Guidelines on ESG Scenario Analysis

The European Banking Authority (EBA) released a consultation paper on Guidelines on ESG Scenario Analysis, aimed at providing banking institutions with ESG scenario analysis methods and soliciting opinions.

The European Banking Authority has released Guidelines on Management of ESG Risks, providing standards and methods for identifying, measuring, managing, and monitoring ESG risks. The Guidelines on ESG Scenario Analysis will serve as an important supplement to Guidelines on Management of ESG Risks.

Related Post: European Banking Authority Officially Releases Guidelines on Management of ESG Risks

Background of Guidelines on ESG Scenario Analysis

Scenario analysis is an important tool for strengthening the ability of banking institutions to predict and manage ESG risks. ESG risks may become a potential driving factor for traditional financial risks, affecting credit, market, operational, liquidity, and reputation risks. However, the time frame and risk transmission channels of ESG risks are uncertain and not suitable for traditional risk management methods.

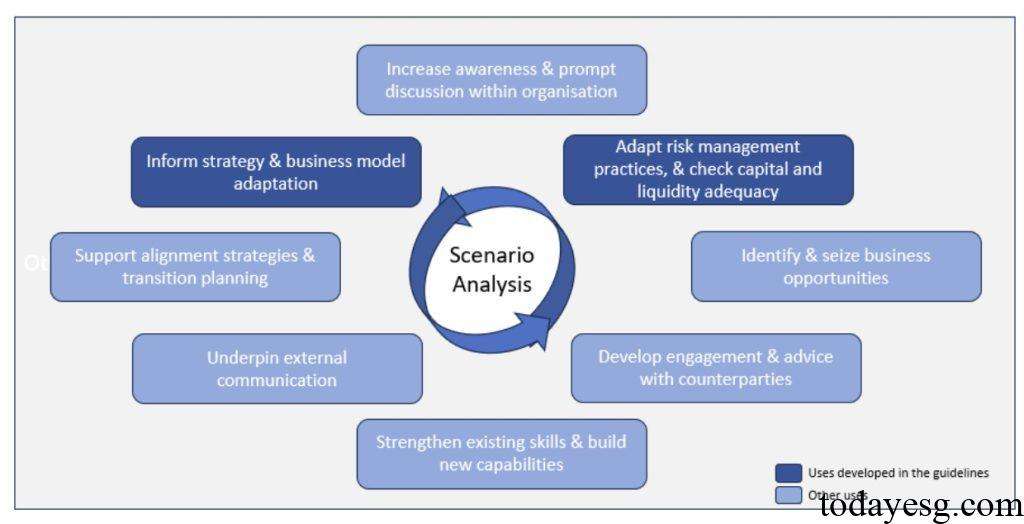

The Taskforce on Climate-related Financial Disclosures believes that scenario analysis is a process of identifying and evaluating a range of possible future impacts under uncertain conditions. Scenario analysis is not intended to provide precise results and predictions, but rather to provide an analytical tool in a constantly changing environment. The European Banking Authority proposes in its ESG risk management guidelines that scenario analysis has the following uses in the banking industry:

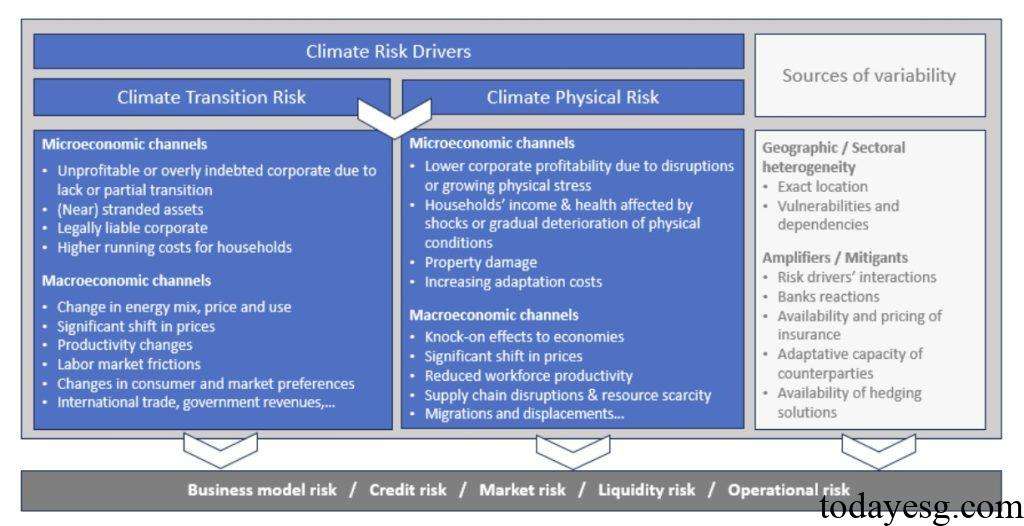

Banking institutions need to set some conditions for conducting scenario analysis. Firstly, the institution should analyze the business environment in which it operates and determine the scenarios to be used for analysis. These scenarios come from institutions such as the Network for Greening the Financial System and the International Energy Agency. In addition, banking institutions need to define the transmission channels through which ESG risks affect financial indicators. The European Banking Authority summarizes this as follows:

Contents of Guidelines on ESG Scenario Analysis

The European Banking Authority believes that ESG scenario analysis can be used in two directions, namely:

- Climate Stress Testing: Climate stress testing measures the financial adaptability of banks and analyzes whether their funds and liquidity are sufficient based on short-term (within five years) uncertainty assumptions.

- Climate Resilience Analysis: Climate resilience analysis measures the adaptability of a bank’s business model and based on a long-term (over ten years) perspective, analyzes whether the bank’s business model is sustainable in the face of climate change.

The Guidelines on ESG Scenario Analysis recommend that banking institutions use scenario analysis to identify business risks and opportunities, assess the impact of physical and transitional risks on investment portfolios, and test their resilience to ESG risks. The steps of scenario analysis include:

- Setting climate scenarios: Banking institutions need to consider factors such as social background, technological progress, climate policies, consumer preferences, etc., use scientific and credible scenarios, and choose scenarios that are consistent with their own business models based on their scope and goals. Banking institutions need to incorporate physical and transitional risks into scenario analysis based on substantive assessments, using baseline scenarios and a set of adverse scenarios to measure potential tail risks.

- Defining climate transmission channels: Banking institutions need to consider the risk transmission channels of climate scenarios, considering their business models, investment portfolios, and geographic risk exposures, and focusing on material risks. Risk transmission channels can be divided into two categories: macro and micro and consider how climate risks can be transformed into traditional financial risks. Banking institutions also need to analyze transmission channels as a continuous process, considering changes in their operating environment, as well as changes in investment portfolios and customers.

The European Banking Authority plans to conduct a three-month consultation on Guidelines on ESG Scenario Analysis and release an official version in the second half of 2025. Institutions other than small and non-complex institutions will officially apply this guideline in January 2026, and small and non-complex institutions will officially apply this guideline in January 2027.

Reference: