Application of Climate Scenario Analysis

This article introduces the application of climate scenario analysis in financial industry. With the increasing financial risks caused by climate change, climate scenario analysis has become an important tool for financial industry to manage climate risks.

The financial industry applies to a range of climate scenarios in climate related risk analysis, information disclosure, and stress testing, with the most common being the 1.5-degree Celsius scenario. Some regulatory agencies have also released scenario analysis guidelines to provide regulatory guidance for the financial industry.

Related Post: European Banking Authority Releases Consultation Paper on Guidelines on ESG Scenario Analysis

Application Cases of Climate Scenario Analysis

United Nations Environment Programme Finance Initiative (UNEPFI) proposes several climate scenario analysis application cases, including:

Risk Analysis

Climate scenario analysis can model prospective climate risks for risk analysis over different time frames. Financial institutions can explore the development of their business strategies and confirm their climate change adaptation capabilities based on a range of different scenarios.

Climate Disclosures

In 2017, Taskforce on Climate-related Financial Disclosures (TCFD) launched climate disclosure framework, which uses climate scenario analysis as a strategic tool to understand climate related risks and opportunities. In 2017, TCFD established Network for Greening the Financial System (NGFS) with financial regulatory agencies from various countries, which developed a series of globally available climate scenarios to assist financial institutions in completing information disclosures.

Climate Stress Tests

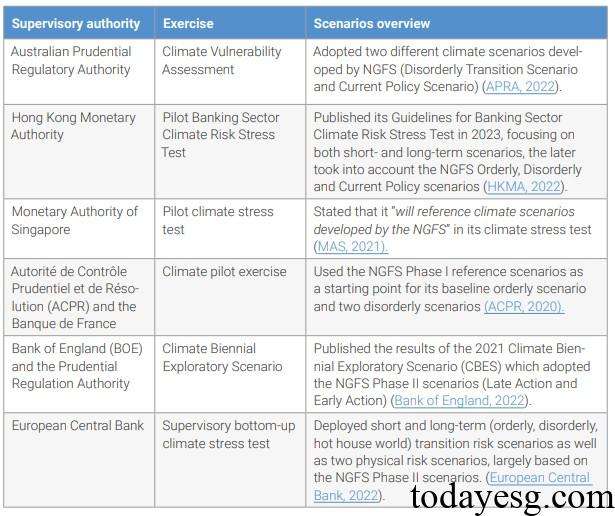

To understand the impact of climate risks on the financial system, global regulatory agencies are designing stress tests related to climate scenarios aimed at identifying and quantifying climate risk exposures. Regulatory agencies that use climate stress tests include:

- Australian Prudential Regulatory Authority conducts a Climate Vulnerability Assessment based on the Disorderly Transition Scenario and Current Policy Scenario released by the NGFS.

- Hong Kong Monetary Authority releases the Pilot Banking Sector Climate Risk Stress Test based on the Orderly Transition Scenario, Disorderly Transition Scenario, and Current Policy Scenario released by the NGFS.

- Monetary Authority of Singapore conducts climate stress testing based on climate scenarios released by the NGFS.

- French ACPR conducts climate stress tests using three climate scenarios released by the NGFS.

- Bank of England releases the Climate Biennial Exploratory Scenario based on the second phase scenario released by the NGFS.

- European Central Bank conducts regulatory climate stress testing based on three transition risk scenarios and two physical risk scenarios released by the NGFS.

Net Zero Strategy

Net Zero Tracker report shows that an increasing number of jurisdictions are committing to achieving net zero, covering 88% of global carbon emissions, 92% of GDP, and 89% of the population. Some financial institutions are joining the net zero path through Net Zero Asset Owner Alliance (NZAOA) and Net Zero Banking Alliance (NZBA). Climate scenario analysis will help these institutions develop net zero strategies and evaluate the alignment of their investment portfolios with net zero targets.

Reference: