2024 Sustainable Investment Report

Morgan Stanley releases 2024 sustainable investment report, which aims to analyze the development of the global sustainable investment market from institutional investors.

Morgan Stanley surveyed 295 asset owners and 606 asset managers in North America, Europe, and the Asia Pacific to understand their sustainable investment actions and attitudes.

Related Post: Morgan Stanley Releases 2024 H1 Global Sustainable Fund Report

Sustainable Investment Development Trends

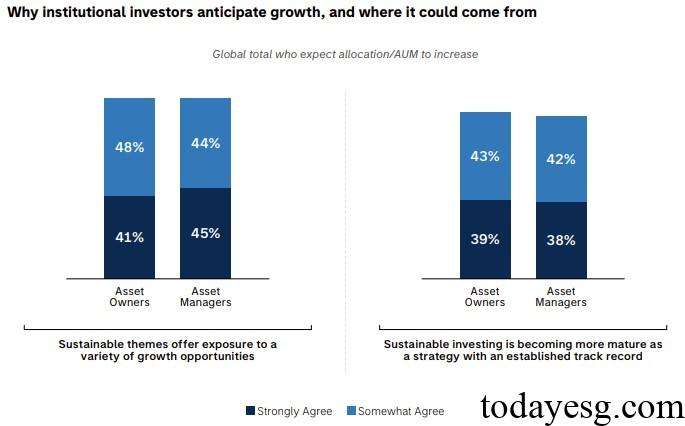

Most institutional investors are optimistic about the development of sustainable markets, with 78% of asset managers and 80% of asset owners believing that the AUM of sustainable funds will increase in the next two years, mainly due to an increase in the proportion of sustainable assets allocated by clients. Currently, 21% of asset managers and 27% of asset owners have sustainable assets accounting for over 50%. The reasons why investors are optimistic about sustainable investment are that it provides numerous growth opportunities and investment strategies have become more mature. Asset managers believe that an increase in the preference of asset owners for sustainable investments can lead to an increase in sustainable assets.

79% of asset managers believe that sustainable investment is an important factor in attracting asset owners to allocate funds. 76% of asset owners believe that sustainable investment is an important factor in selecting asset managers. More than 80% of asset owners require asset managers to develop sustainable investment strategies. Customer demand, portfolio risk reduction, and regulatory policies are the main considerations for institutional investors.

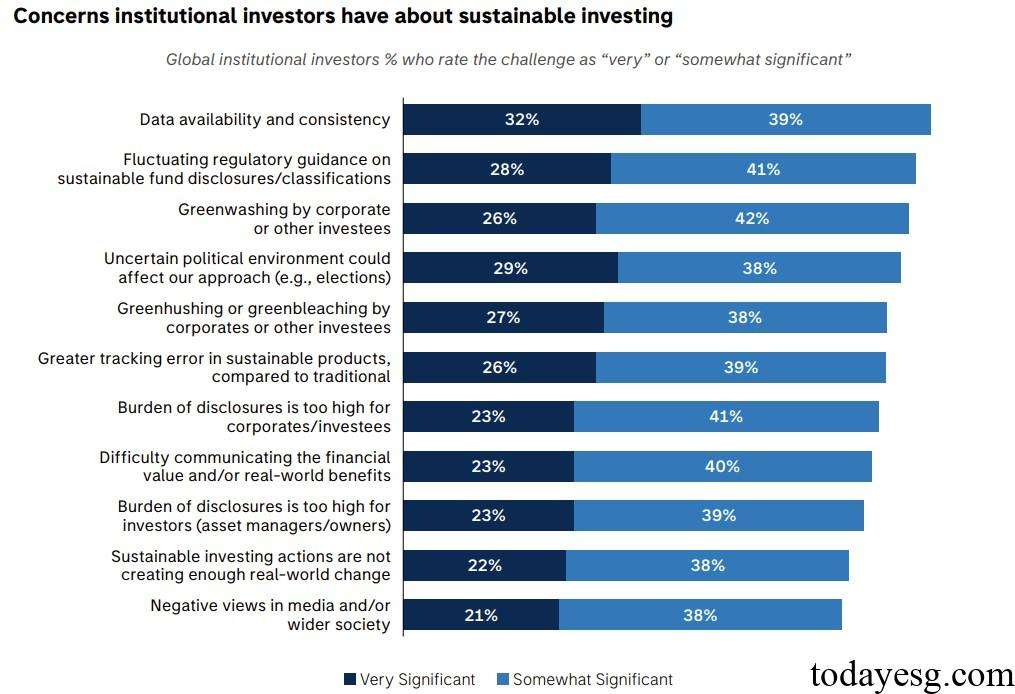

In terms of the challenges of sustainable investment, data availability (71%), changes in sustainable fund policies (69%), and investees’ greenwashing behaviors (68%) have received attention. In addition, 71% of asset owners are concerned about asset managers engaging in greenwashing behavior, and 67% of asset managers are concerned that asset owners’ expectations for sustainable development outcomes do not align with the actual situation.

Sustainable Investment and Net Zero

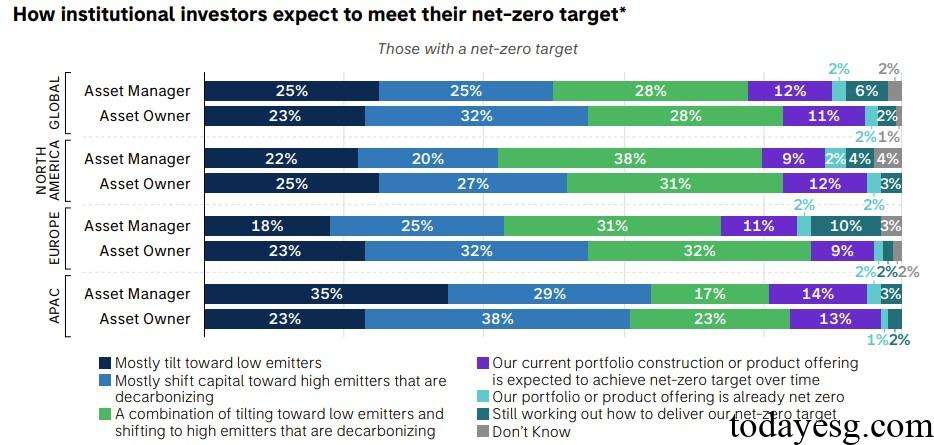

65% of asset owners and 57% of asset managers have set net zero targets, with 2% of institutional investors stating that they have achieved net zero emissions in investment portfolios. The most common way for institutional investors to adopt net zero measures is to invest in carbon reduction assets and low-carbon assets. Some investors plan to use both methods simultaneously, while others believe that their investment portfolios will achieve net zero in the near future. These answers indicate that institutional investors prefer assets with lower carbon emissions and assets that are actively reducing carbon emissions.

Institutional investors are reducing portfolio carbon emissions through the use of carbon offsets, with 39% of asset owners and 31% of asset managers already using this method. Regarding the use of carbon offsets by investees, 30% of institutional investors believe that it is an effective component of decarbonization strategies, 28% believe that investees should wait for high-quality carbon offsets to emerge, and about 5% of investors believe that carbon offsets should not be considered as investment targets for investees.

Sustainable Investment Themes and Solutions

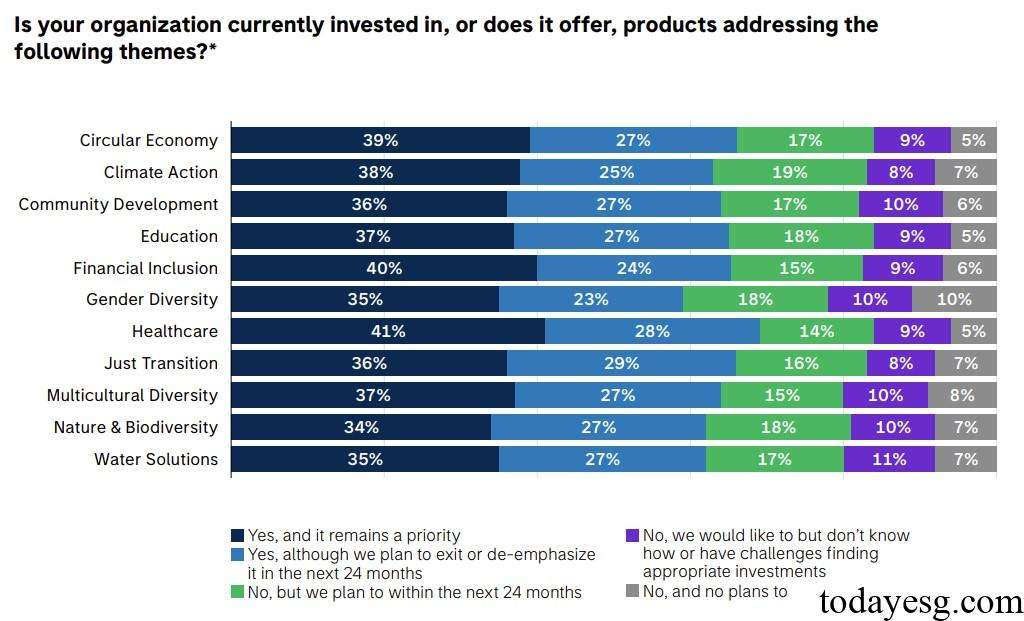

In terms of sustainable development themes, healthcare (41%), financial inclusion (40%), circular economy (39%), and climate action (38%) account for a relatively high proportion. However, 25% to 30% of respondents still plan to reduce their asset allocation for these sustainable investment themes in the next two years. For each sustainable investment theme, 5% to 10% of investors do not allocate funds and do not plan to invest in the future.

Different regions have different priorities for sustainable development themes, with North America investing the most in healthcare and financial inclustion, Europe investing the most in climate action and circular economy, and the Asia Pacific region investing the most in circular economy and financial inclusion. In terms of sustainable investment solutions, renewable energy and energy efficiency are given high priority globally.

Reference: