Net Zero Asset Owner Alliance Progress Report

The Net Zero Asset Owner Alliance (NZAOA) has released its third progress report to summarize members’ progress in climate action.

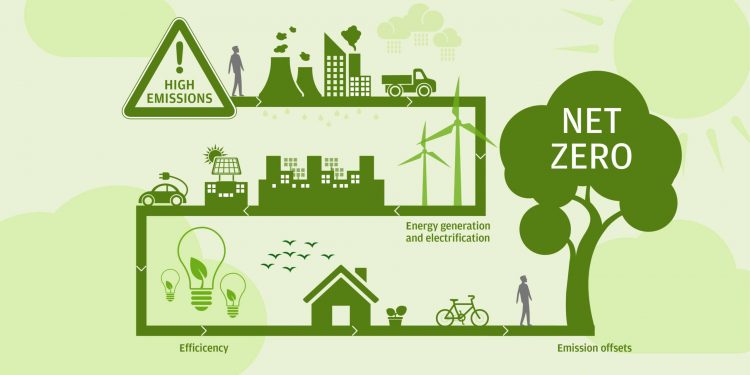

NZAOA’s members have committed to achieving net zero emissions from their portfolio by 2050, with interim targets set every five years. To achieve net zero and limit warming to 1.5 degrees Celsius, global greenhouse gas emissions need to peak in 2025, fall by 43% in 2030, and fall by 60% in 2035.

The Net Zero Asset Owner Alliance was established in 2019. The number of members has increased to 86, with total assets under management exceeding US$9.5 trillion, and 69 of its members have set mid-term goals.

Related Post: IIGCC Launches Net Zero Standards for Banks

Net Zero Asset Owner Alliance’s Progress on Decarbonization

NZAOA requires its members to publicly disclose greenhouse gas emissions data for their portfolios in order to increase the transparency of information. Although the number of members has continued to increase in recent years, carbon dioxide emissions have dropped from 221 million tons to 213 million tons, with the total emissions declines in the past three years accounting for -12%, -20% and -16%.

In terms of portfolios held by members, NZAOA requires carbon emissions reductions to fall by 22% to 32% in 2025 and by 40% to 60% in 2030. From the analysis of equity assets, the average emission reduction plan of current members in 2025 is 27.2%. From the analysis of debt assets, the average emission reduction plan of current members in 2025 is 28.9%. Analyzing from fixed assets (such as real estate and infrastructure), current members have an average emission reduction plan of 26.2% in 2025. Taking into account the proportion of various assets in the investment portfolio, the average emission reduction figure is 27.4%.

Net Zero Asset Owner Alliance’s Progress on Fossil Fuel

In 2020 NZAOA released a position paper on thermal coal and asked members to adjust plans based on the document. The current proportion of members holding thermal coal assets is 97%, of which 82% have aligned with the position paper. These stances are mainly reflected in reducing funding for thermal coal power plants, canceling investment in thermal coal projects that are still in the early stages of construction, and gradually divesting thermal coal assets that account for a high proportion of revenue.

In 2023, NZAOA has developed a position paper on the oil and gas industry following two years of discussions, providing a framework for members to communicate the net zero transition to stakeholders. Members will strengthen ties with asset managers and actively influence their investment strategies.

Net Zero Asset Owner Alliance’s Progress on Climate Solutions

NZAOA defines climate solutions as investments that help mitigate climate change and adapt economic activity and are consistent with existing climate-related sustainability taxonomies. These solutions cannot cause significant harm to social and environmental goals, but can accommodate regional differences.

The total assets under management of NZAOA members invested in climate solutions reaches $380.6 billion in 2023. Among them, investment in infrastructure, sovereign bonds, and green bonds has grown fastest. In terms of industry classification, investment in the construction and energy industries accounted for 84%. In terms of transition financing, NZAOA requires members to expand the scale of mixed financing and invest in emerging market economies to ensure a fair investment environment.

Net Zero Asset Owner Alliance’s Perspective on COP28

At the upcoming COP28 in December, NZAOA has made some recommendations:

- Expand innovation in financial and investment frameworks, attract private capital, and create sustainable business models.

- Develop globally applicable transition planning policies to integrate climate action into national activities.

- Develop a multilateral financial architecture to finance the scale-up of the net-zero transition.

- Increase the supply of alternative energy and promote research on renewable energy technologies.

Reference: