2024 Institutional Investor Sustainability Survey

EY releases the 2024 institutional investor sustainability survey, aimed at analyzing the sustainability perspectives and actions of institutional investors.

EY collects the views of 350 institutional investors worldwide, including asset management companies, wealth management companies, insurance companies, and pension funds. The survey results show that although investors have a positive attitude towards using sustainable information, they are still concerned that ESG related actions will harm short-term investment performance.

Related Post: Schroders Releases Institutional Investor Sustainability Report

Institutional Investors’ Attitudes towards Sustainable Investment

The survey shows that there is a gap between institutional investors’ views and actions on sustainability, with 88% of respondents increasing their use of ESG information in the past year to assist their investment decisions. However, the increase in sustainable information has not been reflected in sustainable asset allocation. 92% of respondents believe that short-term investment performance risks outweigh long-term returns from using ESG investments, and 66% of respondents may reduce the use of ESG factors in investment decisions in the future.

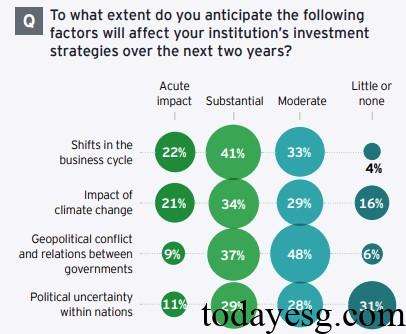

Although investors agree that sustainable business models can increase the long-term value of investees, their current investment decisions still mainly depend on short-term goals. 63% of respondents believe that changes in the business cycle will be the biggest factor affecting investment decisions in the next two years, with trade restrictions and tariffs (62%), capital costs (53%), labor costs (50%), and energy costs (33%) being the main concerns in the business cycle. 55% of respondents believe that climate change is also an important factor to consider, but 16% of respondents still believe that the impact of climate change is very small or close to zero.

Institutional Investors’ Attitudes towards Sustainable Disclosure

Besides considering short-term performance, investors also have concerns about the sustainable information disclosure of the investees. 85% of respondents believe that the current greenwashing problem is more severe than the five-year period. The 2023 EY Sustainable Value Survey suggests that companies are delaying their year of achieving climate goals from 2035 to 2050. Some companies will take sustainable actions that are relatively easy to achieve first, and are striving to achieve more difficult sustainable goals.

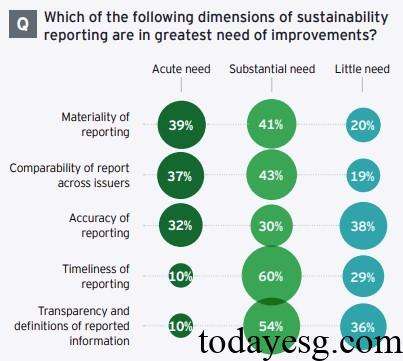

For the sustainability reports of existing companies, 80% of respondents believe that the materiality and comparability of the reports need to be further improved, and 62% believe that the accuracy of the reports needs to be improved. As more jurisdictions issue mandatory disclosure requirements, these issues may be resolved, but due to the current global sustainability disclosure standards mostly taking effect in 2024 or 2025, 36% of respondents are still dissatisfied with sustainability reports.

In terms of evaluating non-financial performance information such as sustainability, 68% of respondents believe they are able to assess supply chain ESG information, and 62% of respondents believe they are able to assess climate related information. 23% of respondents are very confident in evaluating short-term ESG impacts, while only 9% of respondents are very confident in evaluating long-term ESG impacts. This may be due to the presence of more variables and unknown factors in long-term evaluations. Investors may use third-party data or internal systems during the evaluation process, and half of the respondents are choosing employees with sustainable information to improve their sustainability analysis capabilities.

How to Increase Sustainable Investment

To increase sustainable investment, EY provides the following recommendations for institutional investors:

- Adopting a balanced approach to performance and risk: In addition to measuring performance, investors should also evaluate the long-term value of assets.

- Pay attention to sustainable regulatory policies: Sustainable regulatory policies may have a significant impact on investment portfolios, therefore requiring close monitoring, evaluation, and interpretation.

- Analyzing the transition path of industries and companies: Institutional investors can seek investment opportunities and select high-quality companies from the transition path.

- Understanding customers’ long-term value preferences: Institutional investors can stay in touch with customers and obtain their attitudes towards sustainable investment.

- Investing in sustainable data and technology: Sustainable data and technology can help investment portfolios assess sustainable risks and opportunities.

- Cultivating sustainable talents: Institutional investors need to increase the supply of sustainable talents in order to establish sustainable investment strategies.

Reference: