Blue Transition Bond Fund

Fidelity International has launched the world’s first Blue Transition Bond Fund, aimed at promoting environmental and social characteristics by investing in bonds that support the transition of the blue economy.

According to the EU Sustainable Finance Disclosure Regulation (SFDR), the Blue Transition Bond Fund belongs to Article 8 funds and disclosures information based on SFDR.

Related Post: Amundi Launches Net Zero Strategy ESG Funds

Introduction to Blue Transition Bond Fund

The Blue Transition Bond Fund is an open-end fund with the goal of achieving long-term capital growth. The fund will invest at least 70% of its assets in bonds issued by global companies, which must meet the following requirements:

- Bonds contribute to ocean and freshwater goals that align with one or more of the United Nations Sustainable Development Goals.

- Raising funds will be used for activities that are beneficial to the sustainability of oceans and freshwater (such as blue bonds).

- Bonds will improve the management of risks and opportunities related to water resources.

- Bonds will reduce the negative impact of climate change on oceans and freshwater.

The investment ratio of the Blue Transition Bond Fund includes:

- China onshore bonds: up to 10%.

- Emerging market bonds: up to 40%.

- Bonds issued by eligible REITs: up to 20%.

- Mixed bonds and convertible bonds: less than 30%, with convertible bonds less than 20%.

- Money market instruments: up to 20%.

- Bonds below investment grade: up to 20%.

Investment Process of Blue Transition Bond Fund

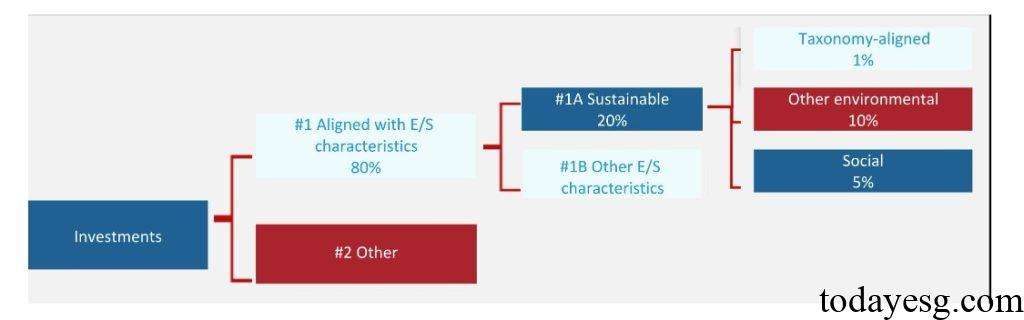

According to the EU Sustainable Financial Disclosure Regulation, at least 80% of the fund’s investments must be used to meet the environmental or social characteristics described in its investment policy, with at least 20% of the investments meeting sustainable investment requirements. 1% of sustainable investments will have environmental goals consistent with the EU Taxonomy, 10% will have environmental goals inconsistent with the EU Taxonomy, and 5% will have social goals. The fund will also exclude assets that do not meet ESG and climate transition characteristics through negative screening.

Fidelity International will evaluate environmental and social characteristics through multiple internal and external data sources, including ESG rating data, screening data, principal adverse impact data, sustainable investment data, and more. Some data are provided internally, while others come from data providers such as MSCI, FactSet, Moody’s. These data will be processed and analyzed based on the sustainable investment framework released by Fidelity International for investment research, portfolio construction, and risk management.

In measuring the environmental and social characteristics generated by the Blue Transition Bond Fund, the fund will refer to the following indicators:

- Percentage invested in blue transition bonds.

- Percentage invested in bonds with risk exposure.

- Percentage of assets invested in sustainable investments.

- Percentage of assets invested in environmental objectives that comply with the EU Taxonomy.

- Percentage of assets invested in environmental objectives that do not comply with the EU Taxonomy.

- The percentage of assets invested in sustainable investments with social goals.

Fidelity International plans to monitor the fund’s compliance with various terms daily to align with investment objectives and minimum investment ratios. The fund will conduct sustainability reviews every quarter and report on environmental and social characteristics annually.

Reference: