Hong Kong Taxonomy for Sustainable Finance

The Hong Kong Monetary Authority (HKMA) launches the Hong Kong Taxonomy for Sustainable Finance, which aims to provide the market with a green and sustainable finance classification framework to promote capital flows and mitigate greenwashing risk.

The Hong Kong Monetary Authority invites Climate Bonds Initiative (CBI) to assist in the development of a sustainable finance taxonomy and appoints Green and Sustainable Finance Cross-Agency Steering Group (CASG) to assist. The Hong Kong Taxonomy for Sustainable Finance is also consistent with China’s Green Bond Endorsed Projects Catalog and the European Union’s Taxonomy for Sustainable Activities.

Related Post: Hong Kong Plans to Establish Green Taxonomy

Background on Hong Kong Taxonomy for Sustainable Finance

The Hong Kong Taxonomy for Sustainable Finance aims to provide the financial industry with a consistent and internationally recognized definition of green and sustainable economic activities that is interoperable, comparable and able to align with the definitions of other taxonomies around the world. The Hong Kong Taxonomy for Sustainable Finance is established based on the following principles:

- Alignment with the Paris Agreement. The taxonomy focuses on providing a clear definition of the emissions intensity performance required for economic activities to keep global warming targets below 2 degrees Celsius, and ideally controlled at 1.5 degrees Celsius. This goal is aligned with the Paris Agreement.

- A proof from greenwashing. The taxonomy can provide a clearer definition of green activities while providing a set of easy-to-use verification standards to reduce greenwashing.

- Interoperability with other taxonomies. The taxonomy considers the sustainable finance taxonomies of China, the European Union, and ASEAN, and is based on the International Standard Industrial Classification of All Economic Activities (ISIC) and the Hong Kong Standard Industrial Classification (HSIC) to classify economic activities and ensure the interoperability.

- Science-based criteria and thresholds. The calculation standards and trajectories are consistent with global net-zero emissions requirements by 2050.

- Foundations of Do No Significant Harm and Minimum Social Safeguards. The taxonomy incorporates the concepts of Do Not Cause Significant Harm (DNSH) and Minimum Social Security (MSS), and plans to explore the application of these concepts in subsequent developments.

Introduction to Hong Kong Taxonomy for Sustainable Finance

Hong Kong has formulated four main decarbonize strategies in its 2050 climate plan, namely net-zero electricity generation, energy saving and green buildings, green transport and waste reduction. The industries covered by this sustainable finance taxonomy are closely related to the above four carbon reduction strategies. These industries include:

- Electricity, Gas, Steam and Air Conditioning Supply.

- Transportation and Storage.

- Water Supply, Sewerage, Waste Management and Remediation Activities.

- Construction.

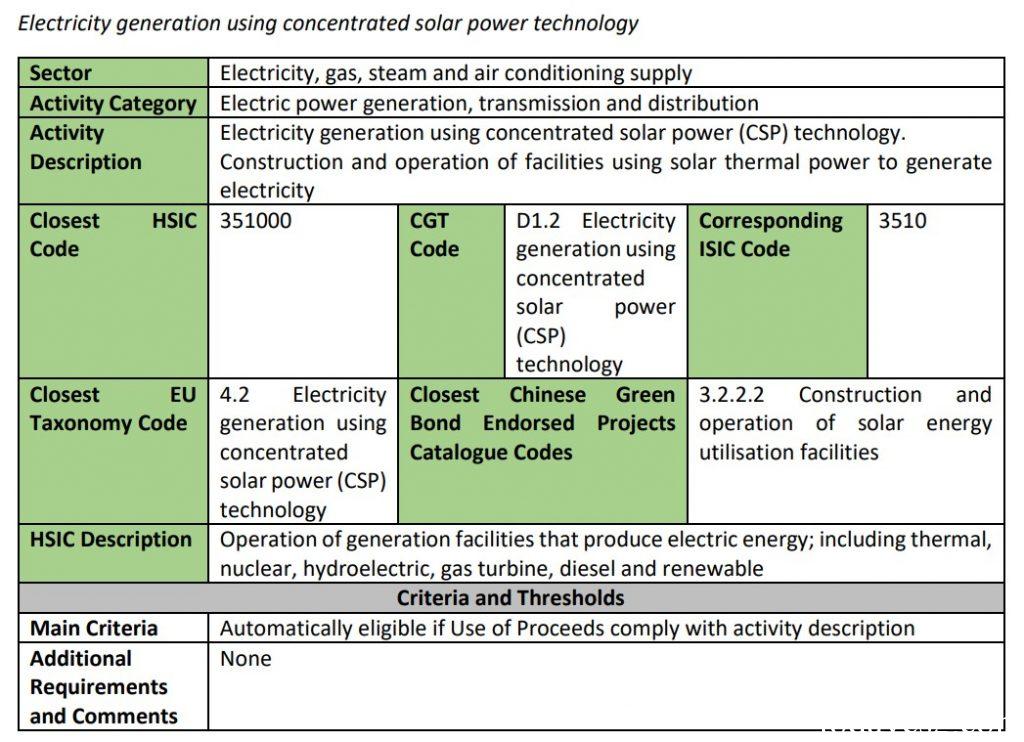

For the economic activities in each industry, the Hong Kong Taxonomy for Sustainable Finance provides a number of activity cards, each card containing a detailed description of one or more activities.

Taking the solar power generation above as an example, the activity card gives the industry classification involved in solar power generation, as well as the activities that are closest to the Hong Kong Standard Industrial Classification (HSIC), the International Standard Industrial Classification (ISIC) and other taxonomies. The activity card also includes a further description of the activity, criteria for meeting the green classification and additional requirements.

Although there are no additional requirements for solar power in the above example, other activities may actually have related requirements. These include some greenhouse gas emissions standards and industry-specific metrics. Economic activities can only be considered sustainable when they meet these additional requirements.

The Hong Kong Monetary Authority plans to continue to expand the industries covered by the taxonomy and include transition activities in it. HKMA will also continue to work with stakeholders to promote the application of the sustainable finance taxonomy.

Reference:

Hong Kong Monetary Authority – Hong Kong Taxonomy for Sustainable Finance