Working Paper on Sovereign ESG Investing

The International Monetary Fund (IMF) releases a working paper on sovereign ESG investing, which aims to analyze the ESG framework of sovereign ESG rating providers and summarize the development of global sovereign ESG investing.

As one of the world’s largest asset classes, sovereign assets have become an important part of institutional investors’ portfolios, and sovereign ESG investment has also become a core part in sustainable investment. Sovereign ESG is quite different from corporate ESG, and it is an essential reference for investors when allocating assets.

Related Post: Introduction to the World Bank Sovereign ESG Database

Sovereign ESG Rating Providers

In order to conduct an in-depth study of sovereign ESG investment methods, the IMF selects seven sovereign ESG rating providers, which account for more than 80% of the sovereign ESG rating market. These providers include FTSE, ISS ESG, MSCI, RepRisk, Robeco, Sustainalytics, V.E and Verisk Maplecroft. Six of the seven providers participated in the IMF’s sovereign ESG investment research published in 2021.

The IMF believes that the transparency of sovereign ESG ratings has improved compared to 2021, with more rating providers disclosing rating indicators, calculation weights and data sources. Since all rating providers’ rating data are used for commercial purposes, some unique rating data are still retained as commercial secrets. Most rating providers define sovereign ESG rating products as risk products, which are designed to measure sovereign ESG risks and opportunities from a financial materiality perspective.

Empirical Analysis of Sovereign ESG Ratings

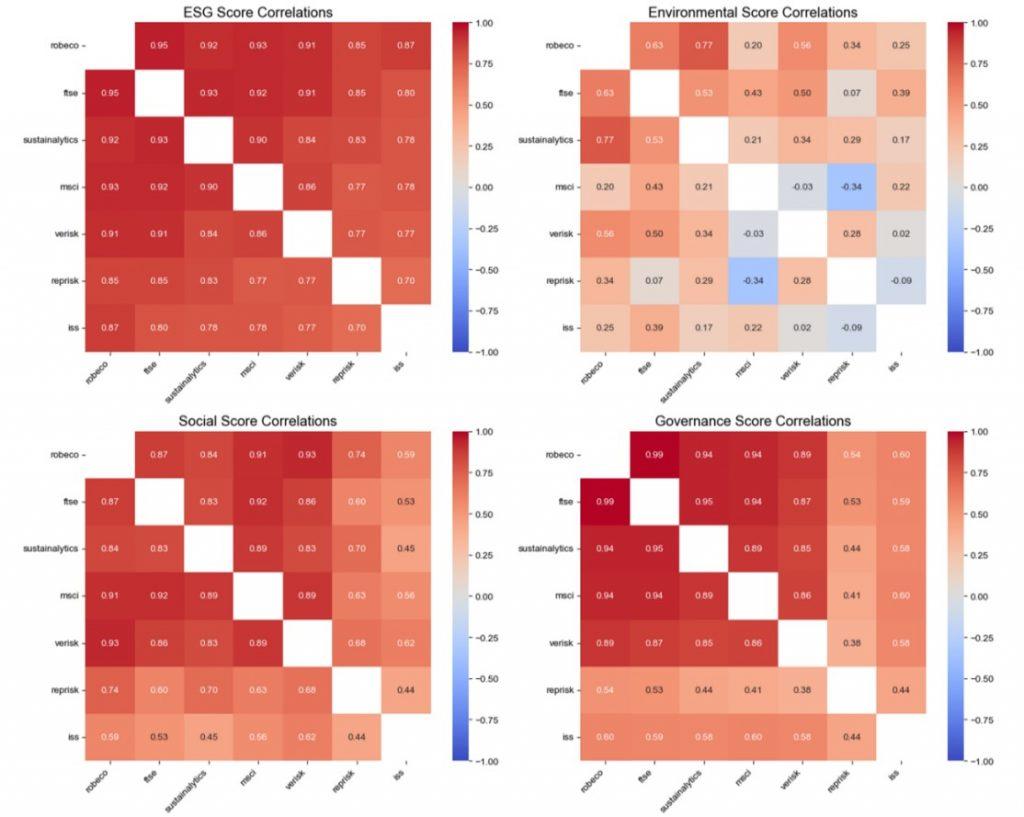

To understand the differences between different sovereign ESG ratings, the IMF conducts a correlation analysis of all sovereign ESG ratings and the sub-ratings of environmental, social and governance factors used in these ratings. The overall correlation of sovereign ESG ratings is 0.84, which is similar to the results of the 2021 study (0.85). In terms of sub-ratings, governance factors have the highest correlation, reaching 0.70, and environmental factors have the lowest correlation, reaching 0.27. Different ratings have negative correlations in terms of environmental factors, reflecting the challenges faced by rating providers in the methods and data for handling environmental factors.

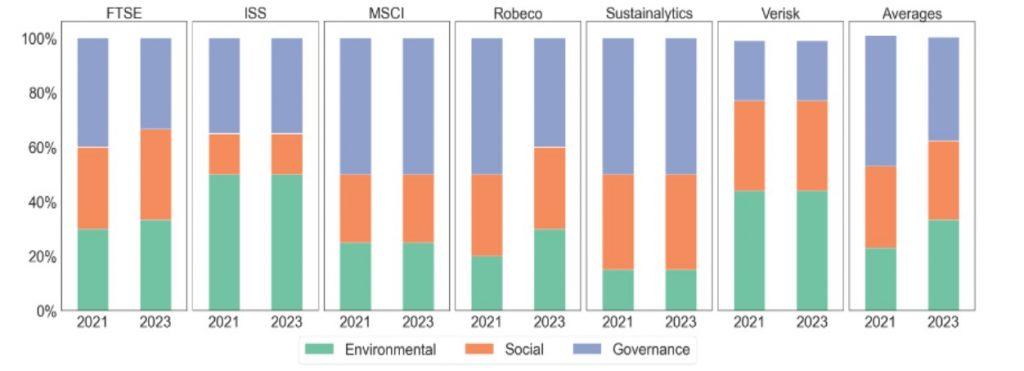

From the independent weights of environmental, social and governance factors, the overall weights have changed from 29%, 28% and 43% in 2021 to 33%, 29% and 38%. The weight of governance factors has decreased, while the weight of environmental factors has increased. This change mainly comes from the adjustment of the ESG rating framework by FTSE and Robeco, but governance factors still occupy a dominant position. Most rating providers believe that without good governance, it is difficult to manage environmental factors and social factors effectively.

Environmental Factors in Sovereign ESG Ratings

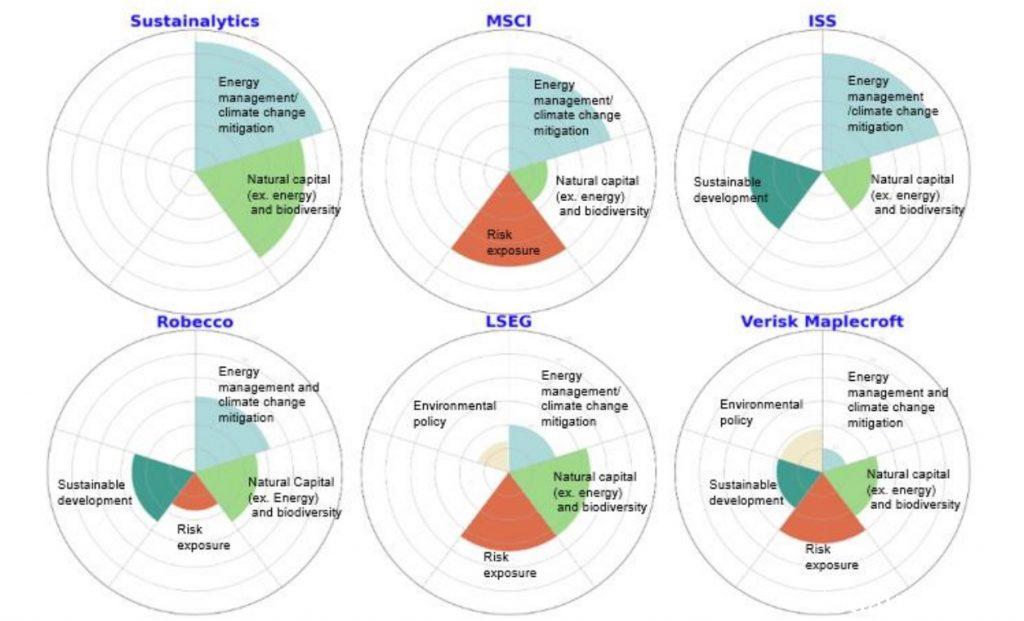

Different sovereign ESG ratings have subsequent differences in environmental factors, and understanding these differences is very essential for analyzing sovereign ESG ratings. The IMF believes that different rating providers have different views on the choice of environmental factors. Although some rating providers focus on physical climate risks such as natural disasters, the weight of greenhouse gas emissions in environmental factors is increasing given the connection between greenhouse gas emissions and transition risks. Natural capital and biodiversity are also receiving more attention after the Kunming-Montreal Global Biodiversity Framework, which was adopted at COP15 meeting in 2022.

The IMF maps the environmental factors involved in different ESG ratings to specific categories and finds that environmental factors are concentrated in several common categories, such as energy management, natural capital and risk exposure. Some environmental factors take into account environmental policies, sustainable development and other aspects, but overall, the rating providers have obvious differences in environmental factors considerations.

Reference:

Sovereign Environmental, Social, and Governance (ESG) Investing: Chasing Elusive Sustainability