Green Investment Bank Report

The Asian Development Bank (ADB) releases a report on green investment banks, aiming to emphasize the role of green investment banks in climate financing and low-carbon transition, and provide relevant recommendations.

The Asian Development Bank believes that public financial institutions need to play a greater role in addressing climate change, and the current issue of long-term funding shortages for climate projects is very urgent. Due to the large investment, high risk, long term, and unstable returns of these projects, it is difficult for private capital to fill the annual financing gap. Green investment banks may play a role in these areas, overcoming investment barriers and achieving sustainable development goals.

Related Post: Climate Policy Initiative Releases Global Climate Finance Report

Background of Global Green Investment

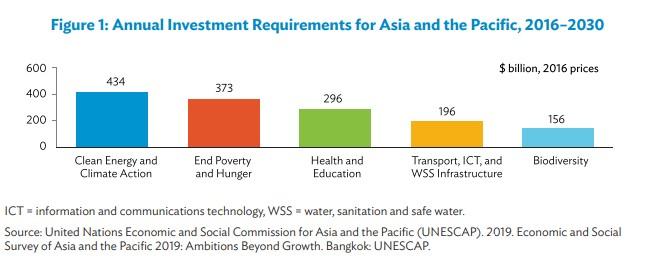

Emerging markets and developing economies require significant investment to mitigate and adapt to climate change. The Asian Development Bank estimates that they need to invest $1.7 trillion annually in climate infrastructure, and private capital investment in this area is not optimistic. From 2000 to 2021, the cumulative current account surplus of emerging market and developing economies reached $892 billion, which is difficult to use for domestic resource mobilization, especially for investing in climate and sustainable development.

Although regulators hope to drive a large amount of private capital investment through mixed financing with a small amount of public funds, the actual effect is not satisfactory. With the changes in the global financial cycle, the rise in interest rates in developed economies has attracted more capital inflows. Therefore, the necessity of promoting green investment through public financial institutions such as multilateral development banks and national development banks is increasing. In addition, public financial institutions can provide countercyclical financing, which has a positive impact on the urgency of current climate action.

Development of Global Green Investment Banks

Currently, there are 522 public financial institutions worldwide, involving different regions and countries, but only a few have explicitly taken on the role of green investment banks. In 2018, the Asian Development Bank positioned itself as the Asia and the Pacific’s Climate Bank, committing to supporting subsequent actions in 75% of its business activities and planning to accumulate $100 billion in climate financing by 2030. In 2019, the European Investment Bank transformed itself from a bank supporting climate to a Climate Bank and released the Climate Bank Roadmap in 2020.

Given the investment demand for green transformation, transforming existing public financial institutions into green investment banks is a feasible measure. These green investment banks can obtain funds from government, central banks, multilateral development banks, and other channels. The OECD believes that the transition of existing institutions is better than creating new green investment banks, although some large national development banks may not transform into green investment banks, their businesses and investment portfolios can also be aligned with climate goals. The United Nations Development Programme is proposing recommendations to strengthen public financial institutions in sustainable financing.

Suggestions for Developing Green Investment Banks

There are a total of 139 public financial institutions in the Asia Pacific region with total assets exceeding $6.9 trillion, but currently these banks rarely include green footprints in their business and investment portfolios. The Asian Development Bank believes that public financial institutions in the Asia Pacific region need to stop financing environmentally harmful projects and expand financing for green projects. Regulators in various countries should consider transforming national development banks into green investment banks or establishing green investment banks.

The development of the UK Green Investment Bank has provided experience for the establishment of green investment banks in the Asia Pacific region, such as:

- Green investment banks should establish comprehensive charters, clear missions, and operational rules to guide long-term development.

- Green investment banks should establish clear strategic priorities and high-level guidelines that describe priority areas and investment standards.

- Green investment banks should cultivate employees with knowledge of green financing and improve their capacity building.

Reference:

Green Investment Banks: Unleashing the Potential of National Development Banks to Finance a Green and Just Transition

ESG Advertisements Contact:todayesg@gmail.com