Report on Corporate Transition Plan Evaluation

The EU Platform on Sustainable Finance releases a report on corporate transition plan evaluation, aiming to provide financial market participants with a method for evaluating corporate transition plans.

The EU Sustainable Finance Platform believes that transition plans are the core tool for companies to raise funds and an important reference for financial market participants to provide transition financing. The transition plan evaluation report can help stakeholders assess whether the transition plan complies with the EU environmental goals and the content of the Paris Agreement, thereby supporting the transition and development of enterprises.

Related Post: IOSCO Releases Report on Transition Plan Disclosures

EU Corporate Transition Plan Framework

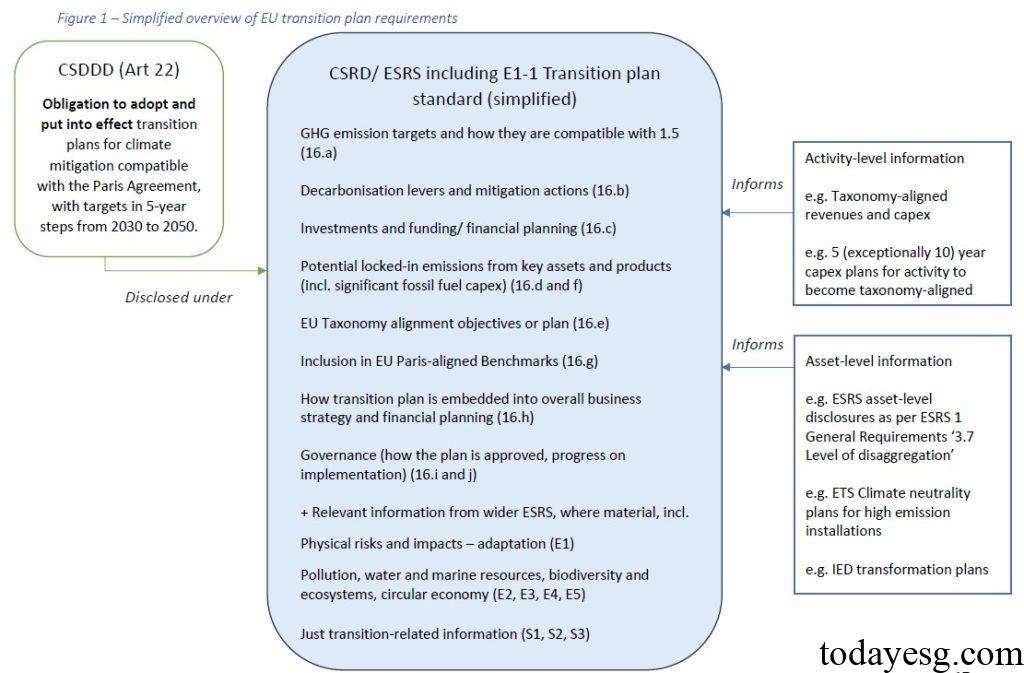

Transition plans aim to improve climate and environmental performance and promote sustainable economic development. Transition plans are usually related to activities such as corporate information disclosure, strategy, and risk management, and receive attention from supply chain participants, investors, and regulatory agencies. The EU corporate transition plan framework can be divided into two parts, namely:

- Transition plan at the enterprise level: Corporate Sustainability Due Diligence Directive (CSDDD) requires large enterprises and financial institutions to adopt and implement climate change mitigation transition plans that comply with the Paris Agreement’s 1.5 ° C warming target and include climate targets from 2030 to 2050. In addition, the EU Corporate Sustainability Reporting Directive (CSRD) requires companies and financial institutions to disclose their climate transition plans and how they align with them. When companies believe that there is materiality, they also need to disclose transition plans related to biodiversity and ecosystems.

- Transition plan at the activity level: EU Taxonomy requires companies to disclose Key Performance Indicators (KPIs) to demonstrate how they finance their transition activities. The Industrial Emissions Directive stipulates that companies have an obligation to develop transition plans and provide information on achieving a sustainable, clean, circular, resource-efficient, and climate neutral economy by 2050.

How to Evaluate Corporate Transition Plan

The EU Sustainable Finance Platform believes that financial market participants should evaluate transition plans based on the material impact, risks, and opportunities of the enterprise, rather than just from the perspective of mitigating climate change. The evaluation principles for enterprise transition plans include:

- Ambition, environmental and social integrity: Participants should review whether the transition plan is consistent with environmental and climate goals and ensure that it does not cause significant harm to other environmental and social goals.

- Consistency and feasibility: Participants should evaluate whether the transition plan is aligned with the company’s strategic goals, ensuring that decarbonization actions are technically and economically feasible.

- Transparency and completeness: Participants should consider whether the information disclosure of the transition plan is complete and whether sufficient details have been provided.

The Corporate Sustainability Due Diligence Directive requires that the transition plan of the enterprise should include at least the following contents:

- Science based greenhouse gas emission reduction targets, covering emission reduction plans for each five-year period from 2030 to 2050.

- Key decarbonization levers and actions to achieve emission reduction targets.

- Investment and funding to support the transition plan.

- Governance of transition plans.

In response to the above requirements, the EU Sustainable Finance Platform proposes the core elements of enterprise transition evaluation:

- Scientific and time limited objectives: Participants need to pay attention to the climate scenarios, transition goals, and scope of the transition plan.

- Mitigation actions and decarbonization leverage: Participants need to conduct evaluations from both qualitative and quantitative perspectives, considering the impairment and stranded risks of some high carbon emission assets.

- Financial planning: Participants should integrate the transition plan with the overall financial planning of the enterprise to achieve key performance indicators through capital expenditures and operating costs.

- Governance: Participants should pay attention to the governance structure of the board, ensuring that the board approves and supervises the transition plan, while evaluating the participation of corporate stakeholders and third-party verification.

Reference:

Building Trust in Transition: Core Elements for Assessing Corporate Transition Plans