Multilingual ESG Fund Naming Guidelines

The European Securities and Markets Authority (ESMA) releases multilingual ESG fund naming guidelines, aimed at providing guidelines for the use of ESG and sustainability related terms by funds in the EU region, ensuring that investors are protected from unverified or expanded sustainable term marketing in fund names, and providing clear and measurable fund naming standards for asset management companies.

ESMA believes that fund names are an important way for funds to convey information and an important tool for fund marketing. Although investors should pay attention to the fund’s information disclosure, fund name still has an impact on their investment decisions. The ESG fund naming guidelines released this time will standardize fund naming and reduce greenwashing.

Related Post: European Securities and Markets Authority Releases Guidelines on ESG Fund Names

ESG Fund Naming Guidelines Development

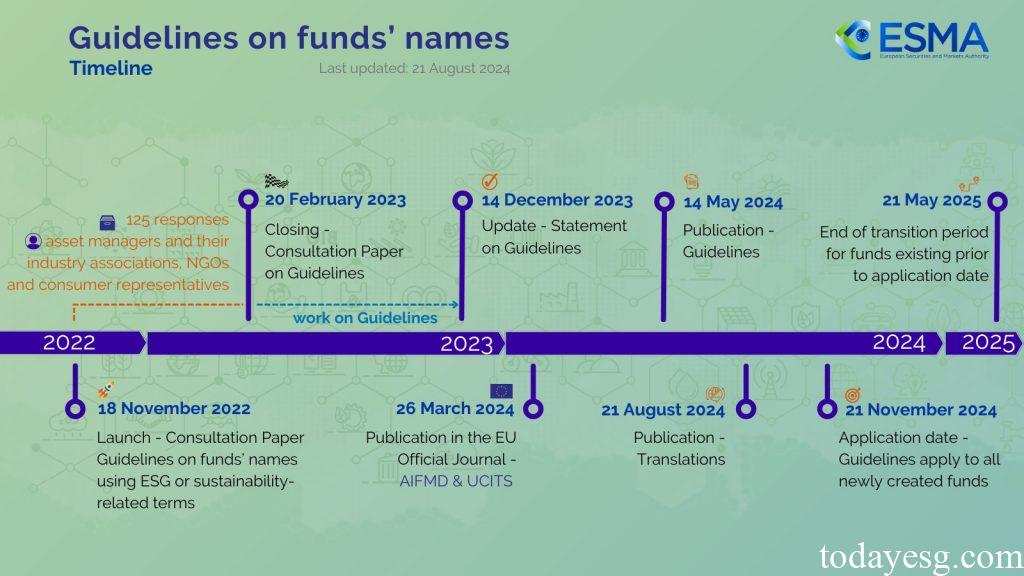

In November 2022, the ESMA released a consultation document soliciting opinions from the asset management industry on the naming of ESG funds, and received 125 responses. In December 2023, the ESMA updated the draft ESG fund naming guidelines based on these opinions. In March 2024, the guidelines were published in the EU Official Journal and officially released in May 2024. In August 2024, the guidelines were translated into multiple EU official languages.

The ESMA has released guidelines on its official website, requiring financial regulatory agencies in EU member states to respond within two months, stating whether they comply with the guidelines. The asset management industry does not need to response, but adjustments need to be made in accordance with the requirements of regulators. The guidelines will take effect three months after release. After the guidelines come into effect, any newly established fund must immediately comply with the guidelines, and existing funds need to make adjustments within six months.

Contents of ESG Fund Naming Guidelines

The ESG fund naming guidelines apply to all management companies of the European Union’s Undertaking for Collective Investment in Transferable Securities (UCITS) and Alternative Investment Funds (AIF). The guidelines require companies to conduct business honestly and fairly, and ensure that all information is fair, clear, and not misleading in marketing communications. The ESG Fund Naming Guidelines standardize the terminology used by funds, including:

- When using terms related to transition, society, and governance: the proportion of investments that meet sustainable characteristics reaches 80% of the total assets of the fund, while not investing in companies involved in Article 12 (1) (a) to (c) of the CDR (EU).

- When using environmental or impact related terms: the investment proportion that meets sustainable characteristics reaches 80% of the total assets of the fund, and cannot invest in companies involved in Article 12 (1) (a) to (g) of CDR (EU).

- When using sustainability related terms: the investment proportion that meets sustainability characteristics reaches 80% of the total assets of the fund, and cannot invest in companies involved in Articles 12 (1) (a) to (g) of the CDR (EU), while committing to invest in companies involved in Article 2 (17) of the Sustainable Finance Disclosure Regulation (SFDR).

- When using transition or impact related terms: In addition to meeting the above conditions, it is also necessary to ensure that these investments can generate clear and measurable environmental or social impacts.

The naming supervision of ESG funds will be the responsibility of financial regulators in various jurisdictions. When the above conditions are violated, regulatory agencies need to distinguish between different situations. If the fund uses ESG or sustainability related terms but temporarily deviates from the investment threshold, it can be considered a passive violation and corrected in a timely manner. If a fund adopts these terms but intentionally fails to meet the relevant threshold, regulators may consider that the fund will result in investors receiving unfair and unclear information, leading to greenwashing.

Reference:

ESMA Publishes Translations of its Guidelines on Funds’ Names