Report on EU Taxonomy

KPMG releases a report on EU Taxonomy, aimed at analyzing information disclosure based on EU Taxonomy in 2024.

KPMG believes that the requirements for corporate information disclosure under the EU Taxonomy have been increasing since 2022, and this year for the first time, companies need to consider economic activities related to six environmental objectives.

Related Post: The EU Releases a Report on the Application of EU Taxonomy

Regulatory Requirements for EU Taxonomy

The EU Taxonomy came into effect in July 2020, providing a definition for environmentally sustainable activities. For an economic activity, the enterprise first needs to check whether it is in the delegated regulations in order to determine whether it is taxonomy-eligible. Secondly, companies need to check whether the activity meets the criteria of the EU Taxonomy in order to determine whether it is taxonomy-aligned.

In September 2021, the EU released the Climate Delegated Act, which focuses on the first two of the six environmental goals, namely climate change mitigation and climate change adaptation. In March 2022, the EU released the Complementary Climate Delegated Act, expanding economic activities to include nuclear and natural gas energy. In June 2023, the EU released the Amended Climate Delegated Act to continue revising the technology screening criteria. In June 2023, the EU released the Environmental Delegated Act, which established technical screening criteria for four additional environmental objectives.

Information Disclosure Based on EU Taxonomy

KPMG studied 291 non-financial companies headquartered in the EU in STOXX Europe 600 Index, representing EU member states and covering 17 industries. According to the EU Taxonomy, companies are required to disclose their taxonomy-eligible activities and taxonomy-aligned activities for the first two environmental objectives, while for the other four environmental objectives, companies only need to disclose their taxonomy-eligible activities. In the next reporting period, companies must disclose the taxonomy-aligned activities of the other four environmental goals, and in this reporting period, companies can choose to voluntarily disclose.

91% of enterprises reported eligible activities for mitigating climate change, followed by circular economy transformation (43%) and climate change adaptation (29%). For the four newly added environmental goals, 36% of companies have not disclosed any information, and these companies may not have qualified activities that belong to the four environmental goals.

Turnover KPIs:

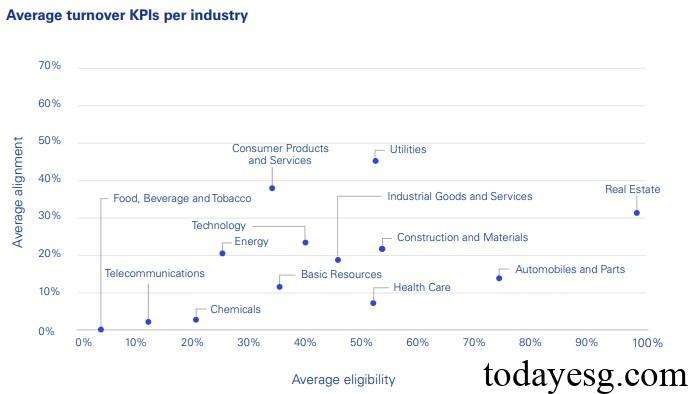

77% of companies reported an eligible turnover greater than zero, an increase from last year (60%). As more environmental goals and activities are incorporated, the average eligible turnover of enterprises is 43%, higher than last year (37%). For aligned turnover, the average data for enterprises is 20%, which means that only half of eligible activities meet the corresponding technical screening criteria and are classified as aligned activities. For eligible turnover, the real estate industry (98%), automotive industry (74%), and construction industry (54%) account for a relatively high proportion. For aligned turnover, the utility industry (45%), real estate industry (32%), and construction industry (21%) account for a relatively high proportion.

CapEx KPIs:

94% of companies reported an eligible CapEx greater than zero, indicating that although some companies do not have eligible turnover, they are still investing in environmental goals. For eligible CapEx, the real estate industry (98%), utility industry (85%), and automotive industry (81%) account for a relatively high proportion. For aligned CapEx, the utility industry (77%), real estate industry (42%), and energy industry (30%) account for a relatively high proportion.

OpEx KPIs:

71% of enterprises reported eligible OpEx greater than zero, an increase from last year (59%). 20% of companies have utilized material exemptions, which allow them to withhold disclosure when OpEx do not have a significant impact on business. Among the companies that have already disclosed data, the average eligible OpEx are 45%, and the average aligned OpEx are 25%. For eligible OpEx, the real estate industry (91%), automotive industry (79%), and utility industry (75%) account for a relatively high proportion. For aligned OpEx, the utility industry (65%), real estate industry (28%), and automotive industry (23%) account for a relatively high proportion.

Reference:

Navigating EU Taxonomy: Progress and Pathways to Compliance

ESG Advertisements Contact:todayesg@gmail.com