Report on European Impact Investing Market

Impact Europe releases a report on European impact investing market, aimed at analyzing the development of the European impact investing market.

As a member of the European Impact Investing Consortium, Impact Europe is establishing standards for the European impact investing market to understand its trends and practices.

Related Post: Global Impact Investing Network Releases 2024 Impact Investment Market Report

Overview of European Impact Investing Market

The size of the European sustainable investment market is 4.7 trillion EUR, of which the impact investing market is 230 billion EUR, accounting for 5% of the sustainable investment market. Impact investing can be divided into listed impact investing and unlisted impact investing, with market sizes of 40 billion EUR and 190 billion EUR respectively. Impact Europe denotes listed impact investing into public impact investing and unlisted impact investing, with differences in investment methods between the two.

Impact Europe estimates that the assets for implementing impact investing in Europe is 7.6 trillion EUR, accounting for one-third of the total asset size in Europe (22.9 trillion EUR). Of the 7.6 trillion EUR, 4.6 trillion EUR belong to unlisted assets and 3 trillion EUR belong to listed assets. The growth rate of the European impact investing market (20% -21%) is higher than that of the European sustainable investment market (17%), but it is still relatively low in terms of absolute AUM.

European Impact Investing Market Analysis

From the perspective of countries, UK (29%), Netherlands (25%), and France (22%) have relatively high proportions. These countries have a well-established impact investing ecosystem and an active investor base. Italy (9%), Denmark (5%), Belgium (5%), and Spain (3%) also rank high in the European impact investing market. Impact Europe plans to include more countries in future reports to comprehensively measure the market development.

From the perspective of investor categories, venture capital and private equity managers account for 45% of the total number of investors and manage 40% of assets. The proportion of development financial institutions is relatively low (4%), but their assets account for 27%. These investors play an important role in large-scale impact investing projects. Foundations have a relatively high proportion in terms of quantity (11%), but their AUM proportion is only 0.7%, indicating that these institutions are more inclined to invest in small-scale impact investing projects.

From the analysis of the investment locations, Europe (55%), Africa (18%), and Asia (12%) have a relatively high proportion, among which the proportion of impact investing in Africa has increased by 4 percentage points from 2022, reflecting investors’ attention to African market.

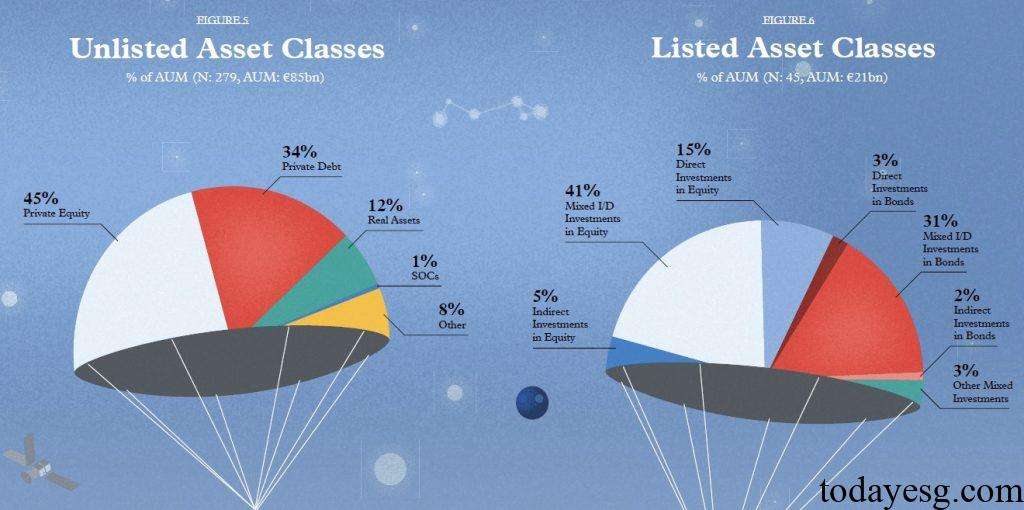

From the perspective of impact investing asset classes, private equity (45%), private debt (34%), and physical assets (12%) account for a relatively high proportion in the private impact investing market. In the public impact investing market, mixed equity investment (41%), mixed debt investment (31%), and direct equity investment (15%) account for a relatively high proportion.

Impact Investing and UN Sustainable Development Goals

Impact Europe analyzes the relationship between European impact investing and the United Nations Sustainable Development Goals and found that Sustainable Development Goal 8 (Decent Work and Economic Growth), Sustainable Development Goal 13 (Climate Action), and Sustainable Development Goal 10 (Reduced Inequality) account for a relatively high proportion, at 47%, 47%, and 38%, respectively. According to the 2022 report, these three goals account for 62%, 46%, and 55% respectively. This change indicates that impact investors continue to pay attention to climate action solutions.

Investors in different regions have different concerns about sustainable development goals, with Northern European investors paying more attention to environmental related sustainable development goals and Southern European investors paying more attention to social related sustainable development goals.

Reference:

The Size of Impact

ESG Advertisements Contact:todayesg@gmail.com