Global Net Zero Progress Report

Accenture releases a global net zero progress report, aimed at analyzing the development of large global companies in net zero and providing recommendations for accelerating net zero transition.

Accenture believes that global large companies are moving towards net zero targets, but only 16% will be able to achieve net zero emissions by 2050. Stakeholders such as businesses, investors, and regulators need more action to achieve net zero.

Related Post: MSCI Releases Global Net Zero Tracker Report

Net Zero Target and Transition Plan

Accenture analyzes the top 2000 companies in the world by revenue, with a focus on their net zero actions. After the Paris Agreement came into effect in 2016, 55% of companies have reduced their operational emissions, and 77% of companies have reduced their Scope 1 and Scope 2 emission intensity. 52% of companies have simultaneously reduced their absolute emissions and emission intensity. This indicates that these companies are incorporating decarbonization strategies into their core business activities to achieve sustainable development.

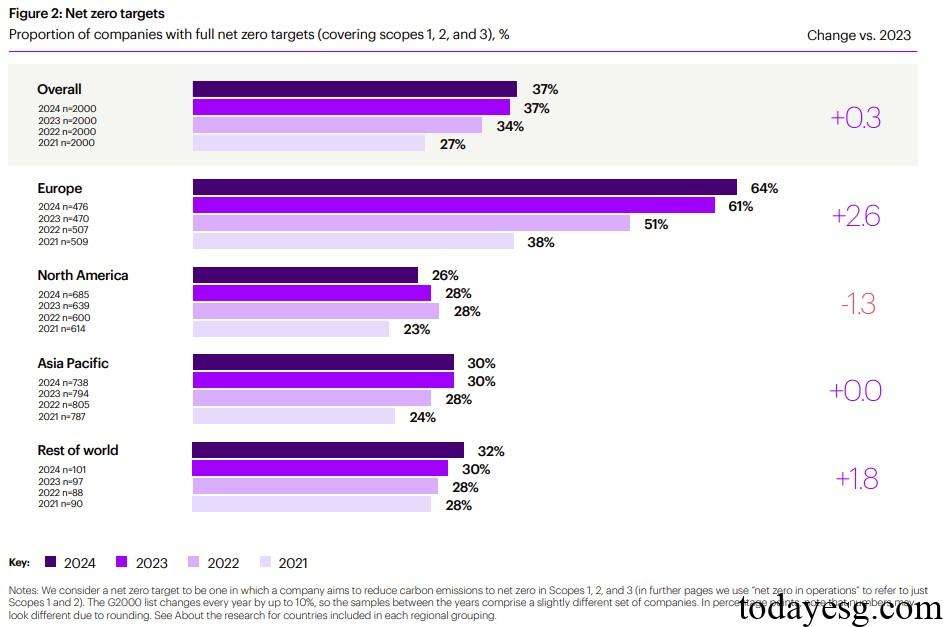

In terms of carbon reduction targets, 37% of companies have set net zero targets that include Scope 1, Scope 2, and Scope 3, an increase of 10 percentage points compared to 2021. 65% of companies have set net zero targets that include Scope 1 and Scope 2, an increase of 26 percentage points compared to 2021. 18% of companies have not yet set a net zero target, a decrease of 24 percentage points compared to 2021. The net zero target setting in the European region is leading the world.

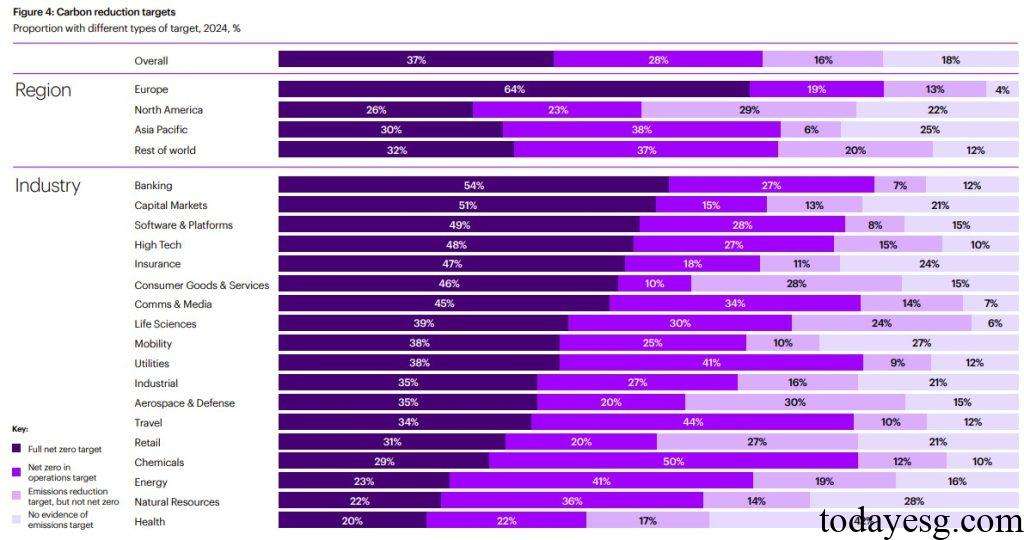

When setting a net zero target, companies need to consider the distribution of their emissions throughout the entire value chain. Scope 3 typically accounts for a significant portion of carbon emissions in many industries, so there are significant differences in net zero targets across different industries. The proportion of banks, capital markets, and software industries setting net zero targets is relatively high, at 54%, 51%, and 49% respectively.

In addition to the net zero target, companies can also develop transition plans to demonstrate their emission reduction commitments. 46% of companies worldwide have developed transition plans, with 67% in Europe, 44% in Asia, and 33% in North America.

Decarbonization Action and Decarbonization Lever

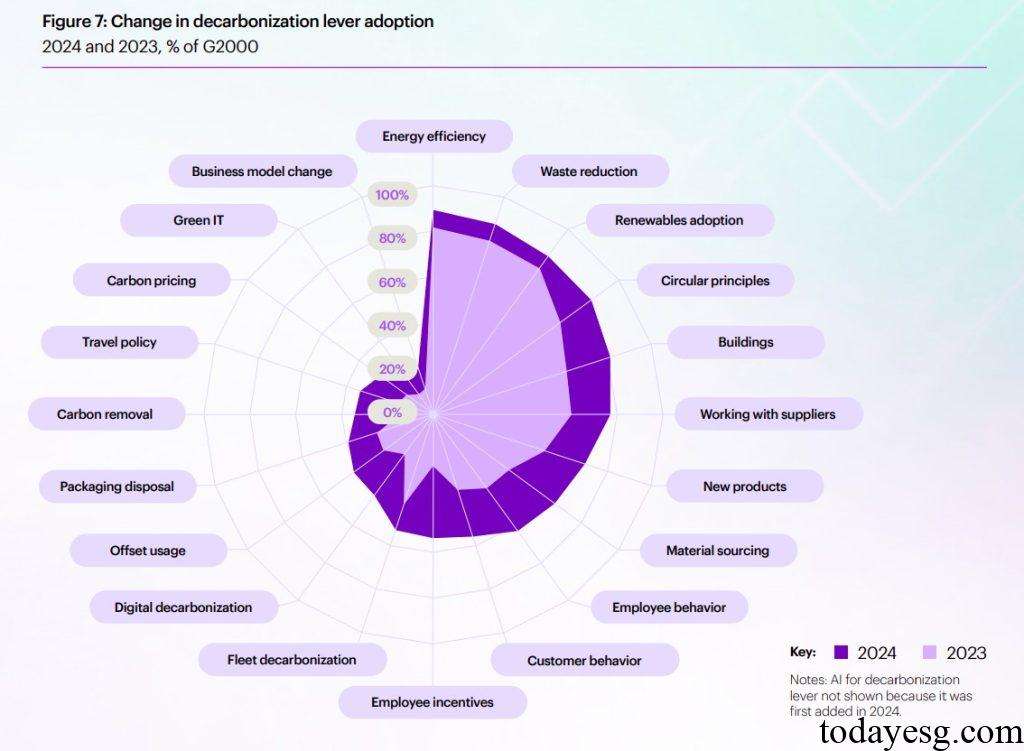

Accenture defines decarbonization lever as the business actions taken by a company to decarbonize. Among the 21 decarbonization levers, most companies use 12 levers, with the most commonly used being energy efficiency (89%), waste reduction (87%), renewable energy application (85%), circular principles (85%), and construction (81%). Compared to last year, the proportion of decarbonization leverage applications by companies has increased, thanks to the implementation of net zero targets and transition plans.

Accenture finds that companies with more decarbonization leverage make faster progress in reducing carbon emissions. Companies with 15 or more leverage have reduced their carbon emissions by approximately 2% annually since 2016, while companies with less than 10 leverage have increased their carbon emissions since 2016. The average number of leverage used by European, North American, and Asia Pacific companies is 13.9, 10.9, and 10.4.

Based on current decarbonization rate predictions, only 16% of companies will be able to achieve net zero emissions by 2050. 39% of companies are reducing carbon emissions but will not be able to achieve net zero by 2050. 45% of companies are still increasing their carbon emissions. Only 6% of companies with higher absolute carbon emissions are able to achieve net zero on schedule, while 36% of companies with lower absolute emissions are able to achieve net zero.

How to Achieve Net Zero in the Future

Accenture believes that companies can take action at different times to achieve net zero:

- Within the next three months: Set a net zero target and develop a transition. Companies need to consider setting net zero targets and transition plans to begin reducing carbon emissions. Companies with net zero targets are making faster progress in carbon reduction than those without targets.

- Within the next year: Evaluate materiality and adopt decarbonization leverage. Companies can evaluate which decarbonization levers are most important for reducing emissions and prioritize their use to address carbon emissions.

- Within the next two years: Apply artificial intelligence to improve efficiency. Currently, only 14% of companies are using artificial intelligence to reduce carbon emissions. In the future, artificial intelligence will achieve real-time carbon reduction monitoring and evaluation, improving the efficiency of net zero actions.

Reference: