Application of EU Taxonomy

The EU releases a report on the application of EU Taxonomy, aimed at measuring the progress of European companies and financial institutions in applying the EU Taxonomy. The EU Taxonomy is an important sustainable finance classification system that can help market participants identify and participate in sustainable activities to develop a net zero economy and address climate change.

The EU Taxonomy provides standards for how economic activities align with environmental goals. Currently, the market is adopting two environmental goals related to climate change, and four environmental goals related to water resources, circular economy, and biodiversity will take effect this year. The EU finds in its research that businesses and financial institutions are applying the EU Taxonomy to business activities such as investment and financing.

Related Post: CDP Releases EU Taxonomy Report

Apply EU Taxonomy to Enterprises

EU finds that companies have started using EU Taxonomy to conduct green investments. Currently, 20% of corporate investments meet the requirements of the EU Taxonomy, with investments in the public sector having the highest compliance rate, reaching over 60%. In 2022, 608 companies made investments that comply with the EU Taxonomy, and this number has increased to 723 in 2023.

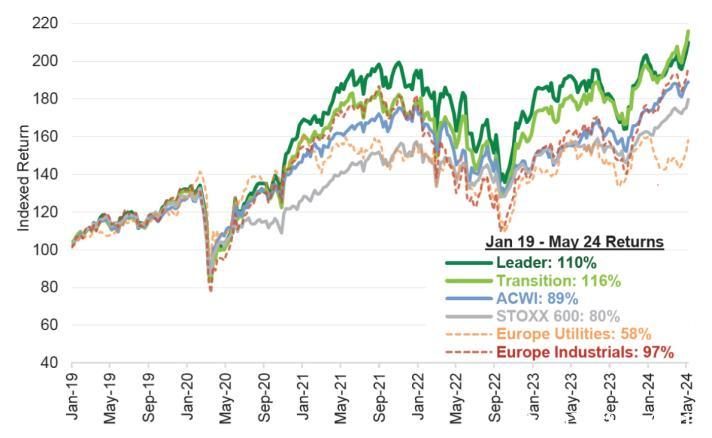

In the fiscal year 2022, European companies invested 191 billion euros in economic activities related to classification. In the fiscal year 2023, companies disclosed an investment of 249 billion euros, with Germany (114 billion euros), France (63 billion euros), and Spain (60 billion euros) accounting for the highest proportion. As the company incorporates new environmental goals into its business processes, it is expected that this number will continue to grow. In terms of the effects of implementing the EU Taxonomy in enterprises, the EU analyzes the average stock price performance of leading companies during the implementation of EU Taxonomy and finds that these leading companies are able to significantly outperform the market.

Apply EU Taxonomy to Financial Institutions

The application of the EU Taxonomy in financial institutions has also become very common, with 90% of green bonds issued by the EU public sector in 2023 already referencing the EU classification system to set the purpose of funds. Banking loan assets that comply with the EU classification system account for over 90% of EU bank assets. 56% of funds in Europe already comply with Article 8 or Article 9 of the European Sustainable Finance Disclosure Regulation and are investing based on the EU Taxonomy.

Apart from the EU Taxonomy, over 180 billion euros of assets meet the EU climate transition benchmark and the EU Paris aligned benchmark, which have become important tools for investors in decarbonization investments. In order to improve the availability and market acceptance of the EU Taxonomy, the EU is developing implementation guidelines for the EU Taxonomy, which will apply to large companies that require mandatory disclosure and also to small and medium-sized companies that voluntarily disclose.

Reference: