2024 EU Carbon Market Report

European Securities and Markets Authority (ESMA) releases 2024 EU carbon market, aimed at analyzing the development of pricing, trading, and derivatives in the EU carbon market.

This report is based on the EU emission allowances (EUA) trading report released by ESMA in 2022, taking into account changes in energy prices, economic development, and carbon emissions.

Related Post: EU Deploys Revenues from Emission Trading System

EU Carbon Market: Price and Volatility

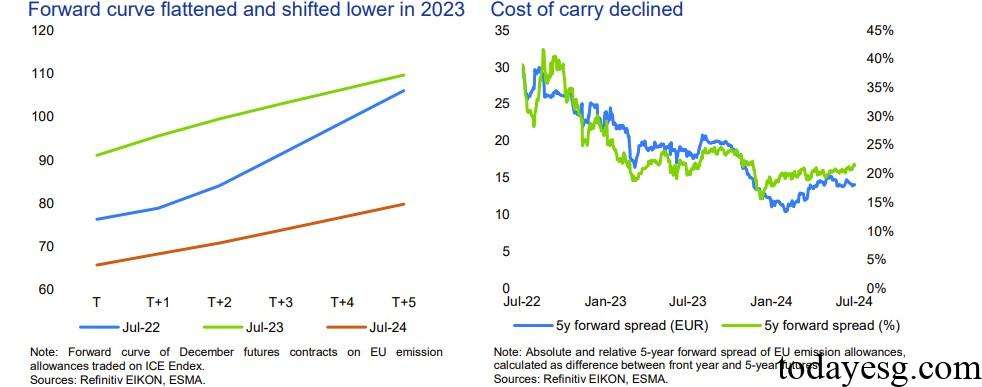

The EU carbon market price reached a historical high of 100 euros per ton in February 2023 and then began to decline. This decline is mainly due to the decrease in energy demand caused by the economic slowdown, as well as the increase in renewable energy production. The reform of the Emissions Trading System (ETS) proposed by the European Union has a positive impact on carbon prices, while the REPowerEU has a negative impact on carbon prices. At present, the forward futures price of carbon prices is higher than the spot price. However, due to the continuous decrease in the cost of holding carbon futures, the slope of the forward curve is decreasing.

In 2023, the EU Emissions Trading System offset a total of 1.127 billion tons of carbon dioxide, a decrease of 16% compared to last year. The reason for the decrease is that greenhouse gas emissions have decreased by 24%. The EU Emissions Trading System has allocated a total of 560 million quotas for free, auctioned 523 million quotas, and the total number of allowances in circulation (TNAC) is 1.1 billion, a decrease of 2% compared to last year.

EU Carbon Market: Auction and Trading

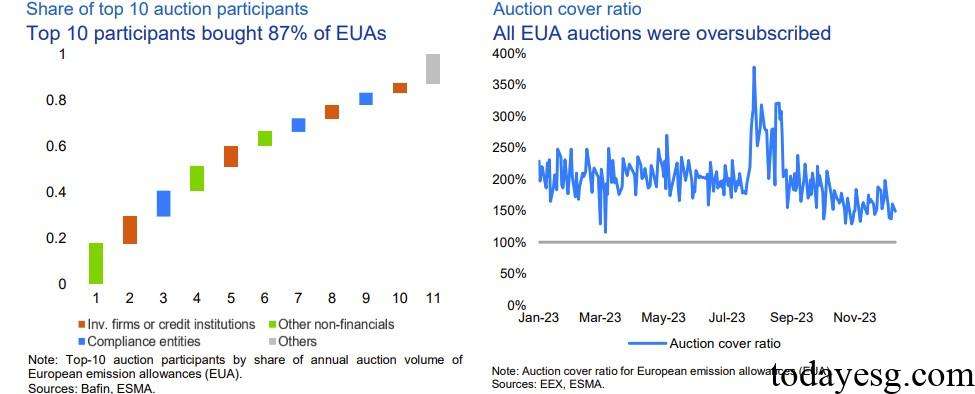

In 2023, the EU Emissions Trading System auctioned a total of 523 million quotas on the European Energy Exchange, with a total value of 44 billion euros, a year-on-year increase of 7%. The total number of auctions in 2023 is 223, with an average monthly turnover of 43 million quotas and a value of 3.6 billion euros. All auctions were oversubscribed, with 40% successfully subscribed, a year-on-year decrease of 4 percentage points. Germany (57%) and the UK (17%) have a relatively high proportion of participants. The auction market is highly concentrated, with only ten participants purchasing 90% of the quota, with the top three typically purchasing 50% to 80% of the total amount.

In 2023, the EU Emissions Trading System saw a total of 3.2 million transactions, equivalent to 9.3 billion tons of carbon dioxide, with a total value of 648 billion euros. The majority of trading is conducted through futures contracts, accounting for 81% of the total trading volume, while options trading accounts for 18%. The participants in secondary market are mainly investment companies and credit institutions, with a relatively high proportion of participants from the United States (34%), the United Kingdom (24%), and Germany (14%). In the on-site trading market, high-frequency trading and algorithmic trading have emerged, which simultaneously purchase and sell multiple financial instruments in order to create a non-directional exposure.

EU Carbon Market: Derivatives Market

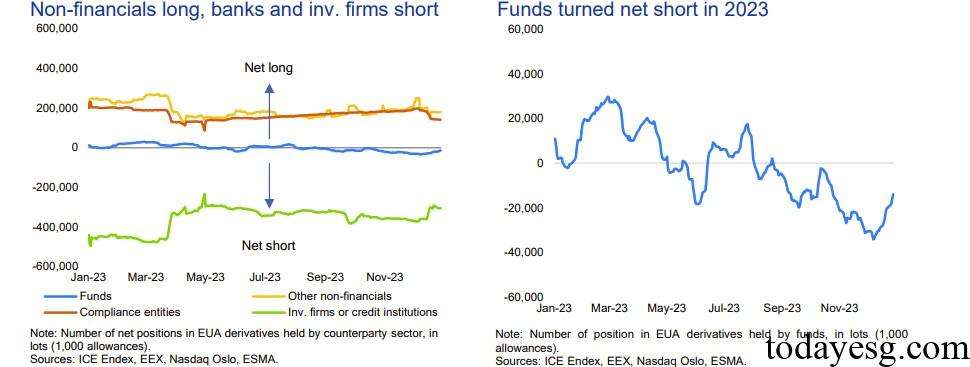

The derivatives market plays an important role in the EU carbon emissions trading system, with the number of derivative holdings continuously increasing since March 2023 and reaching its peak in December. According to the annual compliance cycle, companies hold long positions in derivatives, while banks and investment companies hold short positions in order to complete delivery the following year. In order to match the greenhouse gas emissions in April each year, companies will also purchase derivatives that expire in March.

In 2023, the prices of derivatives in the EU carbon market gradually declines, and the derivative holdings of investment funds shifts from long positions to short positions. 406 funds hold daily positions, with 75% in offshore fund structures. 206 companies hold long positions in derivatives, while 118 banks and investment companies hold short positions in derivatives.

Reference: