Sovereign ESG Analysis Services

Fitch subsidiary BMI launches Sovereign ESG Analysis Services ESG Country, a service aimed at analyzing ESG risks and opportunities in 140 countries, and providing relevant ESG indices, reports, and research.

BMI believes that sovereign ESG analysis services can meet the market’s demand for reliable and transparent sovereign ESG data, help clients quantify ESG risk exposure, and assist in investment decision-making. As an international economic forecasting agency, BMI has 40 years of expertise in national risk forecasting and provides insightful historical data analysis and predictions.

Related Post: IMF Releases Working Paper on Sovereign ESG Investing

Introduction to Sovereign ESG Analysis Services

BMI’s sovereign ESG analysis services include ESG Country Index, ESG Country Report, and Bespoke ESG Research. The ESG Country Index measures the risk of sovereign ESG to economic and business activities by analyzing over 400 data points. The ESG Country Report provides comprehensive national level insights into economic sustainability expectations, while bespoke ESG research provides market specific ESG risk and opportunity analysis.

Sovereign ESG analysis services can help investors cope with economic sustainability risks and opportunities at the national level, understand how ESG factors affect a country’s economic development, and measure ESG risk exposures of different countries. For clients investing in emerging market economies, sovereign ESG analysis services can evaluate regulatory frameworks, reduce compliance risks, and provide opportunities for long-term investments.

Introduction to ESG Country Index

The ESG Country Index launched by BMI quantifies the ESG risks faced by different countries over the next decade and is used in ESG sovereign reporting and customized ESG research. It integrates the research experience of BMI and incorporates GeoQuant’s high-frequency indicators, with an index range of 0-100, where 100 represents the highest risk level.

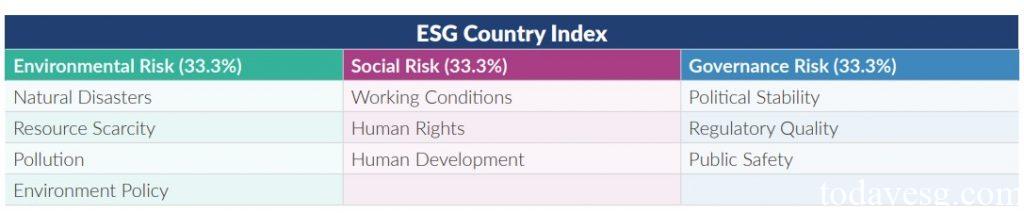

The ESG Sovereign Index divides environmental, social, and governance risks into three equally weighted parts, each of which includes:

Environmental risk: measuring climate change risks and the market’s ability to protect against these risks. Environmental risks include:

- Natural disasters (25%): the Composite Disaster Exposure Score measures the frequency and impact of climate risk, geology, and ecosystem natural disasters. The Composite Disaster Resilience Score measures the quality of infrastructure and the financing and management capabilities for disaster recovery.

- Resource scarcity (25%): the Composite Food Insecurity Score measures the supply and demand relationship of the current and future food systems. The Composite Water Insecurity Score measures the current and future supply and demand relationship of water resources.

- Pollution (25%): the situation of natural resource pollution and its impact on public health.

- Environmental policy (25%): decarbonization measures of the economy and the robustness of environmental policies, such as fossil fuel subsidies, biodiversity conservation, and carbon emission pricing.

Social risk: measuring population development capacity and quality of life. Social risks include:

- Working conditions (33%): overall quality of working conditions, such as safety, medical security, and labor protection and wage levels.

- Human rights (33%): the scope and implementation of human rights protection, as well as the protection of vulnerable and minority groups.

- Human development (33%): overall level of socio-economic development and youth development.

Governance risk: measures the degree of protection provided by enterprises and stakeholders, as well as the state of corporate governance. Governance risks include:

- Regulatory quality (33%): the quality and effectiveness of regulatory policies, including the openness of trade and investment policies, as well as the quality and effectiveness of legal provisions.

- Public safety (33%): law enforcement quality and social security.

- Stability (33%): policy stability.

The ESG Country Index reflects a country’s ESG performance in a detailed and timely manner through the above indicator system, providing investors with an important tool for evaluating and managing ESG risks at the national level.

Reference:

BMI Launches ESG Country Service to Measure Risk in 140 Markets