EU Taxonomy

This article introduces one of the ESG regulations in Europe, the EU Taxonomy.

The EU Taxonomy is a tool for stakeholders to identify green investment opportunities, which helps to achieve the EU’s green economy goals. Although the EU Taxonomy can guide market participants’ investment decisions, it does not prohibit investment in any activity.

Related Post: The EU Releases a Report on the Application of EU Taxonomy

Basic Information of EU Taxonomy

The EU Taxonomy was introduced in 2020 and currently only affects companies related to the Non-financial Reporting Directive (NFRD). After the Corporate Sustainability Reporting Directive (CSRD) comes into effect in 2026, all companies within this scope will be required to comply with the EU Taxonomy.

Enterprises that comply with the EU Taxonomy are required to disclose activities that meet the taxonomy enforceable and taxonomy aligned classification standards, as well as the proportion of these activities in capital expenditures (CAPEX) and operating expenditures (OPEX). Credit institutions also need to demonstrate how their credit portfolios comply with the EU Taxonomy.

Enterprises need to search for the NACE code corresponding to their activities, which is the EU economic activity classification code and is attached in the EU Taxonomy. If the enterprise activity is located in the attachment, it needs to comply with the requirements of the taxonomy. The EU Taxonomy requires these activities to make a material contribution to at least one objective and not cause significant harm to other objectives (Do No Significant Harm, DNSH), including:

- Climate Change Mitigation.

- Climate Change Adaptation.

- Sustainable use and protection of water and marine resources.

- Transition to a Circular Economy.

- Pollution Prevention and Control.

- Protection and Restoration of Biodiversity and Ecosystems.

There are only two objectives (climate change mitigation and climate change adaptation) in EU Taxonomy in 2023, and the regulators adds the other four objectives in 2024. Enterprises also need to ensure compliance with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights. Enterprises need to collect necessary data on environmental performance indicators to ensure that the data meets the standards.

How to Comply with the EU Taxonomy

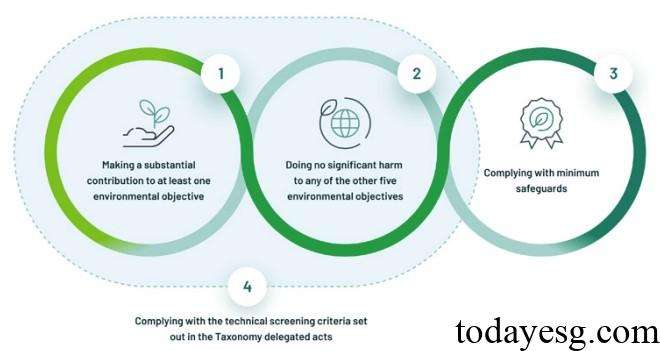

In order to comply with the EU Taxonomy, companies must use Technical Screening Criteria (TSC) to determine whether their economic activities comply with EU recognition, i.e. whether they have potential environmental sustainability. Subsequently, the enterprise needs to evaluate whether the activity meets the classification requirements, including:

- Make material contributions to at least one environmental objective.

- Not causing significant damage to the other five environmental objectives.

- Adhere to the minimum safeguards.

If the activity meets the above three requirements, it is consistent with the EU Taxonomy. Before a company is included in the regulatory scope, it can first consider whether it meets the minimum guarantee standards and adjust internal controls if necessary. EU regulatory agencies will supervise the disclosure of information by financial institutions to ensure compliance with EU Taxonomy. Although penalties for non-compliance with the taxonomy have not yet been established, potential limitations faced by companies include reputation risks and pressure on financing channels.

The challenges faced by businesses in complying with EU Taxonomy include:

- Identify economic activities related to the business.

- Establish a data collection process.

- Search for resources for compliance.

- Ensure accurate interpretation of information disclosure.

- Ensure data quality.

Many small and medium-sized enterprises are part of the value chain of large enterprises, so they need to disclose sustainable information in accordance with EU Taxonomy as early as possible, or have financial institutions comply with EU Taxonomy. Small and medium-sized enterprises presenting standardized sustainable information to customers, partners, and investors may give them a competitive advantage in the market.

Reference: