Report on ESG Rating and Data Product Regulations

The international research institution CDP (Carbon Disclosure Project) releases a report on ESG rating and data product regulations, aimed at evaluating and comparing ESG rating and data product policies in various jurisdictions, and providing development recommendations.

CDP finds that 94% of investors use ESG rating and data products at least once a month, and regulations are also referring to the recommendations of the International Organization of Securities and Commissions (IOSCO) for ESG rating and data products.

Related Post: International Capital Market Association Releases Code of Conduct for ESG Ratings and Data Products Providers

Global ESG Rating and Data Product Regulations

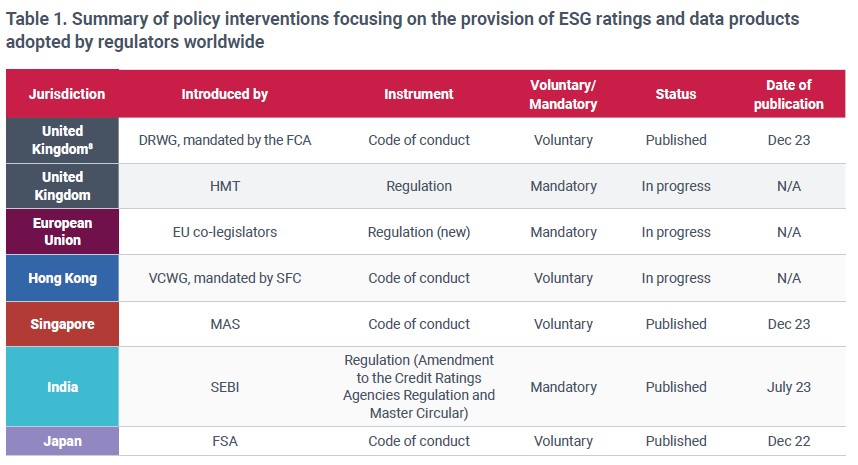

Numerous regulators in Europe and Asia have referred to the recommendations of IOSCO and formulated ESG rating and data product related guidelines and regulations, including:

- EU: In April 2022, the European Commission formulated a regulatory policy for ESG rating activities and initiated consultations. In February 2024, the European Commission reached an interim agreement with the Council of the European Union, which will soon be published in the Official Journal of the European Union. The European Securities and Markets Authority will release technical standards to supplement the regulatory framework.

- UK: In June 2021, UK Financial Conduct Authority launched a consultation on ESG ratings and data product regulation. In 2022, the Financial Conduct Authority established the ESG Data and Ratings Working Group, which released the Code of Conduct for ESG Ratings and Data Product Providers in December 2023. Currently, 21 providers have signed it. In the first quarter of 2024, the HM Treasury confirmed in the Spring Budget that it will modify the scope of responsibilities of the Financial Conduct Authority to regulate ESG rating providers.

- Hong Kong: In 2022, the Securities and Futures Commission of Hong Kong began developing guidelines for ESG rating and data product providers. In 2023, the International Capital Market Association began developing voluntary codes of conduct. In May 2024, the Hong Kong Securities and Futures Commission and the International Capital Markets Association released a draft code of conduct for ESG ratings and data product suppliers.

- Japan: In February 2022, the Japan Financial Services Agency established a technical committee to develop a code of conduct for ESG data providers, becoming the first regulator to respond to IOSCO. The code of conduct was officially launched in December 2022, and as of June 2024, 26 providers have voluntarily complied with it.

- India: In July 2023, the Securities and Exchange Board of India revised the Credit Rating Agencies Regulation, providing ESG rating providers with a six-month transition period. As of June 2024, 7 ESG rating providers have registered under the new regulation.

- Singapore: In December 2023, the Monetary Authority of Singapore released ESG rating and data product provider codes of conduct, and provided a Self Attestation Checklist for suppliers to disclose their adoption and compliance. As of June 2024, 2 providers have voluntarily complied.

Interoperability between ESG Rating and Data Product Regulations

ESG rating and data products are typically applicable in different jurisdictions, and interoperability of regulatory policies can reduce compliance costs and assist investors in using these products. CDP compares regulatory policies in the aforementioned jurisdictions based on recommendations by IOSCO.

- Policy Interventions: Some regulators have included ESG ratings and data products in mandatory regulation, while others have chosen to issue voluntary code of conduct. For example, the Securities and Futures Commission of India has revised its regulatory policies for credit rating agencies and initiated mandatory supervision, while the Monetary Authority of Singapore and the Securities and Futures Commission of Hong Kong have both issued voluntary code of conduct.

- Definitions of ESG Ratings and Data Products: The IOSCO has not provided a clear definition of ESG ratings and data products, and regulatory agencies have different responses in this area. For example, the Securities and Futures Commission of India and the Financial Services Agency of Japan have not provided clear definitions, while the Monetary Authority of Singapore and the European Union have provided different definitions.

- Methodology of ESG Ratings and Data Products: Most regulations mention information disclosure and other aspects, but there are still specific differences. For example, the European Union and India require providers to keep records for five years, Singapore requires providers to keep records for six years, and Japan requires providers to keep records, but does not require a specific time.

- Management of Conflicts of Interest: Most regulatory agencies mention how to identify, avoid, manage, and mitigate potential conflicts of interest. Regulatory policies in Singapore and Japan have continued to expand the scope of conflicts of interest, imposing additional requirements on consulting services for ESG rating and data product providers.

Reference: