Investing in Nature Course

This article introduces the Investing in Nature course released by the European Investment Bank (EIB), which provides investors with investment methods for natural capital and biodiversity related projects, as well as how to address the challenges in these investments.

As the climate bank of the European Union, the European Investment Bank provides investors with numerous free courses on environment and society on the Open Learning page on its official website, including courses on climate change, biodiversity and nature.

Related Post: EY Launches Free Green Skills Course

Introduction to Investing in Nature Course

The Investing in Nature course aims to provide market participants with methods to invest in natural related projects, and is suitable for enterprises that wish to obtain financing from nature, as well as financial institutions that wish to provide financing for natural projects. The course is divided into five parts, namely:

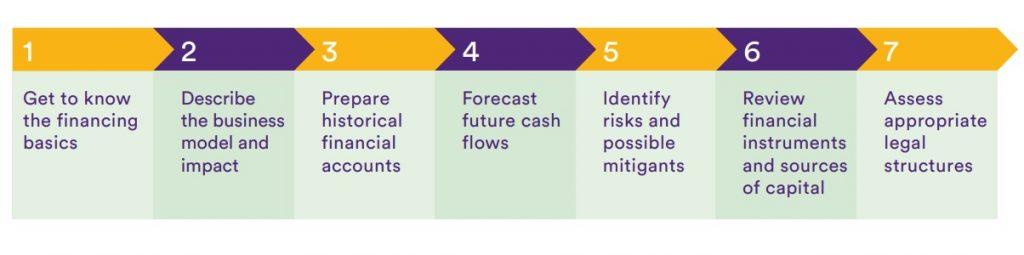

- Part 1: Introduction to financing investments in natural capital. This section introduces the practical challenges faced by natural project financing and how to establish a natural investment plan through several steps.

- Part 2: Business models for conservation and nature-based solutions projects. This section introduces the business model of natural projects and analyzes how to design feasible natural projects through the case of Rewilding Europe Capital, and show key points to financial institutions.

- Part 3: Preparing financials and strengthen commercial viability of your project. This section introduces how to write financial statements for natural projects and predict their future cash flows based on financial data. While predicting cash flows, market participants also need to identify probable risk factors and reduce them.

- Part 4: Understanding the different types of financing. This section introduces different financing methods for natural projects, including equity financing, debt financing, and mixed financing, as well as how to conduct direct or indirect financing.

- Part 5: Assessing appropriate legal structures for investing in natural capital. This section introduces the impact of different legal frameworks for financing methods on financing costs and difficulties, and provide feasible legal support for natural projects.

The investing in nature course provides document and videos for each section. We can learn the basic knowledge of natural investment and study on real cases to master the practical methods.

Reference: