ESG Ratings in SSE 180 Index

The Shanghai Stock Exchange (SSE) releases a new version of the compilation plan for the SSE 180 Index, which includes ESG ratings in the selection method for constituents. The aim is to improve the ESG characteristics of the index and reduce the probability of major risk events occurring in the samples.

The Shanghai Stock Exchange refers to the ESG evaluation system released by China Securities Index and excludes listed companies with ESG evaluation results of C or below in the selection of constituents.

Related Post: HK SFC Releases Code of Conduct for ESG Ratings and Data Products Providers

ESG Evaluation System of China Securities Index

The ESG evaluation system of China Securities Index aims to reflect the returns and risk factors beyond the financial information of listed companies, incorporating ESG into the securities screening process, analyzing listed companies based on environmental, social, and governance aspects, and calculating weighted results. The ESG rating of China Securities Index Co., Ltd. is divided into ten levels, namely AAA, AA, A, BBB, BB, B, CCC, CC, C, and D. The ESG screening implemented by the Shanghai Stock Exchange this time mainly targets listed companies at the C and D levels.

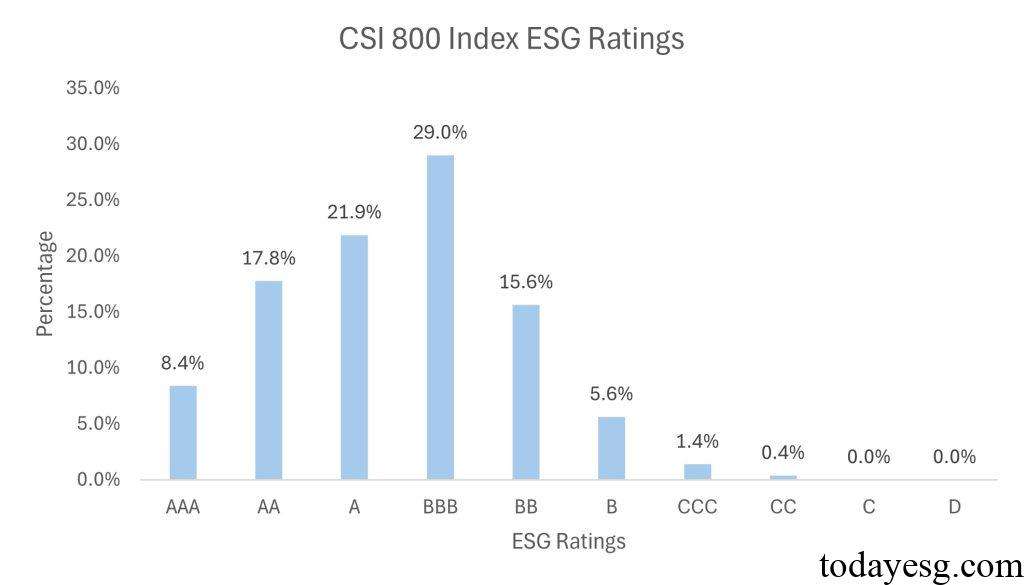

China Securities Index provides ESG rating queries for listed companies on its official website, and currently allows public access to the ESG ratings of the constituents of the China Securities 800 Index (CSI 800 Index). TodayESG conducts a statistical analysis of the ESG ratings of all constituent stocks of the CSI 800 Index and finds that the vast majority of listed companies have ratings of B or above (98.2%), with percentages of 1.4% and 0.4% rated as CCC and CC, respectively. Therefore, currently there are no listed companies at the C and D levels in the ESG rating.

ESG Ratings of SSE 180 Index

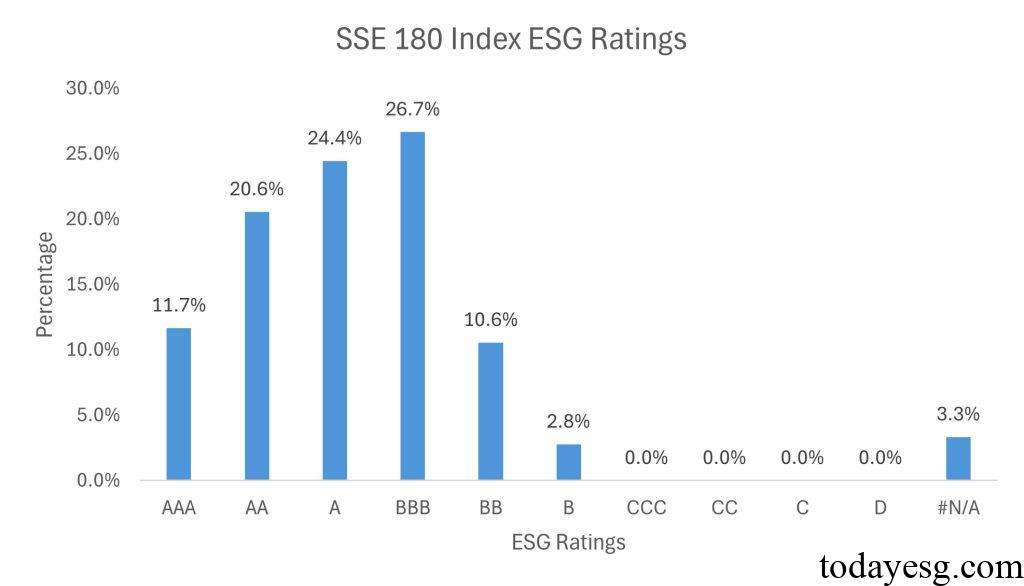

TodayESG continues to search for ESG rating information of the constituent s of the Shanghai 180 Index. There are a total of 180 constituents in the Shanghai 180 Index, of which 174 are constituent stocks of the CSI 800 Index, and all 174 constituents have received ESG ratings. All ESG ratings are at or above B, namely AAA (11.7%), AA (20.6%), A (24.4%), BBB (26.7%), BB (10.6%), and B (2.8%). Except for six constituents that have not publicly disclosed their ESG ratings, all other constituents meet the requirements of the new index compilation plan.

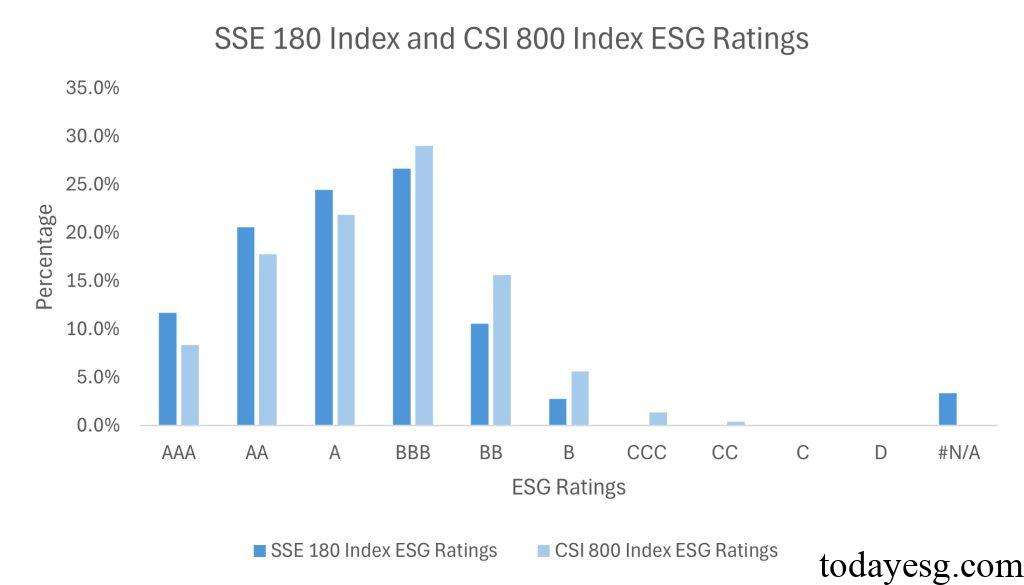

What is the difference between the ESG ratings of the constituents of the SSE 180 Index and the CSI 800 Index? Comparison shows that the percentage of AAA, AA, and A ratings in the constituent stocks of the SSE 180 Index is higher than that of the CSI 800 Index, while the percentage of BBB, BB, and B ratings is lower than that of the CSI 800 Index. The constituents of the SSE 180 Index perform better in terms of ESG information disclosure and actual actions.

The ESG evaluation system of China Securities Index shows that the ESG ratings of listed companies are updated every month. Therefore, the constituents in the SSE 180 Index need to meet screening criteria such as trading volume and market value, while ensuring that their ESG ratings do not reach C or below, in order to avoid being excluded from the sample space. According to the current ESG rating analysis released by the CSI 800 Index, there are currently no listed companies rated as C or below, but it is still necessary to pay attention to the short-term impact of ESG controversies and other factors on the ratings of listed companies.

Reference: