Sustainable Finance Standard for Small and Medium-sized Enterprises

The EU Platform on Sustainable Finance releases sustainable finance standard for small and medium-sized enterprises, aimed at addressing the difficulties they face in sustainable financing.

The EU Sustainable Finance Platform believes that small and medium-sized enterprises are the key to the EU’s sustainable development transition and providing sustainable financing for them can help the EU achieve its net zero goal and low-carbon economic transition.

Related Post: EFRAG Releases Voluntary Sustainability Reporting Standards for Non-listed SMEs

Background of Sustainable Finance Standard

The EU believes that small and medium-sized enterprises face challenges in sustainable finance. Research shows that 58% of small and medium-sized enterprises have invested in sustainable projects, but 65% of their sustainable project financing comes from their own funds rather than external financing. The main reasons for this phenomenon include high financing conditions of financial institutions and insufficient sustainable data for small and medium-sized enterprises.

For example, the EU Taxonomy is the EU’s sustainable financial regulatory policy and an important reference for financial institutions to provide sustainable financing. Small and medium-sized enterprises are not within the scope of application of EU Taxonomy, and it is also difficult for them to comply with the information disclosure requirements of the taxonomy.

To address the challenges of sustainable finance for small and medium-sized enterprises, the EU Sustainable Finance Platform suggests developing a taxonomy suitable for small and medium-sized enterprises, as well as sustainable performance measurement and information disclosure methods, namely the Sustainable Finance Standard for Small and Medium-sized Enterprises. This standard aims to support the transition of small and medium-sized enterprises and achieve environmental goals, while ensuring the compatibility of regulatory policies. Small and medium-sized enterprises can demonstrate the sustainability of their business activities based on this standard.

Introduction to Sustainable Finance Standard

The sustainable finance standard for small and medium-sized enterprises are based on existing sustainable finance policies, focusing on two goals: mitigating climate change and adapting to climate change. They consist of the following parts:

- Activities: Activities listed in the Taxonomy Climate Delegated Act and those included in the EU certification list. The EU will simplify the screening criteria and descriptions for these activities to better adapt to the reality of small and medium-sized enterprises and provide alternative indicators beyond turnover.

- Enterprises: Small and medium-sized enterprises that incorporate climate related practices into their business models and pursue sustainable economic transition. These companies’ activities may not meet the requirements, but they already have measurable climate investments, technologies, and processes, or hold relevant climate certifications issued by the European Union.

- Investment: Sustainable investments that contribute to climate mitigation and adaptation. For example, investments in improving energy efficiency and reducing greenhouse gas emissions can be considered compliant with standard.

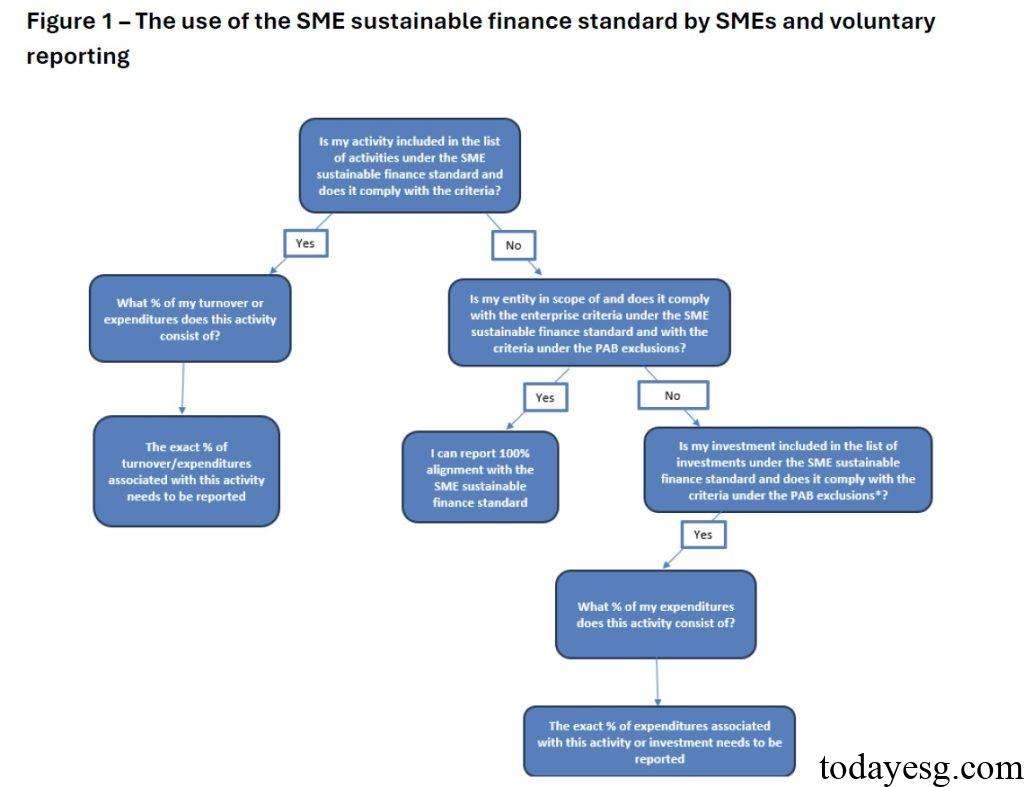

When small and medium-sized enterprises use this standard, they can evaluate whether their activities, businesses, and investments fall under the above criteria in sequence. As long as one of them meets the criteria, they can apply this standard to seek external sustainable financing. EU financial institutions can refer to this standard when providing debt or equity financing to small and medium-sized enterprises. Financial institutions can also use the EIF Sustainability Guarantee Tool developed by the European Investment Fund or the EIB Green Checker Tool to measure whether small and medium-sized enterprises meet the requirements.

Small and medium-sized enterprises can voluntarily submit sustainability reports to demonstrate the sustainability of their business activities and disclose revenue and capital expenditures consistent with the EU Taxonomy. For startups, these data can be used as estimates. This information can help financial institutions determine whether small and medium-sized enterprises meet sustainable financial standard and provide them with financing services.

Reference: