Climate Risk Platform for Financial Authorities

The Bank for International Settlements (BIS) releases a report on the climate risk platform for financial authorities, aiming to introduce the development of Project Viridis and help regulatory agencies identify, monitor, and manage climate risks in the financial system.

The relationship between climate change and financial risks is well-known to global financial authorities. In the absence of consistent and standardized climate data, how to use existing information to handle climate related financial risks is an important. Therefore, the Bank for International Settlements and the Monetary Authority of Singapore have jointly developed the climate risk platform Project Viridis, which can systematically track climate data and indicators, thereby strengthening the ability to assess climate physical risks and climate transition risks.

Related Post: The Relationship between Climate Change and Financial Stability

Challenges of Climate Risk Management for Financial Authorities

When financial institutions engage in climate sensitive businesses, they are inevitably affected by climate change. The Bank for International Settlements believes that climate change may generate financial risks through both microeconomic and macroeconomic channels. The microeconomic channel refers to the impact of climate change on the trading counterparties of financial institutions, which in turn leads to an increase in potential losses for banks. The macroeconomic channel refers to the impact of climate change on commodities, interest rates, and exchange rate factors, ultimately affecting economic growth. The important responsibility of financial authorities is to ensure the stable operation of financial institutions and maintain the stability of the financial system. Therefore, climate change needs to be included in regulations.

The Network for Greening the Financial System suggests that financial authorities understand the ways in which climate risks are transmitted to the financial system and calculate the climate risk exposures faced by financial institutions. The Financial Stability Board recommends that financial authorities include climate risk in their risk assessment frameworks and identify, define, and collect key data and indicators. The Basel Committee on Banking Supervision believes that financial authorities need to identify significant climate risk drivers and their transmission channels, calculate climate risk exposure, and convert climate risk into quantifiable financial risk indicators.

Although global financial authorities are actively considering climate risk management, climate risk still poses significant challenges to regulatory systems. Firstly, there is a lack of a robust climate risk analysis framework globally, and existing frameworks are directly related to model assumptions, methods, etc. This leads to significant differences in the assessment of climate risk by financial authorities. The current attitude of regulatory agencies towards climate risk will also affect the development of future climate risks. Secondly, the quantity and quality of data reflecting climate physical risks and climate transition risks are insufficient, resulting in their inability to be used in climate models. For example, scenario analysis of industry transition paths is usually based on developed economies, and these scenarios are not applicable to emerging market economies.

Introduction to the Climate Risk Platform for Financial Authorities

The climate risk platform Project Viridis focuses on how to assess the climate risks faced by the financial system in the absence of limited climate data and limited consensus on assessment methods. The Bank for International Settlements invites financial authorities, industry and academic experts to discuss to determine the priority of climate risk assessment indicators. It shows that regulatory authorities are most eager to understand the carbon footprint of financial institutions’ investment portfolios, the physical risks of assets held in investment portfolios, industry level decarbonization targets, and standardized risk exposures.

Project Viridis divides its climate risk solutions into five parts, namely:

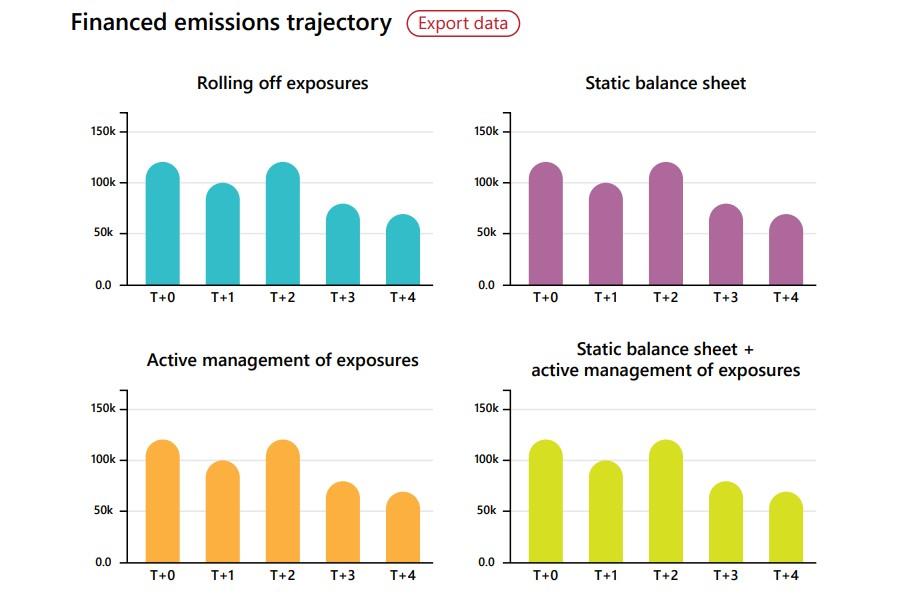

- Transition risks: describe the carbon emission data and transition path of investment.

- Physical risks: measure the sensitivity of the financial industry to physical risks.

- Asset and economic data: cover the location, characteristics, supply chain and value chain information of assets.

- Systemic macro views: include the measurement of risk concentration in financial institutions and the handling of duplicate values.

- Basic user features: equip with interactive explorations and data standardization functions.

The Bank for International Settlements believes that there is a connection between the above five parts, and due to limited data availability, some indicators still need to be modeled using proxy variables. As time goes by, the standards, methods, and technologies for climate risk measures will continue to develop, and Project Viridis will improve with the participation of stakeholders.

Reference:

BIS and MAS Develop Blueprint for a Climate Risk Platform for Financial Authorities