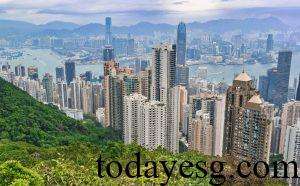

Hong Kong ESG Overview

Hong Kong’s ESG regulatory policies are mainly formulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong, and many polices are based on the Hong Kong Climate Action Plan 2050.

As an international financial center, Hong Kong launches a series of green financial instruments and releases the Green and Sustainable Finance Grant Scheme to provide subsidies to the market. The Hong Kong government also issues green bonds to institutional investors and individual investors to increase public participation.

Hong Kong is regulating ESG development, such as setting climate information disclosure standards based on ISSB guidelines and requiring mandatory disclosure by listed companies. Hong Kong also establishes a green taxonomy to provide a standard framework for sustainable activities.

Future of Hong Kong ESG

Hong Kong plans to become the world’s first jurisdiction to incorporate international sustainable information disclosure standards. The Hong Kong Institute of Certified Public Accountants has released a draft of sustainable financial reporting standards, and will launch mandatory climate disclosure by 2025 to provide standardized information for stakeholders.

As an international financial center, Hong Kong has rich experience in ESG financial products and has successfully issued tokenized green bonds, supporting the development of green fintech enterprises.

In terms of ESG education, Hong Kong has launched Green Week to promote participants’ understanding in ESG activities. Hong Kong also offers a pilot program for green and sustainable finance training, providing tuition subsidies for ESG courses and exams.

“One Earth Summit” 2025 Held Successfully

“One Earth Summit” 2025 Held Successfully in Hong Kong

Hong Kong Mandatory Provident Fund Authority Strengthen ESG Fund Information Disclosure Requirements

Hong Kong MPFA releases a document to strengthen ESG fund information disclosure requirements

Hong Kong Green Finance Association Releases Report on Hong Kong Green Technology

Hong Kong Green Finance Association (HKGFA) releases report on Hong Kong Green Technology

HKEX Releases 2024 ESG Disclosure Report of Listed Companies

HKEX releases 2024 ESG Disclosure Report of Listed Companies, aimed at analyzing their information disclosure

Hong Kong SFC Releases Guidance to Asset Managers Regarding Due Diligence for ESG Products

Hong Kong Securities and Futures Commission releases guidance to asset managers regarding due diligence for ESG products

Hong Kong Releases Roadmap on Sustainability Disclosure

Hong Kong releases a roadmap on sustainability disclosure, aimed at outlining its plan to fully apply ISSB standards in the coming years

HK SFC Releases Code of Conduct for ESG Ratings and Data Products Providers

Hong Kong Securities and Futures Commission officially releases Code of Conduct for ESG Ratings and Data Products Providers

Hong Kong Monetary Authority Releases Climate-related Risk Governance Report

Hong Kong Monetary Authority releases a report on climate-related risk governance