2025 Sustainable Bond Market Outlook

Climate Bonds Initiative (CBI) releases its 2025 Sustainable Bond Market Outlook to summarize the development of sustainable bond market in 2024 and propose development factors for 2025.

The Climate Bond Initiative releases quarterly interim sustainable bond market outlook and plans to release a detailed version of the 2024 sustainable bond market review report in Q2 2025.

Related Post: Climate Bond Initiative Releases 2024 H1 Sustainable Bond Market Report

Review of Sustainable Bond Market in 2024

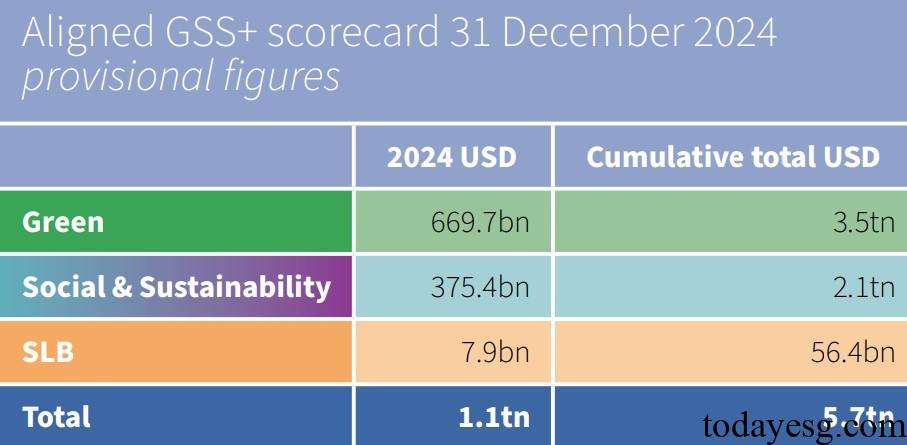

The total amount of Global Green, Social, Sustainable, and Sustainability Linked Bonds (GSS+ Bonds) that align with the climate bond methodology in 2024 is $1.1 trillion. As of December 31, 2024, the cumulative issuance scale of GSS+ bonds is $5.7 trillion, with green bonds having the largest cumulative issuance scale, reaching $3.5 trillion. The cumulative issuance scale of social bonds and sustainable bonds is 2.1 trillion US dollars, while the cumulative scale of sustainable linked bonds is the smallest, at 56.4 billion US dollars.

The Climate Bond Initiative uses the climate bond methodology to classify bonds, and those that meet the classification criteria are classified as GSS+bonds, with a total size of $5.7 trillion. The bond size that does not comply with the classification method is $1.2 trillion, and the bond size that needs more information to make a judgment is $19.1 billion.

Development Factors of Sustainable Bond Market in 2025

The Climate Bond Initiative summarizes the following development factors for sustainable bond markets, including:

- Implementation of the transition plan will promote market development: Global jurisdictions need to make their first update on Nationally Determined Contributions (NDCs) by April 2025. In the updated transition plan, carbon reduction targets for each country have been increased compared to before. Some jurisdictions require companies to disclose transition plans, which will promote the development of the global sustainable bond market.

- Implementation of policies in jurisdictions will accelerate: By 2025, jurisdictions may pay more attention to the development of renewable energy, and sustainable bonds may provide financial support for these projects.

- Development of taxonomies, definitions, and interoperability will expand the GSS+ bond market: Introduction of sustainable taxonomies in various countries, as well as the enhancement of policy interoperability will increase demand for sustainable bonds. CBI plans to launch new standards for the food value chain and release guidelines for reducing methane carbon emissions in 2025, bringing more industries into the GSS+ sector.

- Adaptation and resilience will be included in the scope of GSS+: The GSS+ framework plan will incorporate climate change adaptation and resilience into the criteria for fundraising, and the Climate Bonds Resilience Taxonomy, released by the Climate Bonds Initiative in September 2024, will help issuers identify relevant activities.

- Insurance will enter the sustainable bond market: The COP29 conference plans to increase market participation in green insurance, and in the future, green investment will reduce risks through insurance and attract more investors.

Reference:

Climate Bonds Publishes Provisional 2024 Numbers and Key Factors for Thriving 2025 Market