2024 SFDR Fund Report

The European Fund and Asset Management Association (EFAMA) releases 2024 SFDR Fund Report, which aims to analyze the development of sustainable funds based on the Sustainable Finance Disclosure Regulation (SFDR).

The Sustainable Finance Disclosure Regulation came into effect in March 2021, aiming to require asset management companies to disclose the sustainability information of funds and divide funds into Article 6, Article 8, and Article 9. Although regulatory agencies have not classified it as a fund classification label, investors have regarded it as an important reference for fund classification.

Related Post: European Fund and Asset Management Association Releases SFDR-Based ESG Fund Data

2024 Article 8 Fund Overview

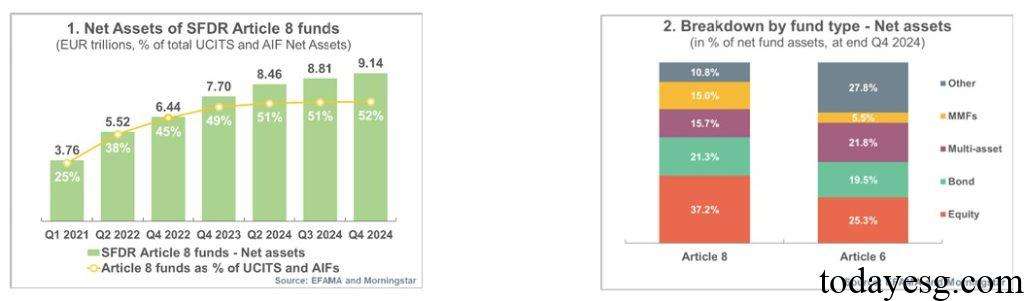

As of the end of 2024, the total size of Article 8 funds in Europe is 9.14 trillion euros, accounting for 51% of the entire European fund market. Since the first quarter of 2021, the market share of Article 8 funds has nearly doubled, and the total size has increased by nearly 2.5 times. The total size of Article 8 funds will increase by 20% and 18.5% respectively in 2023 and 2024.

From the perspective of asset categories, the proportion of equity funds, bond funds, and multi asset funds in Article 8 funds are 37.2%, 21.3%, and 15.7%, respectively. Among them, the proportion of equity funds is higher than that of Article 6 funds, while the proportion of multi asset funds is relatively lower. Money market funds account for 15% of the total size of Article 8 funds, significantly higher than Article 6 funds (5.5%). Currently, approximately 75% of all money market funds in Europe comply with Article 8.

79% of Article 8 funds belong to the Undertaking for Collective Investment in Transferable Securities program, and 21% belong to the Alternative Investment Fund. In 2024, the overall net inflow for Article 8 Fund was 272 billion euros, with the highest inflow in the third and fourth quarters. The transferable securities collective investment plan has received net inflows of funds for six consecutive quarters, while alternative investment funds will experience overall outflows of funds in 2024. From the analysis of the jurisdictions where funds are registered, Luxembourg (35%), Ireland (18%), and France (13%) have relatively high proportions.

2024 Article 9 Fund Overview

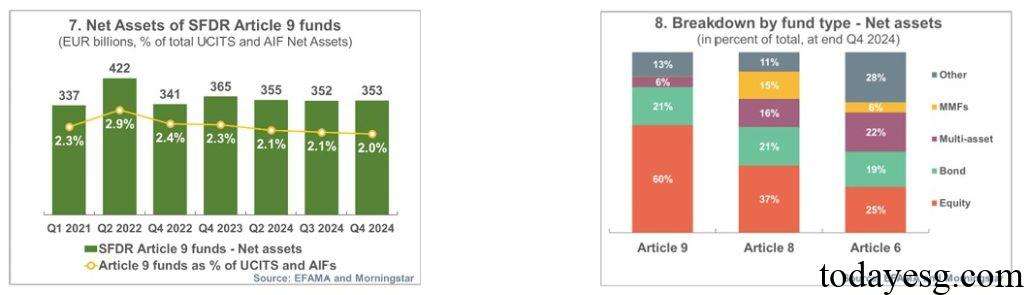

As of the end of 2024, the total size of Article 9 funds in Europe is 353 billion euros, accounting for 2% of the entire fund market. Compared to the end of 2023, the total size of Article 9 funds has decreased by 3%, due to many funds being reclassified from this category as Article 8 funds. These classification activities come from the requirement of the European Securities and Market Authority (ESMA) that the sustainable investment proportion in Article 9 fund investment portfolios must reach 100%.

From the perspective of asset categories, the proportion of equity funds, bond funds, and multi asset funds in Article 9 funds is 60%, 21%, and 6%, respectively. Among them, the proportion of equity funds is significantly higher than that of Article 8 funds (37%) and Article 6 funds (25%), while the proportion of multi asset funds is significantly lower than that of other categories. The proportion of transferable securities collective investment plans and alternative investment funds in Article 9 funds is like that of Article 8 funds.

In 2024, the overall net outflow of Article 9 funds was 21.9 billion euros, with a net outflow of 8.1 billion euros in the fourth quarter, reaching a historical high. This may be related to the market’s reduction in equity fund investments and growth in bond fund investments, with a higher proportion of stock assets in Article 9 funds. In addition, ETFs account for only 4% of Article 9 funds, and ETFs have gained more attention from investors in the past two years, which has had a negative impact on the active investment-oriented Article 9 funds.

Development of Sustainable Finance Disclosure Regulation

The EU is reviewing the Sustainable Finance Disclosure Regulation and plans to release proposals in the fourth quarter of 2025 to ensure compliance with the EU’s sustainable financial framework. In February 2025, the European Union released a proposal to simplify sustainable regulatory policies, in which adjustments to the Corporate Sustainability Reporting Directive (CSRD) may have an impact on asset management companies’ access to ESG data.

The EU Platform on Sustainable Finance has also released a report on the classification of SFDR products, recommending that sustainable funds be divided into three categories. The future modifications to the SFDR will be consistent with sustainable regulatory policies and meet the information needs of investors.

Reference:

The SFDR Fund Market Latest Market Trends and Upcoming SFDR Review