Asia Natural Risk Data

The Asia Investor Group on Climate Change (AIGCC) releases nature risk data in Asia, aiming to analyze Asia’s economic dependence and the nature risks faced in development.

The Asia Investor Group on Climate Change, which completed the study in conjunction with PwC, uses the ENCORE database to assesses exposure to nature risks by industry and geography.

Related Post: Asian Investor Group on Climate Change Releases Net Zero Investment Report

Introduction to Nature and Nature Risk

Asia Investor Group on Climate Change believes that healthy natural ecosystems provide clean water and air, fertile soil, and help pollinate plants and control disease. However, the current rate of global natural decline has reached the fastest rate in history, with ecosystem health in Asia declining by 55% since 1970.

Regulators around the world have realized the importance of natural resources and have developed many policies. The Kunming-Montreal Global Biodiversity Framework released at the COP15 requires companies in signatory countries to disclose nature-related data, and Europe releases EU Regulation on Deforestation Free Products to protect forest resources in business activities.

Nature Dependence in Asia

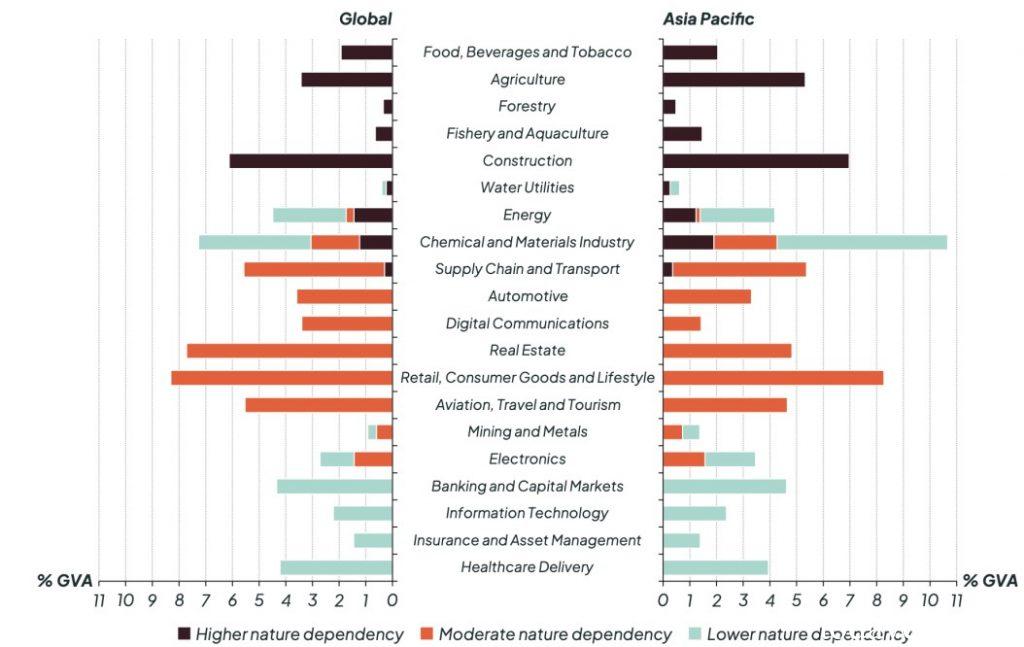

The Asia Investor Group on Climate Change uses Gross Value Add (GAV) to measure Asia’s dependence on nature. The study found that 20% of Asia’s GAV is highly dependent on nature, which is higher than the global proportion of 16%. 33% of the GAV is moderately dependent on nature, including the energy industry, manufacturing industry, and transportation industry. The two combined accounted for 53%, corresponding to GAV of US$18 trillion. 47% of GAV is less dependent on nature, including the real estate industry, medical industry, information technology industry and retail industry. These natural dependencies include fertile soil, clean water, and stable climate conditions.

From an industry perspective, the development of agricultural industry, construction industry, food and beverage industry, and aquaculture industry in Asia is highly dependent on nature, and the dependence of agriculture and construction is significantly higher than the global level. Analyzing from the perspective of listed companies on 14 stock exchanges in Asia, 50% of the listed companies on 11 stock exchanges have a medium or higher dependence on nature, among which the listed companies on the New Zealand Stock Exchange have the highest degree of dependence on nature.

How to Deal with Nature Risk

Biodiversity loss and ecosystem degradation due to nature risks can impact supply chains, leading to lower asset values and ultimately impacting investment returns. Therefore, investors with long-term goals should learn how to deal with nature risks. Asia Investor Group on Climate Change has developed a checklist for investors to identify and manage nature risks. The checklist includes six steps in portfolio investment, which are:

- Identify the relevant information needed to measure the nature risk of a portfolio.

- Gain management and board commitment on nature.

- Evaluate the nature risk exposure of assets and portfolios and conform priority companies based on industry and geography as well as investor’s policy on nature.

- Identify industry and market-related initiatives to join.

- Engage with priority sectors and key companies in the portfolio regularly.

- Use the most relevant nature-related disclosure framework to set investment goals. The Asian Investor Group on Climate Change recommends the disclosure framework provided by the Taskforce on Nature-related Financial Disclosures and the Science-based Targets Network.

The Asia Investor Group on Climate Change plans to publish a report called Nature at a Tipping Point in the future to provide investors with several typical cases of dealing with nature risks. The report will also help investors to understand the impact of nature risks on their portfolios.

Reference:

Over half of Asia Pacific’s Economy Directly Dependent on Nature

ESG Advertisements Contact:todayesg@gmail.com