Impact of Climate Signals on Portfolio Risk and Return

CFA Institute Research & Policy Center releases a report on the impact of climate signals on portfolio risk and return, aiming to help analyze the relationship between climate factors and investment risk and return.

CFA Institute believes that investors may consider climate characteristics in the process of building investment portfolios, and this study can help investors achieve more effective asset allocation and promote net zero investment development.

Related Post: CFA Institute Releases Report on Net Zero Investment Solutions

Climate Investment Portfolio Construction

CFA Institute uses the monthly returns, climate scores, and carbon emissions of MSCI World Index constituent stocks from February 2017 to June 2024. The MSCI World Index has a total of 1626 constituents, including large cap and mid cap stocks from 23 developed economies. In terms of climate variables, CFA Institute uses three climate signals, namely:

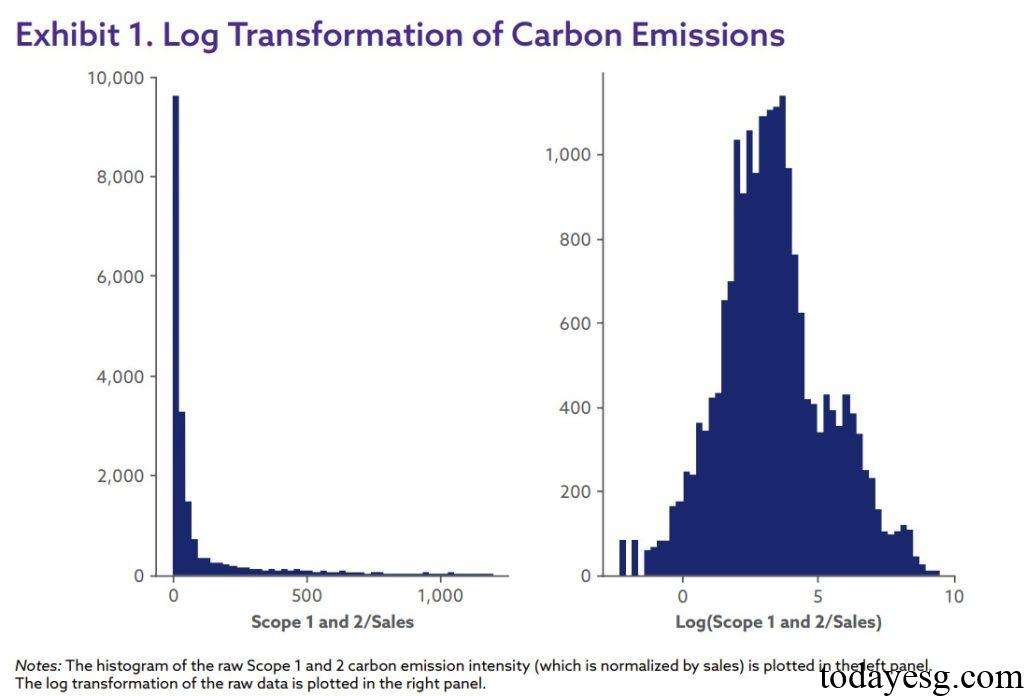

- Carbon emissions: The company’s carbon emission density is based on sales revenue, with basic data from Scope 1 and Scope 2 carbon emission data in the MSCI database, as well as company sales revenue data. After logarithmic transformation, the right skewed features of the data are eliminated.

- Natural capital: The company’s water intensity based on sales revenue, with basic data from the MSCI database on the company’s water usage and sales revenue. This data is also processed using logarithmic transformation.

- Green patents: The company’s number of green patents based on market value, reflecting intangible climate assets. Green patents refer to patents that comply with the United Nations Sustainable Development Goals (UN SDGs).

CFA Institute establishes investment portfolios based on the above data and optimizes company weights. According to the trading calendar of the New York Stock Exchange, a rebalancing is made on the last trading day of February and August, which means completely selling all companies, buying new companies, and holding until the next rebalancing date. The transaction cost is negligible, and the benchmark for the investment portfolio is the MSCI World Index.

Impact of Climate Signals on Portfolios

CFA Institute uses the Shapley attribution method to measure the contribution of climate signals to investment portfolios. The advantage of Shapley attribution is that its total attribution is 100%, meaning that the sum of individual signal returns is the actual total return. In addition, Shapley attribution also has linear addition and symmetry characteristics, making it convenient to measure the marginal return of each signal. Shapley attribution reflects the characteristics of statistical data and does not consider the causal relationship of attribution.

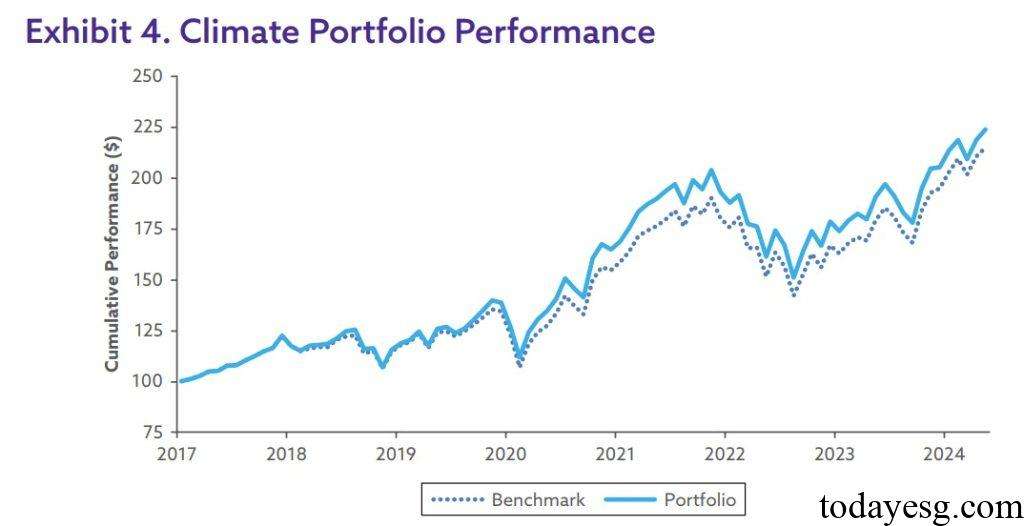

From February 2017 to June 2024, the monthly return rate of the climate investment portfolio is 1.03%, with a benchmark monthly return rate of 0.98%, and the climate investment portfolio outperformed by 63 basis points per month.

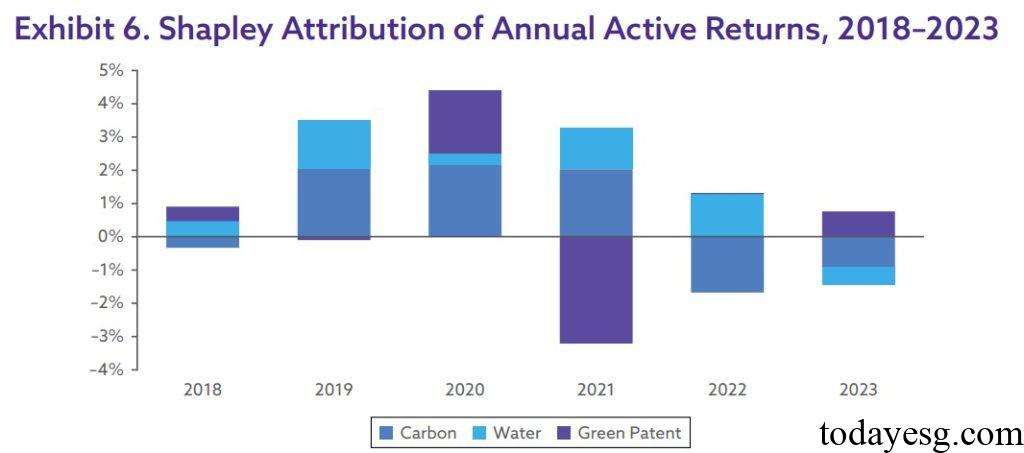

In terms of attribution, CFA Institute analyzes the performance of three climate signals in terms of return, volatility, tracking error, and other aspects. Among the 63 basis points, carbon emissions, natural capital, and green patents receives 14 basis points, 58 basis points, and -9 basis points, respectively. Among the additional 32 basis points, carbon emissions, natural capital, and green patents receives 29 basis points, -9 basis points, and 12 basis points, respectively. In terms of carbon emission intensity, carbon emissions contribute the most.

CFA also provides scores for three climate signals in climate portfolios and benchmarks, which can reflect the impact of climate signals on a certain aspect of the climate characteristics of the investment portfolio. In terms of natural capital, the climate portfolio score is 66%, while the benchmark score is only 19%. In terms of green patents, the climate combination score is 25%, while the benchmark does not have a score.

From an annual perspective, there have been changes in the contributions of the three climate signals to the climate combination. Among them, the carbon emission signal provides a positive contribution from 2018 to 2021, but a negative contribution in 2022 and 2023, possibly due to the increase in global energy prices. Natural capital only provides negative contributions in 2023. The overall contribution of green patents is negative, but it plays a role in diversifying risks during the market downturn in 2020.

Reference: