Introduce ESG to investors

ESG was proposed by the United Nations Global Compact in 2004. After 20 years, it has become an important factor in the asset management industry. However investors may still confuse concepts such as ESG, socially responsible investment, ethical investment, responsible investment, impact investment, and sustainable investment in their investing decisions.

This article analyzes documents released by the UK Sustainable Investment and Finance Association (UKSIF) to understand investors’ views on ESG and help financial market practitioners learn how to introduce ESG to investors.

Related Post: What is ESG? Why is ESG Important?

Investors’ Views on ESG

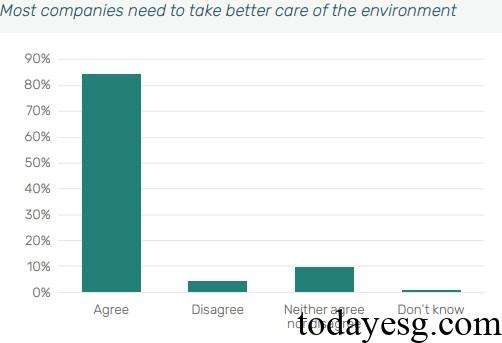

The UKSIF surveys over 1000 investors to understand their attitudes towards ESG, sustainability, as well as their considerations of these factors in their investments. As the most frequently mentioned factor in ESG, the vast majority of investors have a positive attitude towards environment. 85% of respondents believe that companies need to better protect the environment, and 56% of respondents say they consider the company’s environmental reputation when purchasing products and services, indicating a preference for environmental factors in the market.

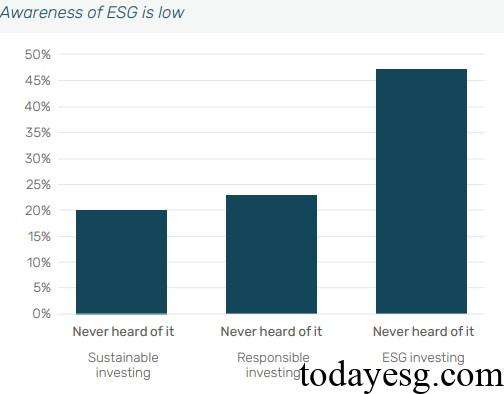

Although the market generally focuses on environmental factors, investors’ attitudes towards incorporating environmental factors into sustainable and ESG investments are not as clear as before. 53% of respondents believe that sustainable companies are more likely to succeed, and 45% of respondents believe that companies with good ESG performance are more likely to succeed. Investors’ awareness of ESG investment is significantly lower than that of sustainable investment. Data shows that nearly half of investors have not heard of ESG, but only 20% of investors have not heard of sustainable investment.

The UKSIF believes that ESG, as an acronym, is difficult to understand intuitively, while sustainable investment, as a phrase, is easy for investors to understand. Among those who are familiar with ESG, there are more people who hold a skeptical. 47% of respondents mention that asset management companies cannot reach a consensus on ESG, which is related to the numerous contradictory ESG data and ESG standards that investors can access.

29% of respondents believe that ESG is a method by which companies impose their beliefs about social and environmental issues on consumers, and these ESG skeptics are prevalent globally. UK respondents are more inclined to believe that investors should invest in the way they deem appropriate. Most investors oppose a direct ban on ESG investments, but demand higher information transparency. In terms of governance, investors are often more difficult to identify, which means asset management companies need to provide more detailed information to help investors understand the potential impact of governance on investments.

How to Introduce ESG to Investors

Based on the above analysis, the UKSIF has developed a series of measures to help financial market practitioners introduce ESG to investors:

- Avoid using overlapping terms: Using terms that investors generally understand can better convey information. Sustainable investment is the most recognized term, surpassing impact investing. Using financial terms such as ESG, transition, and taxonomy may require more detailed information to help investors understand the specific meanings.

- Provide sufficient options: Investors may choose not to invest due to a lack of understanding of ESG products, and practitioners should present sustainable and non-sustainable information to investors, allowing them to make choices based on their risk preferences and values.

- Eliminate investors’ concerns about ESG: Although some investors hold negative views on ESG, practitioners should also introduce its role in risk management, so that investors understand how applying ESG can reduce investment risks.

- Understand anti greenwashing rules: Communication between practitioners and investors must be clear, fair, and not misleading, providing specific evidence and actions related to ESG in marketing materials to reduce compliance risks.

Reference:

How to Talk To Your Clients About Sustainability

ESG Advertisements Contact:todayesg@gmail.com