First Government Green Bond

The Australian Office of Financial Management (AOFM) issues its first government green bond, aimed at providing global investors with opportunities to support Australian green projects.

Australia stated in its sustainable finance strategy document that it will issue green bonds for the first time in this year to support the development of green capital markets. The government green bond issued this time are an important milestone in sustainable financial markets.

Related Post: Australia Releases Sustainable Finance Strategy

Introduction to Australian Climate Policies

The three key green goals of the Australian government are climate change mitigation, climate change adaptation, and improved environmental outcomes. Australia plans to reduce carbon emissions by 43% by 2030 (based on 2005) and achieve net zero by 2050. In the field of climate change, Australia has developed the National Climate Resilience and Adaptation Strategy and the National Disaster Risk Reduction Framework, and implemented the National Climate Risk Assessment to understand the risks and impacts of climate change and reduce the physical risks.

Last November, the Australian Treasury released a sustainable finance strategy consultation document aimed at establishing a comprehensive framework and reducing investment barriers to sustainable activities. The consultation document sets out three pillars, namely improving transparency in climate and sustainable information, strengthening the sustainability of the financial system, and calling for government leadership and participation. The document argues that the net zero transition requires significant private and public investment, and relies heavily on financial markets to play an important role.

Introduction to the Australian Green Bond Framework

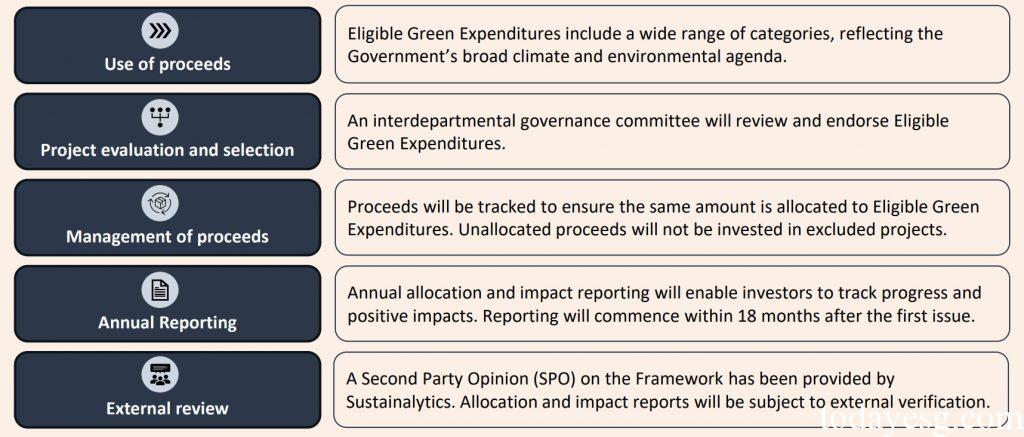

The Australian green bond framework is based on the Green Bond Principles issued by the International Capital Market Association, with the proceeds used for eligible green projects that are aligned with the government’s climate and environmental agenda. The Australian Office of Financial Management (AOFM) is responsible for issuing government green bonds and depositing funds in the Reserve Bank of Australia’s account, investing in green projects within two years. The review of green projects is determined by the Green Bond Committee, which is jointly established by the Australian Treasury and the Department of Climate Change, Energy, the Environment & Water. The committee is responsible for developing green project standards and implementing information disclosure and risk management.

18 months after the initial issuance of green bonds, the Australian government will release a report on the funding allocation and impact of the bonds to provide investors with actual progress on green projects. Australia appoints Sustainalytics as the external review body for green bonds. Sustainalytics has provided a second party opinion (SPO) for the green bond framework and will provide validation for funding allocation and impact reports.

Introduction to Australian Government Green Bonds

The government green bonds issued by the Australian Financial Management Office will mature on June 21, 2034, with a coupon of 4.25% and an issuance size of $7 billion. Government green bonds have been subscribed by numerous investors, with a subscription order size of 22.89 billion USD, which is more than three times the issuance size. The bond fundraising will be used for projects such as green hydrogen energy, clean transportation, and biodiversity conservation, and will bring significant environmental benefits. The Australian Financial Management Office has conducted roadshows with investors from Europe, Asia, and the Americas prior to the bond issuance.

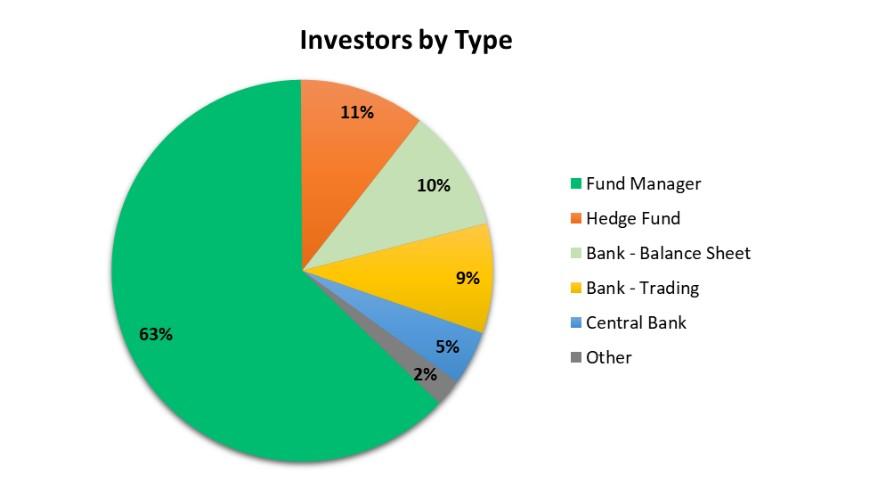

In terms of investors, 65% of investors come from Australia, while the remaining 35% come from other countries, with the UK and EU accounting for a relatively high proportion. The main investors are asset management companies (63%), hedge funds (11%), and banks (10%). The funding allocation and impact report for bonds will be released from 2025.

Reference:

Australia Issues Inaugural Billion Green Bond

ESG Advertisements Contact:todayesg@gmail.com