2025 Climate Transition Report

Asia Investor Group on Climate Change (AIGCC) releases 2025 climate transition report, aimed at summarizing the progress of Asian institutional investors in addressing climate change.

The Asian Investor Climate Change Group surveys 230 asset owners and asset managers in Asia, with a median AUM of $100 billion.

Related Post: Asia Investor Group on Climate Change Releases 2024 Annual Report

Climate Transition and Climate Governance

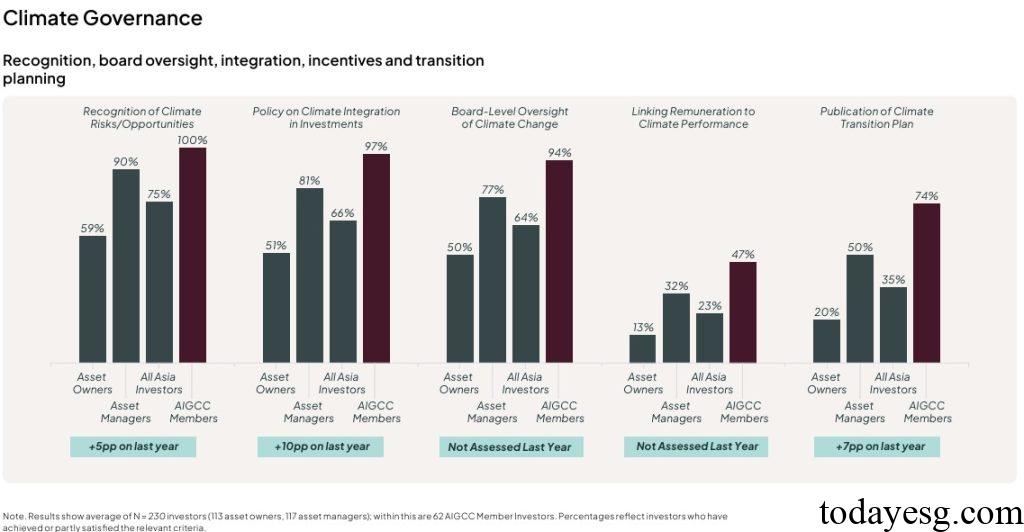

Asian investors have recognized the significant impact of climate change on their investment portfolios, with 75% of investors publicly stating that climate change will create material risks and opportunities, an increase of 5 percentage points compared to last year. 85% of asset managers and 56% of asset owners fully agree with this view. All respondents from AIGCC agree that climate change is a significant factor, with 75% of respondents agreeing with it.

In terms of climate policy, 66% of respondents have already incorporated climate change into their investment decisions, an increase of 11 percentage points compared to last year. The performance of asset managers (82%) once again exceeded that of asset owners (51%). In terms of climate policy themes, climate related risks and opportunities (90%), fossil fuels (61%), and biodiversity (47%) rank high. 77% of asset managers and 50% of asset owners have incorporated climate issues into their oversight at the board level, 35% of respondents have released climate transition plans, and 23% of respondents have linked their compensation systems to climate performance.

Climate Transition and Climate Investment

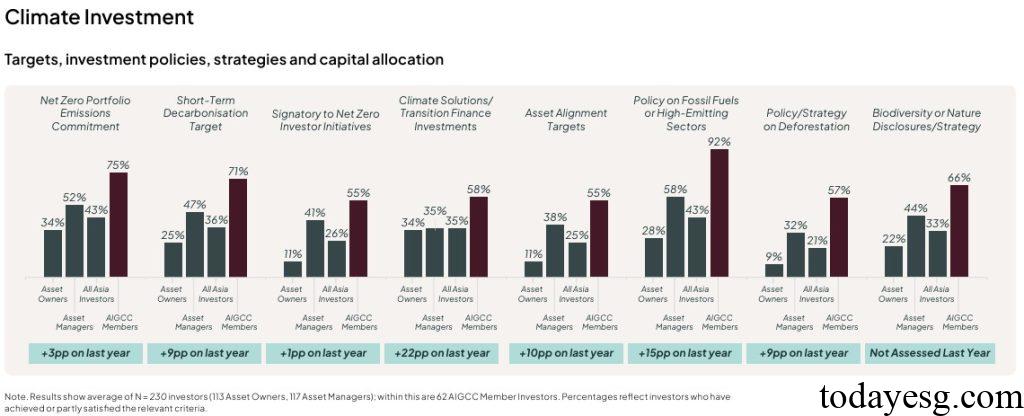

In terms of net zero targets, 43% of respondents have set investment portfolio net zero emissions targets, an increase of 3 percentage points compared to last year. Investors used the Net Zero Investment Framework (NZIF) and the NZIF Implementation Guidelines for Objectives and Targets. 36% of respondents have set mid-term investment portfolio emission reduction targets, and 33% have set short-term targets to fulfill their net zero commitments.

In terms of climate investment, 34% of respondents plan to increase their investment in climate solutions or transition assets, an increase of 22 percentage points compared to last year. Specific actions include setting quantitative or qualitative targets and measuring transition financing exposure. 25% of respondents have set asset allocation targets related to climate change, an increase of 10 percentage points compared to last year. In terms of climate investment themes, 43% of respondents have formulated investment policies for high carbon emission industries, 21% have formulated policies related to deforestation, and 33% have adopted biodiversity related strategies. Asset managers have made faster progress in all fields than asset owners.

Climate Transition and Investment Actions

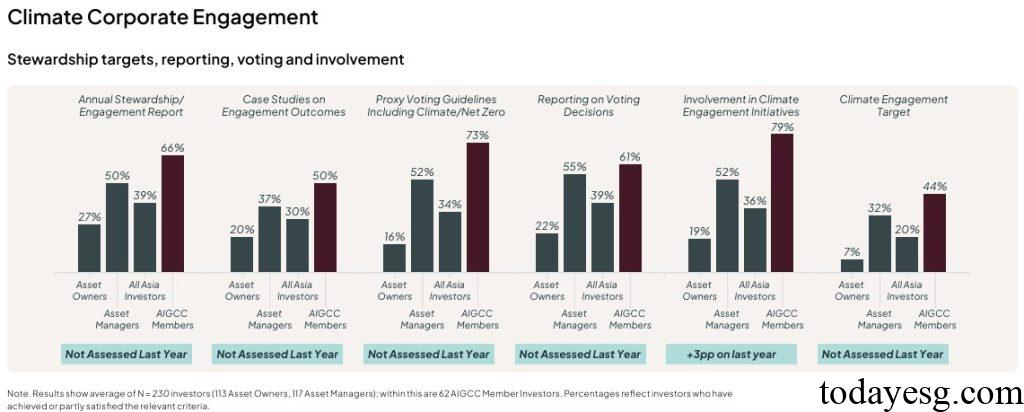

The investment actions taken by the investors include corporate engagement and policy advocacy. In terms of corporate engagement, 39% of respondents submit an annual proactive management report outlining their engagement activities and proxy voting actions with investees. 30% of respondents release climate engagement cases, detailing their engagement goals, action plans, and outcomes. 34% of respondents have included climate factors in proxy voting guidelines, and 39% have disclosed all voting results.

In terms of policy advocacy, 25% of respondents have collaborated with regulatory agencies, mainly through joining policy initiatives, attending seminars, and providing feedback on consultation documents. 23% of respondents sign public documents expressing their opinions in areas such as mandatory climate information disclosure (56%), climate roadmap (52%), and climate finance (50%).

Climate Transition and Climate Disclosures

37% of respondents disclosed their portfolio carbon emissions, of which 35% calculated their portfolio Scope 3 carbon emissions and 21% disclosed them. 44% of respondents released climate scenario analyses, and 28% released various types of climate scenario analyses. 54% of respondents have already disclosed climate information in accordance with TCFD recommendations, an increase of 6 percentage points compared to last year.

Reference: