Sustainable Commercial Paper Report

The International Capital Market Association (ICMA) releases a report on sustainable commercial paper, aimed at analyzing the development of the global sustainable commercial paper market.

The International Capital Markets Association has established a Commercial Paper Taskforce to explore the role of traditional commercial paper in sustainable financial markets and evaluate relevant standards and best practices.

Related Post: International Capital Market Association Releases a Report on Sustainability Linked Bond

Introduction to Sustainable Commercial Paper

Commercial paper is the most widely used unsecured short-term financing tool in the market, with a total outstanding amount of over 1 trillion EUR in Europe. These papers have a maximum maturity of less than one year and are typically issued at a value lower than face value, with redemption at face value upon maturity. The use of proceeds for commercial paper is usually unrestricted, making it an important and flexible liquidity management tool for issuers. The sustainable commercial paper market is still in its early stages and can be divided into two types:

- Use of Proceedings Commercial Paper: The proceeds are specifically used for financing and refinancing green, social, and sustainable projects that meet the definition of sustainable financing framework.

- Sustainability Linked Commercial Paper: The instrument is based on Key Performance Indicators or ESG ratings and is consistent with the issuer’s sustainability linked financing framework or sustainability strategy.

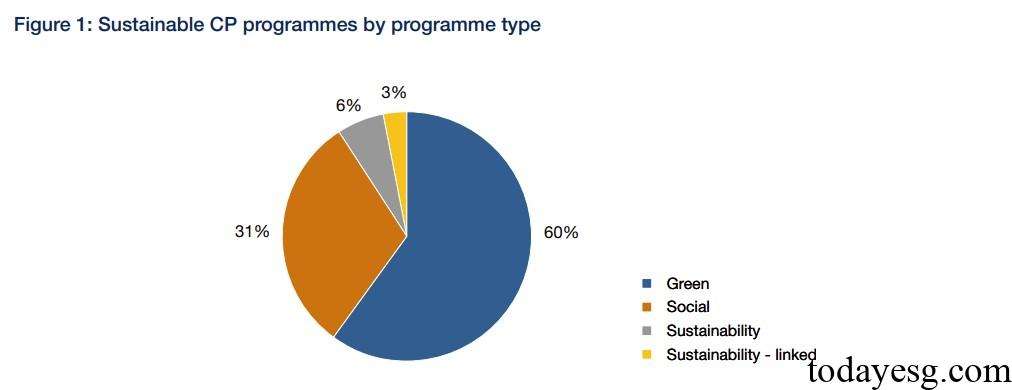

A study by the International Capital Market Association finds that there are a total of 33 sustainable commercial paper schemes in the EU region, of which 23 are Use of Proceedings Commercial Papers and 10 are Sustainability Linked Commercial Papers. The focus of sustainable commercial paper includes green (60%), social (31%), sustainable (6%), and sustainability linked (3%) projects.

Among the 23 Use of Proceedings Commercial Papers, 15 are specifically used to fund green and sustainable projects, and 8 are allowed to be issued together with the issuer’s regular commercial bills. The total fundraising amount for these notes is 265 billion EUR, and all issuers have issued green, sustainable, and social bonds (GSS bonds), demonstrating their commitment to sustainable development projects.

Among the 10 Sustainability Linked Commercial Papers, 7 are specifically used to fund sustainable projects, and 3 are allowed to be issued together with the issuer’s regular commercial notes. The total fundraising amount for these notes is 34 billion EUR, and all issuers have already issued sustainability linked bonds or sustainable loans. 70% of sustainable linked commercial paper is linked to key performance indicators, and 30% is linked to ESG ratings or scores.

Development of Sustainable Commercial Paper

Use of Proceedings Commercial Papers should be used as a qualified debt instrument under the issuer’s overall sustainable financing framework, in order to address the difference between the short-term nature of commercial paper and the long-term nature of sustainable investment. The Use of Proceedings Commercial Papers requires an explanation of how the raised funds can help the issuer promote sustainable development strategies and be used for sustainable projects. The Green Bond Principles (GBP) and Social Bond Principles (SBP) introduced by the International Capital Market Association are applicable to this category and can be further adjusted in terms of information disclosure and external review.

Sustainability Linked Commercial Papers can refer to the Sustainability Linked Bond Principles and the Registry of KPIs. At present, market participants have not yet determined whether sustainable development linked commercial paper provides effective incentives for issuers. The International Capital Market Association believes that when using ESG ratings or scores as key performance indicators (KPIs), it is necessary to consider their consistency.

Reference:

ICMA Publishes New Paper on the Role of Commercial Paper in the Sustainable Finance Market