Sustainable Finance Report

The European Securities and Markets Authority (ESMA) releases a sustainable finance report aimed at analyzing the development of sustainable finance in the European region.

This sustainable finance report is part of the ESMA TRV Risk Monitor, which suggests that greenwashing and related behaviors may damage investors’ trust and the credibility of sustainable finance, affecting the financial system’s ability to provide financing for sustainable transition. As an important part of structured market, the report provides an analysis of the development of sustainable finance.

Related Post: ESMA Releases European Sustainability Reporting Standards Statement

Development of European Transition Financing

Green transition requires shifting various economic activities and infrastructure towards sustainable growth. In order to achieve the goals of the EU Green Deal, the annual investment scale in the European region needs to reach 1.6 trillion euros by 2030, which is 67% higher than the current 940 billion euros. In the past few years, there has been a high level of enthusiasm and acceptance of sustainable investment in the market. However, uncertainty from climate policies has led to market concerns that companies may struggle to achieve their promised climate goals.

The attention of the transition financing market to corporate transition plans is constantly increasing. The Network for Greening the Financial System believes that transition plans need to undergo rigorous risk assessments based on forward-looking information. The EU Corporate Sustainable Reporting Directive requires companies to disclose key information about their transition plans to help investors assess their financial needs in terms of transition.

Development of ESG Investment Market

As of June 2024, there are 182 funds in Europe tracking the EU climate benchmark, with a total asset size of 156 billion euros. The size of the European ESG bond market has reached 2.1 trillion euros, an increase of 17% within one year. The issuance of corporate green bonds in 2024 reached 109 billion euros, an increase of 19% compared to the first half of 2023. The fundraising of bonds refers to the EU Taxonomy, which defines and measures green economic activities in Europe, and requires companies to report their share of sustainable economic activities in order to improve transparency in information disclosure.

According to the analysis of the European Sustainable Finance Disclosure Regulation, Article 9 funds with sustainable investment objectives recorded a net outflow of 9.4 billion euros in the first half of 2024, while Article 8 funds with sustainable characteristics recorded a net inflow of 50 billion euros in the same period. Although there is no clear definition for transition funds, there are already 136 funds with the word ‘transition’ in their names. 70% of these funds belong to Article 8 funds and 22% belong to Article 9 funds, with a total asset management scale of 39 billion euros.

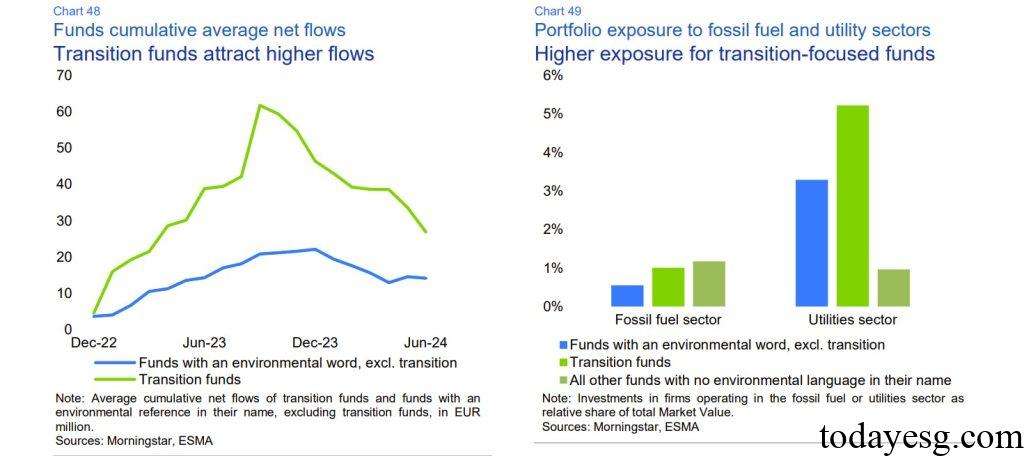

Investors’ enthusiasm for transition funds is constantly increasing, with an average net inflow of 27 million euros in transition funds over the past two years, while the average net inflow of other sustainable funds is 14 million euros. With the increasing standardization of ESG fund names in the European region, the market’s trust in these funds may continue to rise. ESMA finds that the investment portfolio concentration of transition funds is twice that of sustainable funds, and their investment methods are relatively homogeneous.

Another important difference between transition funds and sustainable funds is the exposure to the fossil fuel industry. The transition fund allocates 1% of its funds to companies in the fossil fuel industry, which is twice that of sustainable funds and consistent with the holding ratio of general funds. In addition, the transition fund has a relatively high investment in the green bonds issued by these companies, accounting for about one-fifth of their total holdings of green bonds. This indicates that the transition fund supports these companies in achieving low-carbon transition.

Reference: