Corporate Nature Assessment Guide

World Economic Forum (WEF) releases corporate nature assessment guide for financial institutions, aiming to provide a framework for natural assessment.

The World Economic Forum believes that achieving the Global Biodiversity Framework requires the participation of financial institutions to provide financial support for natural transition.

Related Post: TNFD Releases a Discussion Paper on Nature Transition Plan

Background of Corporate Nature Assessment

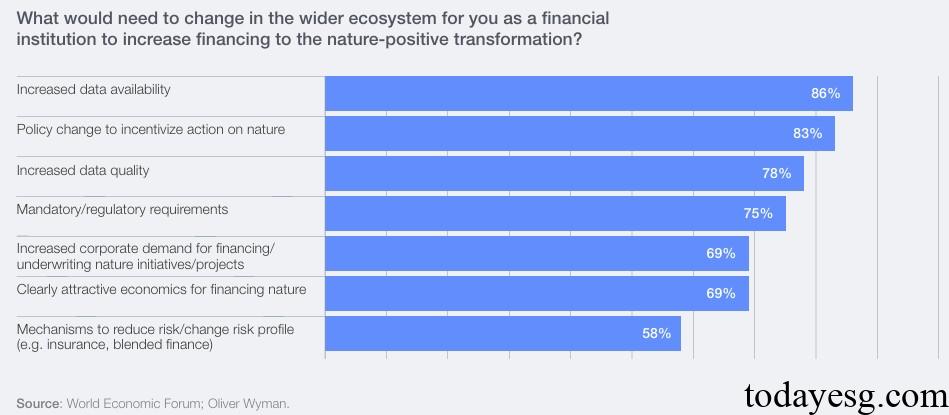

The global biodiversity framework aims to curb and reverse natural loss by 2030 and achieve the vision of harmonious coexistence with nature by 2050, which requires financial institutions to invest in nature positive projects. World Economic Forum conducted a survey on natural investment among financial institutions in 2024, and the survey showed that data availability (86%), policy incentives (83%), and data quality (78%) are the main obstacles to current natural transition investment. In addition, nature-related financial risks are also a focus of attention for regulatory agencies such as the Financial Stability Board (FSB).

At present, most financial institutions tend to evaluate the natural transition of corporates from the perspectives of risk and compliance, such as the EU Corporate Sustainability Reporting Directive (CSRD) which requires financial institutions to disclose relevant information. Some financial institutions are realizing the value of nature as an investment opportunity, with over 43% of respondents believing that sustainable forestry, land conservation, and other natural solutions will generate high market demand in the future.

Introduction to Corporate Nature Assessment Guide

Based on the current background of corporate natural assessment, the World Economic Forum has proposed a guide, aimed at providing financial institutions with practical methods for evaluating the actions of corporates in nature conservation and restoration. This guide is based on consultations between the World Economic Forum and global banks, insurance, and asset management companies, and referenced from the Taskforce on Nature-related Financial Disclosures (TNFD), the Glasgow Financial Alliance for Net Zero (GFANZ), and the World Wildlife Fund (WWF).

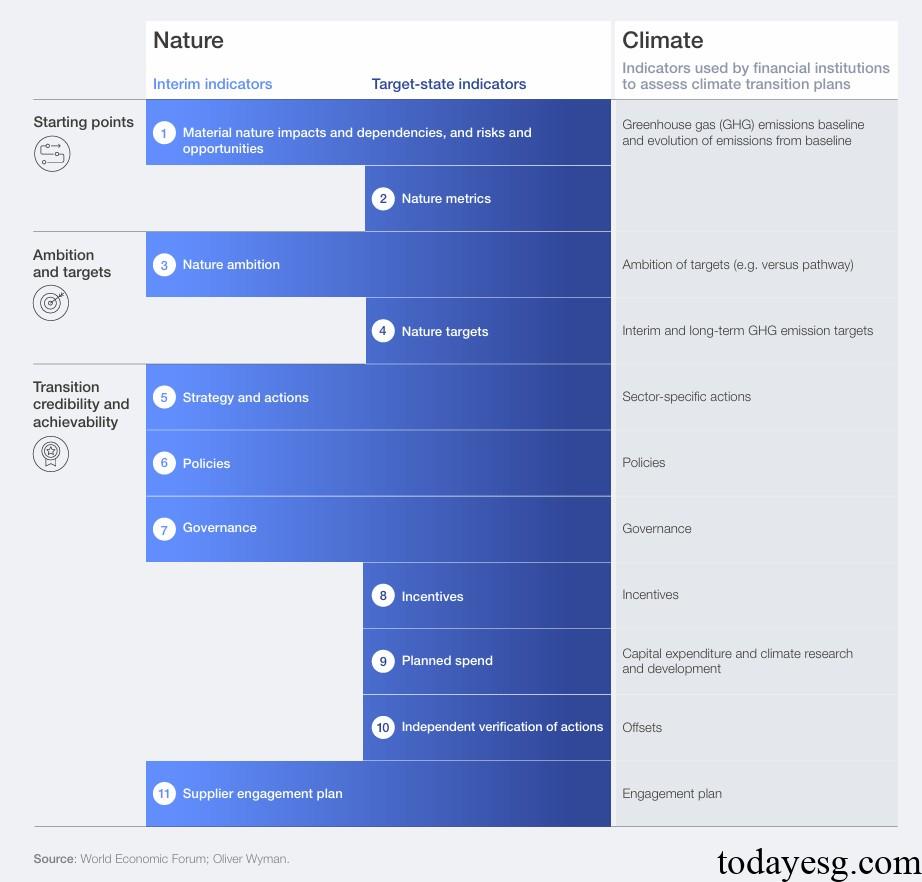

The corporate nature assessment guide includes eleven indicators in three directions, including:

Company Starting Point

- Material nature impacts and dependencies, and risks and opportunities: Financial institutions can obtain information from corporates to understand the natural risks and opportunities related to the corporation and determine the areas of natural transition and possible financing needs.

- Nature metrics: Corporates can provide relevant indicators that focus on natural impacts, dependencies, risks, and opportunities, and financial institutions can also query the natural information disclosure documents filled out by corporates in the Carbon Disclosure Project (CDP) and Global Reporting Initiative (GRI).

Company Ambition and Targets

- Nature ambition: The natural ambition of a company includes its natural goals and priority areas, as well as related business models, value chains, and action plans.

- Nature targets: Short, medium, and long-term natural goals set by corporates, which may be based on science and have measurable and achievable characteristics.

Transition Credibility and Achievability

- Strategy and actions: Corporates align their business activities and operational plans with their natural objectives to evaluate their natural strategies and actions.

- Policies: Natural related policies can provide financial institutions with data to measure corporate transition plans.

- Governance: Corporates may have established natural governance committees in their board of directors and senior management to promote long-term natural transition.

- Incentives: Companies may link employee compensation to natural goals, and their actions are like climate related incentives.

- Planned spend: Specific information on a company’s natural related investment expenditure, research and development expenditures, etc. can help financial institutions evaluate the company’s natural actions.

- Independent verification of actions: Companies can evaluate the credibility of their natural transition plans through external review agencies.

- Supplier engagement plan: Corporates can take actions upstream and downstream of the value chain, and work with stakeholders to achieve natural transition.

Reference: