ESG Fund Names and Fund Flows Report

The European Securities and Markets Authority (ESMA) releases a report on ESG fund names and fund flows, aimed at studying whether incorporating ESG terminology into fund names would attract investors.

The ESMA believes that the fund name may be the first information investors receive when they meet the fund, and it is also a key signal of the fund’s strategy and objectives. If the fund name cannot accurately reflect its investment, it will mislead investors. When ESG funds only consider changing their name without achieving sustainable investment, it can lead to greenwashing.

Related Post: ESMA Releases ESG Fund Naming Report

Development of ESG Fund Names

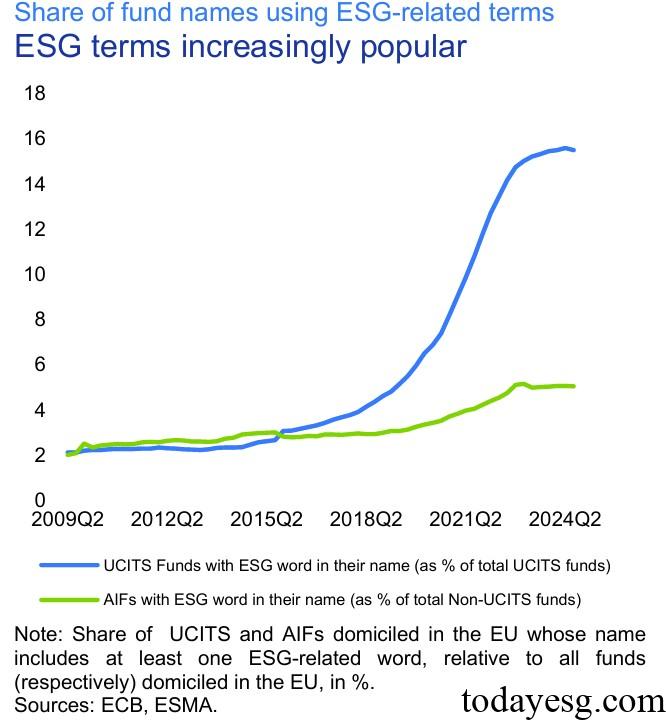

The increasing attention of European market investors towards sustainable investment has had an impact on the fund market. From 2018 to 2024, 1834 EU funds (2.5% of the total EU funds) have added ESG terminology to their fund names. The proportion of funds with ESG terms in their names has increased from 3% in 2015 to 9% in 2024. From the perspective of fund classification, the proportion of ESG terminology used in Undertaking for Collective Investment in Transferable Securities (UCITS) is higher than that in Alternative Investment Funds (AIF).

Since mid-2021, although many funds have added ESG terminology to their fund names, the overall pace has significantly slowed down. The reason for this change comes from the application of the Sustainable Finance Disclosure Regulation (SFDR), which provides more requirements for asset management companies to disclose fund information. In addition, some jurisdictions are concerned that some funds may not incorporate ESG investments into their investment strategies, leading to greenwashing.

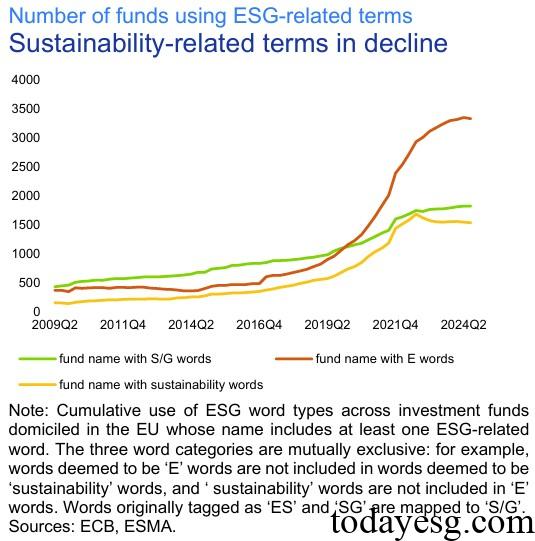

In 2024, the ESMA released ESG fund naming guidelines to standardize the use of ESG and sustainability terms in fund names. The guide focuses on three types of ESG terms, namely social and governance, environment, and sustainability. In the past two years, the number of fund names using social and governance, environmental terms has been slowly increasing, while the number of sustainability terms is slowly decreasing. The reason may be that sustainability terms cover a wider range and are more likely to lead to greenwashing.

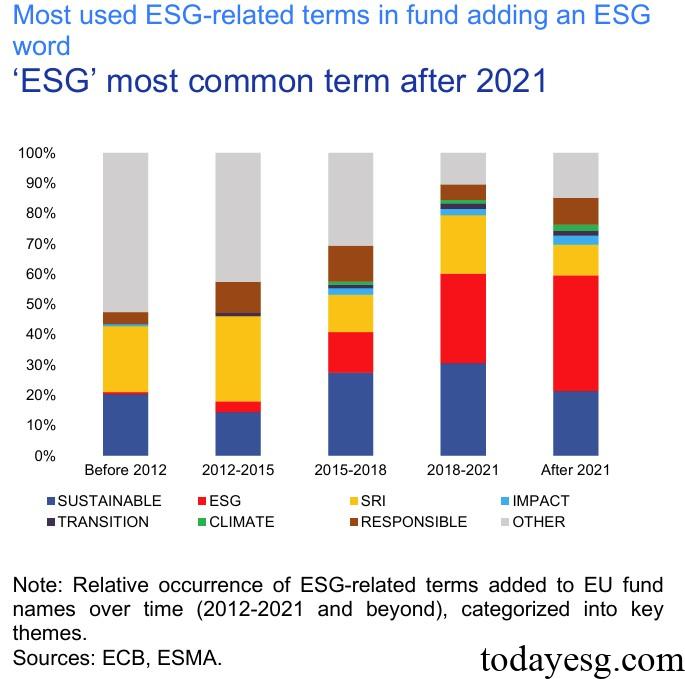

The ESMA has calculated the frequency of application of ESG terms and found that since 2021, ESG terms have increased while sustainability and socially responsible investment terms have decreased. In addition, terms such as responsibility, climate, and transition are increasing. These changes reflect that fund naming is moving towards greater precision and specificity.

Relationship between ESG Fund Names and Fund Flows

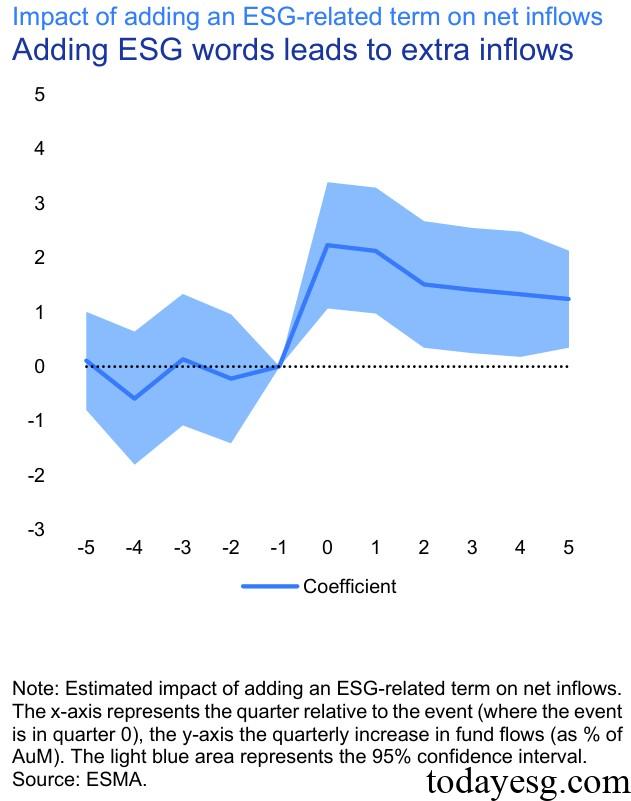

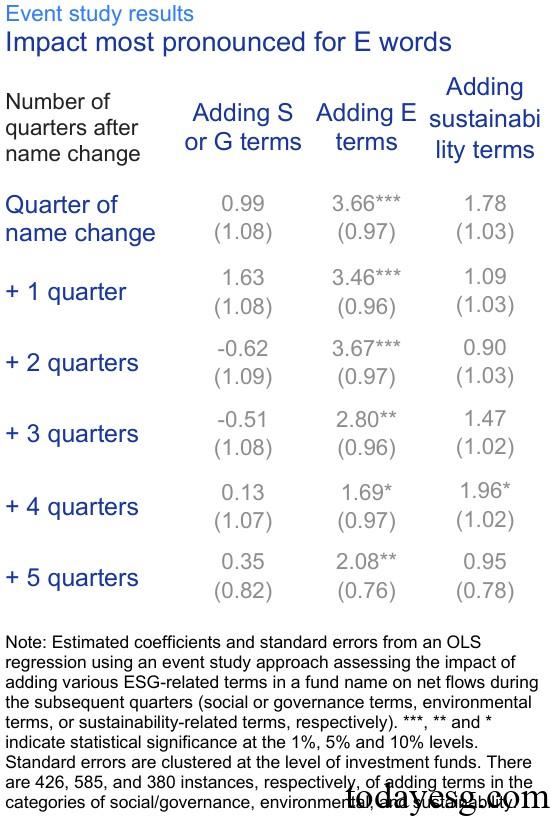

The ESMA studies whether adding ESG terms to fund names will affect fund flows based on factors such as fund performance, size, establishment time, and sustainability characteristics. Adding ESG terms is used as a dummy variable, and the research includes the five quarters before and after adding the terms. Research shows that adding ESG terms has a significant impact on fund inflows, with inflows increasing by 2.2% over two quarters and then remaining at 1.3% to 1.4%.

ESMA has separately examined the relationship between the three ESG term categories and fund flows mentioned above. Research shows that only adding environmental terms has a significant impact on the flow of funds, while adding two external terms does not have a significant effect on the flow of funds. This indicates that the impact of ESG fund names on fund flows only comes from environmental terminology.

ESMA concludes that asset management companies may have financial incentives to add environmental terminologies in fund names. Therefore, regulators need to monitor these funds to ensure that their investment portfolios are consistent with their names.

Reference: