Final Report on Greenwashing in Banking Sector

European Banking Authority (EBA) releases final report on greenwashing in banking sector, which aims to outline greenwashing risks in the banking industry and its impact on industry participants.

The report is a response from European Supervisory Authorities (ESAs) to EU requirements. In May 2022, the European Union requested ESAs to provide opinions on greenwashing, and to release an interim report in May 2023 and a final report in May 2024. In addition to the European Banking Authority, the European Securities and Markets Authority (ESMA) and the European Insurance and Pension Authority (EIOPA) also releases final report on greenwashing in relevant sectors.

Related Post: UK Financial Conduct Authority Releases Guidance on Anti-Greenwashing Rule

Understand Greenwashing in the Financial Industry

Although greenwashing report mainly analyzes greenwashing in the banking industry, ESAs have reached a consensus on the definition of greenwashing in the financial industry. Greenwashing refers to the phenomenon where sustainability related statements, actions, and communication cannot clearly and accurately reflect the sustainable characteristics of entities, financial products, or financial services, and may mislead consumers, investors, and other market participants. The driving factors for greenwashing are complex, including increasing demand for sustainable products, companies wanting to maintain a sustainable image, vague regulatory policies and concepts, and insufficient quality of financial data.

When financial industry practitioners communicate with consumers, investors, and other market participants, they may use vague, false, overly simple, or unconfirmed information, leading to greenwashing. If practitioners perform intentionally, negligently, or lack robust business processes, regulatory agencies may take stricter penalty against greenwashing. Greenwashing exists in multiple stages of financial products or services, including manufacturing, marketing, delivery, monitoring, etc., which can reduce market trust in sustainable finance and lead to unfair competitive advantages for those who use greenwashing.

Greenwashing: Trend, Types and Impacts in Banking Sector

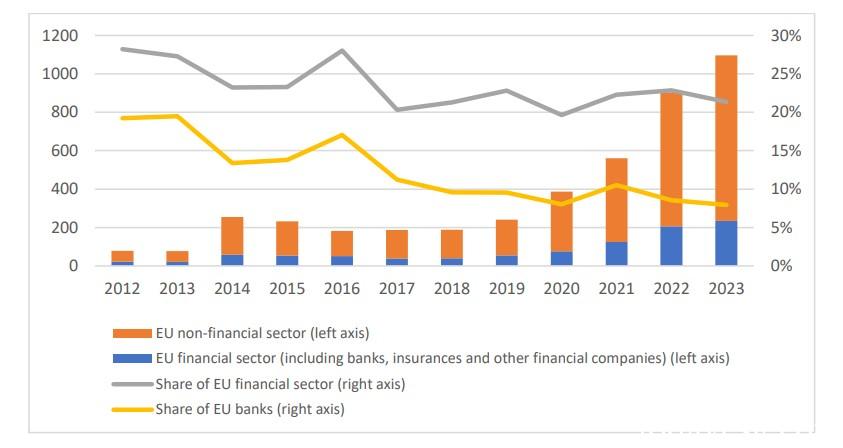

The European Banking Authority uses the RepRisk to analyze greenwashing cases in the global banking industry. Since 2022, the number of greenwashing cases in the European financial industry has rapidly increased (40 in 2018 and 206 in 2022). In 2023, the number of greenwashing cases in the European financial industry reaches 234, accounting for 21% of all greenwashing cases in Europe. There are 90 cases of greenwashing in the banking industry, accounting for 8% of all greenwashing cases in Europe. The three main topics of European financial industry greenwashing cases are climate change, biodiversity, and the impact on local communities.

European Banking Authority continues to collect complaints from banks regarding greenwashing and finds that the most common complaints are “vague, unclear, or lacking clarity information”. Other major complaints included “exaggerated publicity”, “inconsistent information disclosure”, “lack of fair and intentional comparison, basic assumptions”, etc. Some rare complaints about greenwashing include “outdated information”, “misleading text and images”, etc. Most of these complaints come from consumers and investors, with a few coming from public institutions.

For the banking industry, credit and loan is an essential business, and sustainability-linked loans have become a research focus in greenwashing. Sustainability-linked loans typically have lower borrowing costs and require entities to meet certain sustainable performance targets or key performance indicators. The phenomenon of greenwashing has led to a decrease in the trust of market participants in borrowers, and the scale of globally sustainable linked loans has declined for the first time in 2023 after rapid growth in recent years.

How to Solve Greenwashing in Banking Sector

European Banking Authority believes that there are two ways to solve greenwashing. One is to regulate the marketing and communication behavior of financial institutions, and avoid misleading statements and unfair business practices. The other is to develop a sustainable finance framework, incorporating sustainable finance into regulatory scope, in order to identify greenwashing behavior and propose solutions. The European Taxonomy and Corporate Sustainability Reporting Directive have proposed an ESG information disclosure framework, which helps reduce greenwashing.

For banking institutions, European Banking Authority has provided some suggestions, such as providing clear and detailed information in green deposit promotion, using scientific performance targets in sustainable linked loans, and seeking verification from third-party auditing agencies. In addition, banking institutions can also refer to the International Capital Market Association’s guidance on sustainable financial products and establish business processes that comply with international standards.

Reference:

ESAs Call for Enhanced Supervision and Improved Market Practice on Sustainability-related Claims