Net Zero Investment Framework 2.0

The Institutional Investors Group on Climate Change (IIGCC) releases the Net Zero Investment Framework (NZIF) 2.0, aimed at helping investors develop net zero transition strategies and analyze climate risks and opportunities.

The net zero investment framework was first proposed in 2021 and is a major achievement of the Paris Aligned Investment Initiative. It is also the most widely used net zero transition framework for investment portfolios by global investors. After three years of practical application, IIGCC updated it and released the Net Zero Investment Framework 2.0.

Related Post: Asian Investor Group on Climate Change Releases Net Zero Investment Report

Update on Net Zero Investment Framework 2.0

In terms of investment objectives, the Net Zero Investment Framework 2.0 will modify the previous’ Reducing Financing Emissions’ to ‘Financing Reduced Emissions’. The Institutional Investor Group on Climate Change believes that focusing solely on reducing carbon emissions from investment portfolios has limited impact on net zero. Investors should consider providing funding for low-carbon portfolios at the initial investment stage, rather than setting annual carbon reduction targets for investment portfolios after investment.

In terms of investment categories, the Net Zero Investment Framework 2.0 adds three parts: Infrastructure, Private Equity, and Private Debt, and makes adjustments to the existing investment frameworks for company stocks, bonds, sovereign debt, and the real estate industry. The net zero target and implementation guidelines for each investment category are written on the same basis to assist investors with multiple asset classes in implementing net zero investments.

In terms of substantive industries, the Net Zero Investment Framework 2.0 reclassifies Agriculture, Forestry, and Fishing as high material industries, acknowledging their importance in carbon emissions. In addition, for all material industries, the Net Zero Investment Framework 2.0 also adds action plans to provide investors with reasonable net zero advice.

Introduction to Net Zero Investment Framework 2.0

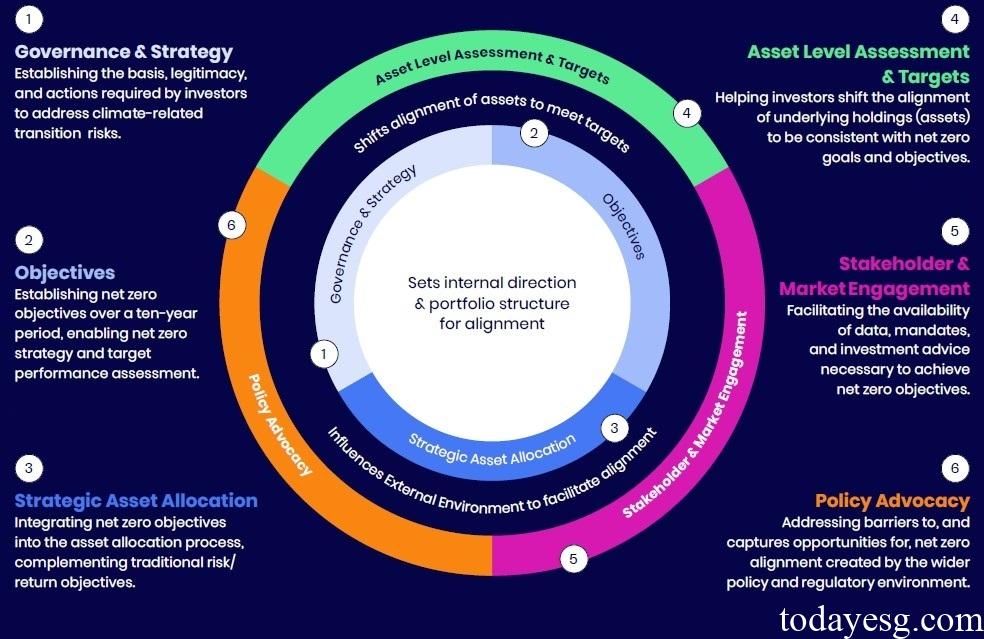

The net zero investment framework aims to provide asset owners, asset managers, and investment advisors with an ‘Implement or Explain’ framework for setting net zero goals and implementing net zero investments. The net zero investment framework supports investors to adopt a net zero coordinated decarbonization pathway when setting climate goals, in order to assess whether assets meet the Paris Agreement’s 1.5 degree Celsius warming target. The net zero investment framework is mainly divided into the following parts:

- Governance & Strategy: Investors need to establish a governance framework related to net zero, commit to investing according to the net zero emission path, and allocate execution and regulatory work to the investment committee and company management. In terms of strategy, investors establish a net zero strategy and use scenario analysis to evaluate the feasibility of decarbonization.

- Objectives: Investors need to develop decarbonization targets for Scope 1, Scope 2, and Scope 3 based on the current carbon emissions situation of their investment portfolio, and disclose their carbon emission calculation methods. The duration of decarbonization targets needs to reach ten years, and status or updates and adjustments of the targets should be disclosed annually.

- Strategic Asset Allocation: Investors need to incorporate net zero targets into the strategic asset allocation process, testing them based on market assumptions, asset returns to clarify net zero asset allocation.

- Asset Level Assessment & Targets: Investors need to calculate whether carbon emissions meet decarbonization pathways based on different asset classes and set short-term emission targets for each asset class. This section requires confirmation of substantial carbon emitting industries and consideration of investment methods such as screening and exclusion.

- Stakeholder & Market Engagement: Investors can disclose information related to the net zero investment framework to stakeholders and encourage them to apply it.

- Policy Advocacy: Investors can consider directly or indirectly participating in policy-making to support the development of net zero regulations.

Reference:

Updated Net Zero Investment Framework Published as NZIF 2.0

ESG Advertisements Contact:todayesg@gmail.com