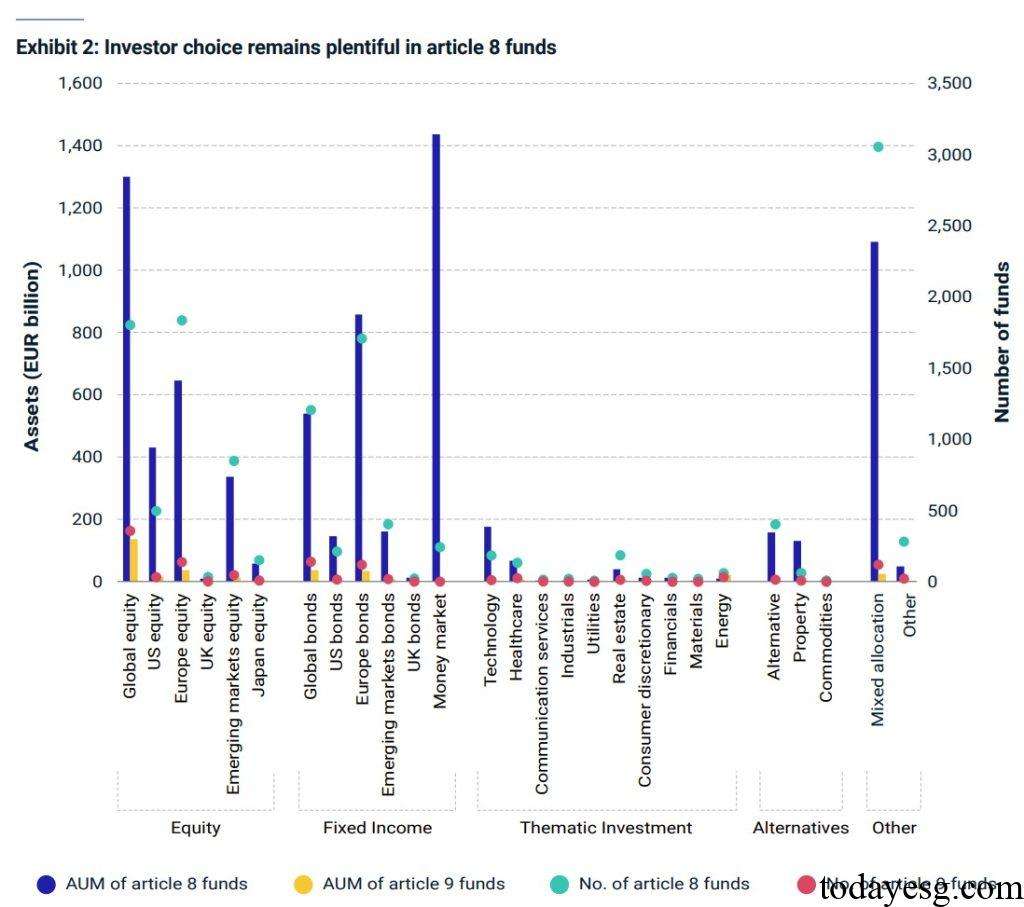

As of June 2024, there are approximately 38000 funds in Europe with an AUM of 14 trillion euros. The AUM of sustainable funds has reached 8 trillion euros, accounting for 57%. The main investment directions of sustainable funds are stocks (43.8%) and bonds (39.5%). According to the analysis of fund categories classified by the Sustainable Finance Disclosure Regulation (SFDR), global equity funds and money market funds have a relatively high proportion.

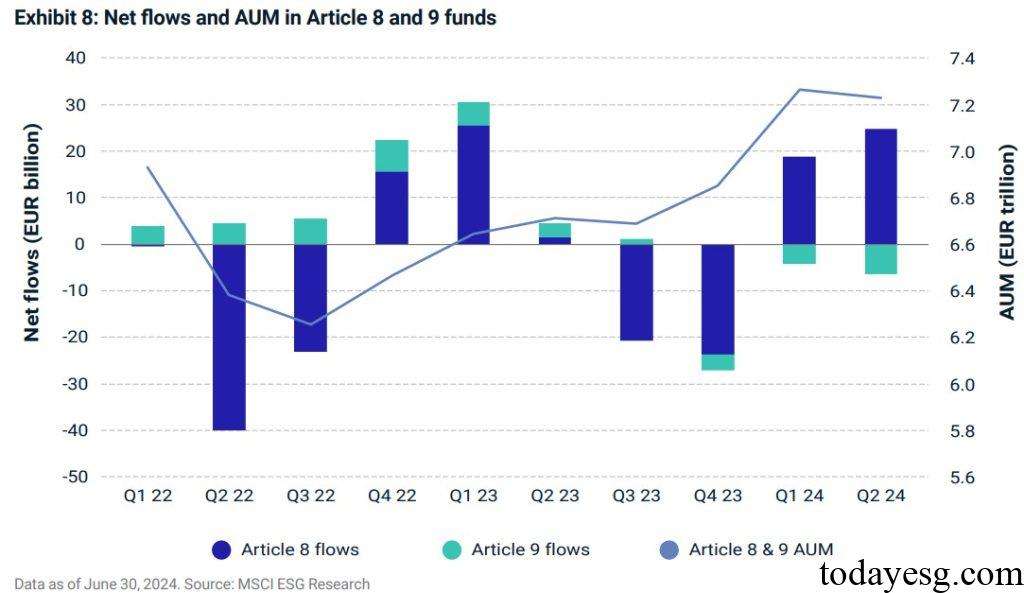

In the first half of 2024, the net inflow of Article 8 funds in Europe was 43.5 billion euros, and the continuous net outflow of Article 9 funds was nearly 10 billion euros. The total size of Article 8 funds is 6.9 trillion euros, and the total size of Article 9 funds is 330 billion euros, of which the number of Article 8 funds is 12 times that of Article 9 funds. In the first half of 2024, Article 8 funds increased by 671 and Article 9 funds increased by 60. 35 Article 8 funds have been reclassified as Article 9 funds, and 5 Article 9 funds have been reclassified as Article 8 funds. These classification changes have significantly decreased compared to previous years, reflecting that asset managers’ compliance with SFDR is gradually improving.

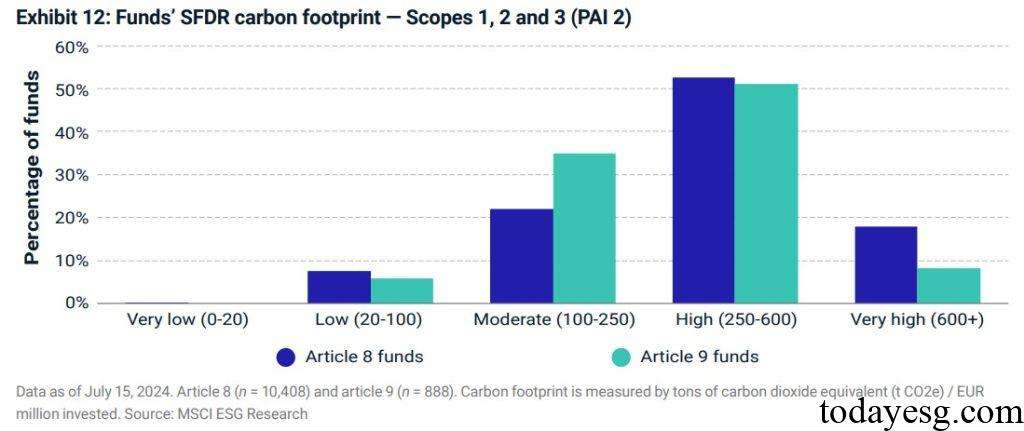

In terms of Principal Adverse Impact (PAI) indicators, sustainable funds have the lowest exposure to the fossil fuel industry, with 50% of Article 9 funds having an exposure of less than 2.5% to the fossil fuel industry. MSCI finds that 25% of Article 9 funds still use green bonds in their names while having an exposure to the fossil fuel industry greater than 10%. These funds may not comply with the ESG fund naming rules issued by the European Securities and Markets Authority (ESMA), and therefore need to change their names or adjust their investment portfolios. In terms of fund carbon footprint, the overall performance of Article 9 Fund is better than that of Article 8 Fund, especially in the high carbon emission field.

Impact of European ESG Fund Naming Rules

In May 2024, the ESMA issued ESG fund naming rules, which set requirements for fund names and investment portfolios. ESG funds need to invest at least 80% of their funds in sustainable assets and exclude assets that do not meet the Climate Transition Benchmark (CTB) or Paris Aligned Benchmark (PAB). As of July 2024, MSCI found a decrease of 30 funds using sustainable terms in their names and an increase of 16 using transitional terms, which may indicate a more pronounced impact of climate transition benchmarks using sustainable terms.

MSCI finds that green bond funds and infrastructure funds are more susceptible to the naming conventions of ESG funds. The EU Green Bond Standard allows companies in the utility and energy industries to issue green bonds, but funds investing in these green bonds are required to exclude high carbon emitting assets. Infrastructure funds also face similar challenges, with 50% of their investment portfolios failing to pass the screening of the Paris Aligned Benchmark.

The UK Financial Conduct Authority (FCA) officially implemented the Sustainability Disclosure Requirements (SDR) in May 2024, requiring sustainable funds to use sustainable investment labels from July 2024. The deadline for this requirement has been extended to April 2025. MSCI believes that there are a total of 320 funds in the UK using sustainable terminology, with a managed size of 175 billion GBP, accounting for 20% of the total sustainable funds. As of September 2024, only four funds have publicly disclosed their sustainable investment labels.

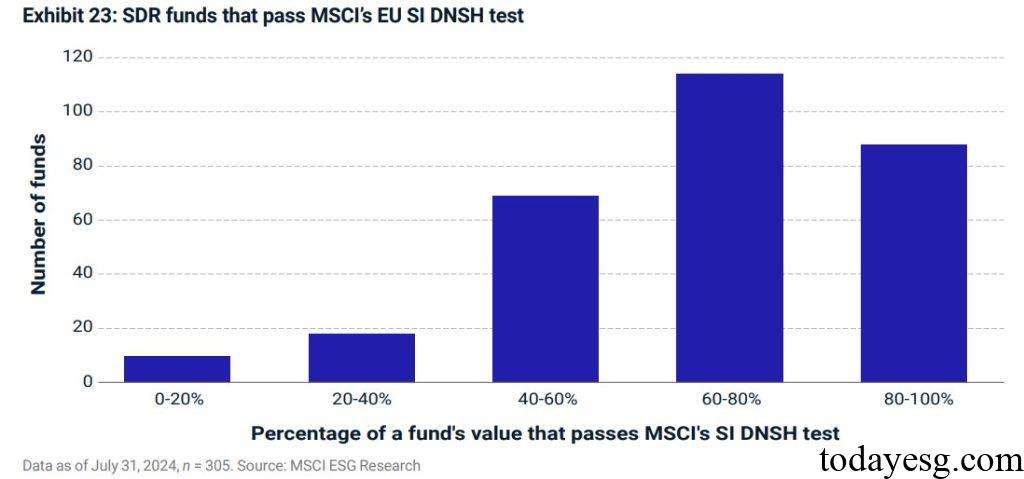

MSCI evaluates whether UK sustainable funds meet the requirements based on the Do No Significant Harm (DNSH) test for EU sustainable investments. When a threshold of 60% is set, two-thirds of UK sustainable funds pass the test. When the threshold of 40% is set, 10% of sustainable funds fail, and these funds may need to change their names in the future.

Reference: