Report on Carbon Emission Data

The CFA Institute Research & Policy Center releases a report on carbon emission data aimed at analyzing how carbon emission data can be applied to achieve investment portfolio goals.

The CFA Institute believes that carbon emission data plays an important role in achieving net zero investment portfolios, and the difficulty of measuring portfolio carbon emissions increases when investors hold global assets.

Related Post: CFA Institute Releases Report on the Impact of Climate Signals on Portfolio Risk and Return

Carbon Emission Data and Measurement

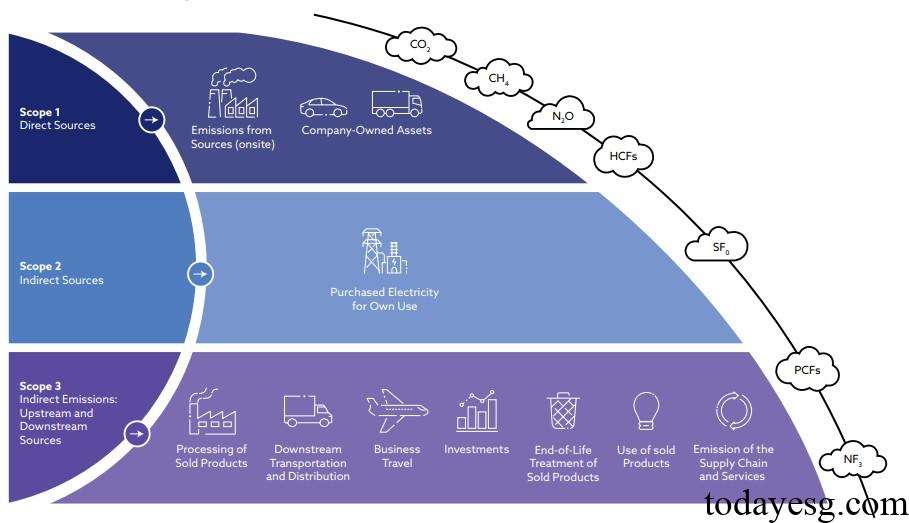

The greenhouse gas measurement standards emerged in the 1990s and were officially applied in the 1997 Kyoto Protocol. Carbon emissions accounting is divided into two categories: non fluorinated gases such as carbon dioxide and methane, and fluorinated gases such as hydrofluorocarbons. The Kyoto Protocol converts different types of carbon emissions into carbon dioxide for calculation.

In 2001, the World Resources Institute released the Greenhouse Gas Protocol, proposing a carbon emission measurement framework that includes Scope 1, Scope 2, and Scope 3. Scope 4 was proposed in 2013 as a measure of emissions reduction resulting from the use of products or services to avoid emissions. Due to the high computational difficulty of Scope 4, the market is paying more attention to the definition and calculation of Scope 1, Scope 2, and Scope 3.

In addition to historical carbon emission data, companies may also disclose their future carbon emissions. For example, the Science Based Targets Initiative recommends that companies set short-term and long-term carbon emission targets to help them achieve net zero. Enterprises can continuously adjust these targets based on actual carbon emissions in the future.

Application of Carbon Emission Data in Investment

Carbon emission data is crucial for investors as it can be used to assess regulatory risks faced by businesses and achieve long-term sustainable development of investment portfolios. The carbon emission data used by investors usually comes from enterprises and third-party data providers, where there are differences in calculation methods, coverage, and update frequency among different data providers. Investors can consider using multiple data sources to merge and validate data for a more accurate, timely, and comprehensive understanding.

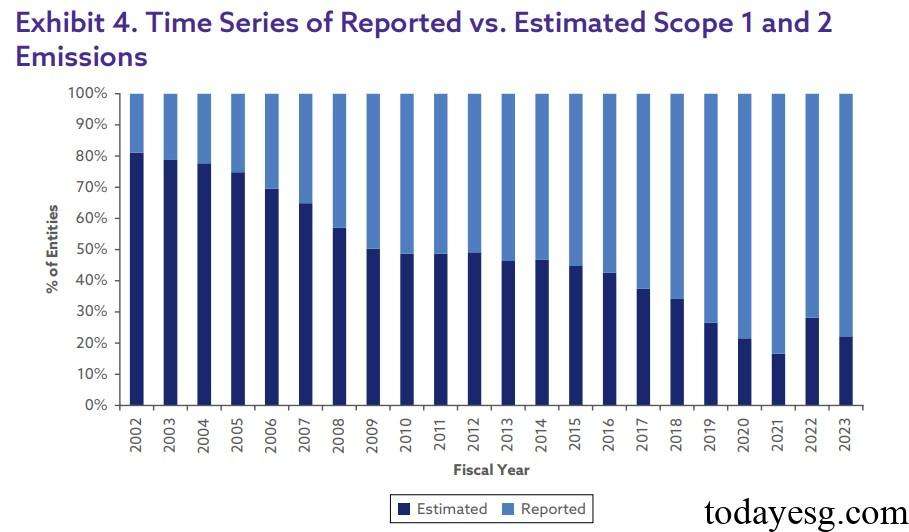

Investors’ attention to the accuracy of carbon emission data is constantly increasing, and corporate carbon emission data disclosure is increasing. The CFA Institute measured the proportion of carbon emission data disclosure and estimation values of MSCI All Country World Index constituent stocks and found that the proportion of carbon emission data estimation values has been continuously decreasing since 2002. This trend indicates that the transparency and accuracy of carbon emission data are improving. Scope 1 and Scope 2 have higher statistical accuracy due to their ease of calculation, while Scope 3 has relatively less corporate disclosure due to its complex calculation.

Although carbon emission data has significantly improved, there are still differences compared to standardized financial data. In terms of disclosure regions for carbon emission data, Europe, Japan, and the US rank higher, with Scope 1 and Scope 2 accounting for over 80% of disclosures, and Scope 3 accounting for over 70% of disclosures. In terms of industry, the energy industry, utilities, and materials industry have the highest proportion of disclosure, while the technology industry, communication industry, and finance industry have the lowest proportion of disclosure. This phenomenon is related to the total carbon emissions of these industries, that is, the higher the total carbon emissions, the higher the proportion of information disclosure.

Investors need to pay attention when applying carbon emission data, such as the different methods used by different suppliers in data estimation, which may lead to significant varieties in Scope 3 data. There may be differences between the Scope 3 data of some companies and the Scope 1 and Scope 2 data of other companies, which may result in duplicate calculations from the perspective of investment portfolios. With the release of regulatory policies and the improvement of carbon emission methods, these issues will be improved.

Reference:

The Scope of Net Zero: The Use of Carbon Emission Data to Achieve Portfolio Goals