Net Zero Banking Alliance Progress Report

The Net Zero Banking Alliance (NZBA) releases 2024 progress report, which aims to summarize the actions taken by its members to achieve net zero goals by 2030 and 2050.

Since its establishment in 2021, the number of members of NZBA has increased from 43 to 144, with 118 banks voluntarily disclosing their net zero targets and 76 banks announcing their net zero transition plans.

Related Post: Glasgow Financial Alliance for Net Zero Releases 2023 Annual Progress Report

Progress on the Net Zero Goal of NZBA

The Net Zero Banking Alliance 2024 progress report summarizes the progress of 122 member banks in setting goals and transition plans as of May 2024. 65% of the members of the Net Zero Banking Alliance are located in developed economies, and 35% are located in emerging market economies. Europe, America, and Asia have the highest proportions at 48.5%, 27.7%, and 20.7%, respectively.

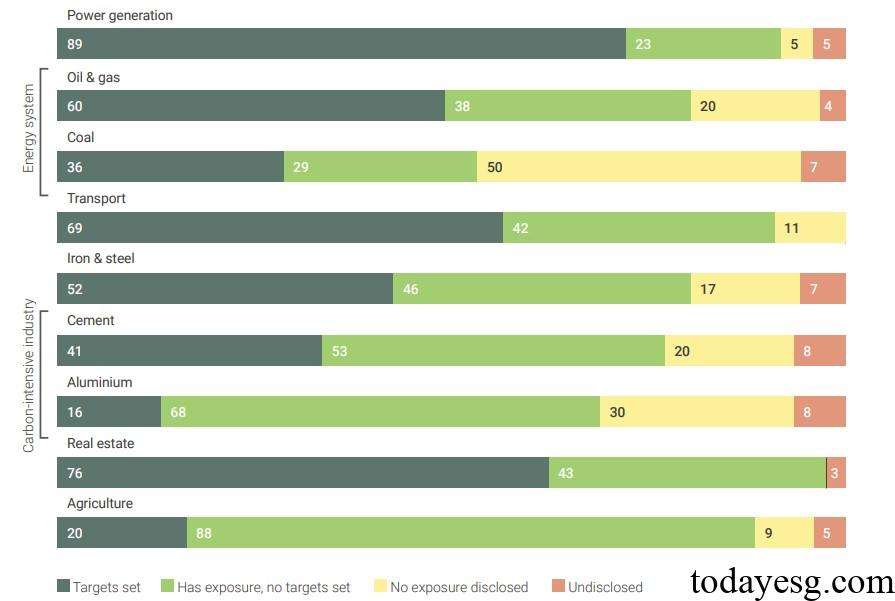

When a bank joins the Net Zero Banking Alliance, it needs to voluntarily and independently commit to achieving net zero by 2050 and set mid-term goals for 2030 or earlier. These mid-term goals need to align with the 1.5 degree Celsius warming scenario and cover most of the nine carbon intensive industries. As of May 2024, 97% of members have completed this action, and 80% of members have set net zero targets covering the vast majority of carbon intensive industries. The banks that fail to achieve the set targets mainly come from emerging market economies, which face phenomena such as poor data quality and unclear decarbonization paths in the market.

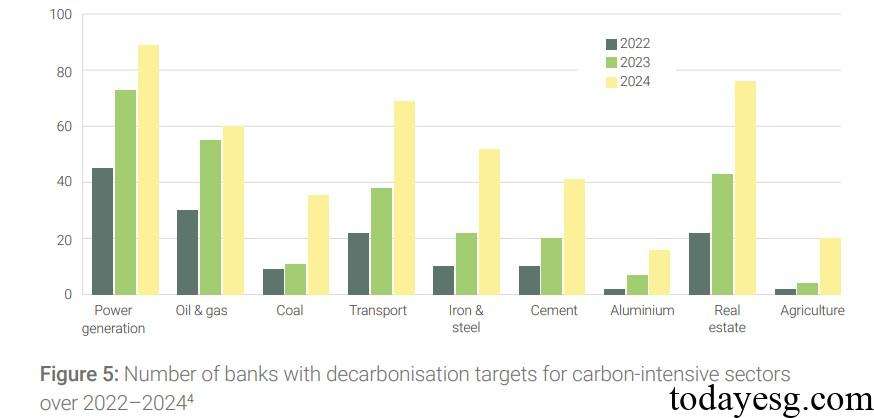

When setting a net zero target, banks will prioritize industries with the highest absolute emissions. For example, members of the NZBA set the most net zero targets in the energy production sector, mainly concentrated in the power generation and fossil energy industries. More than half of the banks set decarbonization targets in these areas, as well as in the coal, real estate, transportation, and steel industries. The decarbonization path in the agricultural sector is not clear, so net zero targets in this field are the least. Since September 2023, the number of members setting targets for carbon intensive industrial sectors such as cement, steel, and aluminum has doubled, and the decarbonization path for these industries is becoming clearer.

Progress on the Transition Plan of NZBA

Measuring emissions and setting net zero targets are the first and second steps of banks’ climate mitigation measures, and banks also need to focus on how to achieve this goal. The transition plan is an important measure to achieve the net zero target, with over two-thirds of the members having already announced their transition plans, and an additional 25% planning to announce them by the end of this year. 70% of banks have already developed customer engagement strategies, with an additional 21% in the process of developing them. The NZBA presents in its report the methods adopted by banks to manage climate risk, provide consulting and financing solutions for customers, and create value for shareholders in the form of case studies.

The NABZ believes that its members need to continue improving their net zero goals and transition plans. These actions include:

- Set goals using scenarios to control the temperature rise to 1.5 degrees Celsius.

- Improve the quality of carbon emission data.

- Disclose annual financing emissions in the form of absolute and physical strength.

- Set a net zero target for the materials industry.

- Disclose information on the investment portfolio held by the target company.

- Develop and disclose transformation plans based on industry development.

In the aluminum, agriculture, coal, cement, and transportation industries, the number of members setting net zero targets is relatively small. The Net Zero Banking Alliance plans to develop guidance programs to support members in setting goals and assist members of emerging market economies. The NZBA will also pay attention to the disclosure of carbon emission data in different industries and provide a summary of different data points.

Reference: