ESG-related Strategic Roadmap

The European Investment Bank (EIB) releases an ESG-related strategic roadmap, aiming to formulate priorities for the next three years and provide financial support for ESG development in Europe.

As the EU’s climate bank, more than 50% of the European Investment Bank’s investments are used to support climate action and environmentally sustainable projects. In 2023, it has signed financing of approximately 88 billion euros and driven approximately 320 billion euros in matching funds. It has a significant role in the EU countercyclical and risk-sharing capabilities.

Related Post: European Investment Bank Releases Sustainable Innovation Report

Introduction to ESG-related Strategic Roadmap

The European Investment Bank develops a strategic roadmap from 2024 to 2027, in which ESG-related strategies include:

- Consolidate EIB’s position as a climate bank: The EIB considers financing the green transition and supporting climate action to be strategic priorities and plans to strengthen investments in sustainable infrastructure and support biodiversity, circular economy and nature-based solutions. The European Investment Bank will launch two new programs in the future, namely the water program to support the blue economy and the energy efficiency program for small and medium-sized enterprises. The water program will invest in infrastructure and water management technologies to combat flooding, droughts and rising sea levels caused by climate change. The energy efficiency program will promote low-carbon technologies to achieve energy savings and improve business operations.

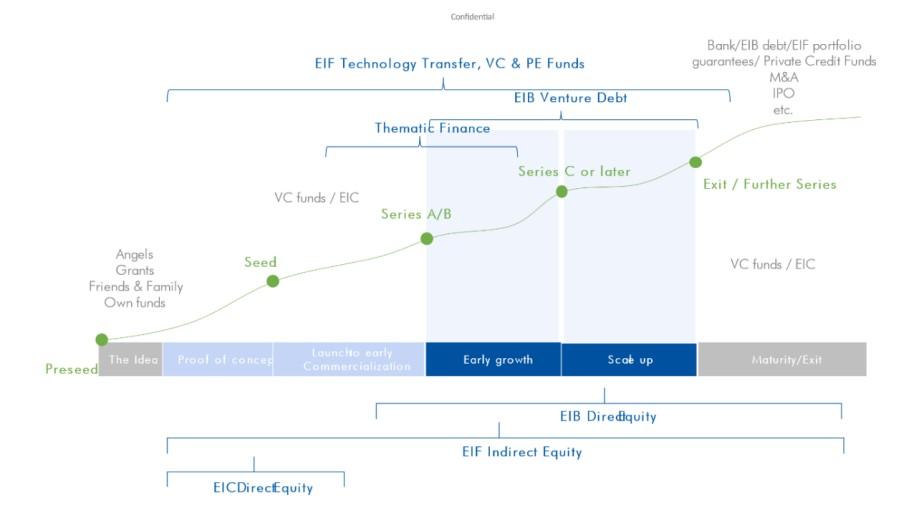

- Accelerate digitalization and the deployment of new technologies: The European Investment Bank will invest in key technologies such as net-zero emissions and promote the development of industrial production capacity based on Tech-EU plan. As the backbone of European venture capital market, the European Investment Bank has launched a venture debt model to provide financing for innovative companies in strategic areas such as clean technology. These financings can close the capital gap and lead to the allocation of private capital.

- Support agriculture and the bioeconomy: The European Investment Bank plans to develop the bioeconomy and circular economy to finance climate change mitigation and adaptation. It will also develop a new pan-European agriculture program to help member states manage climate risks.

- Reinforce investment in European social infrastructure: The European Investment Bank believes that investment in education, training, and skills can increase productivity and achieve sustainable growth. The European Investment Bank plans to rely on partners to test new origin-to-distribute models and establish standardized products to lead institutional investor asset allocations. This model can increase large-scale investment to support technological innovation.

Reference: